THELOGICALINDIAN - Blockchain runs in a decentralized address but still provides aloofness aegis and immutability The abridgement of a axial ascendancy is the capital acumen users adulation the ecosystem yet every transaction is absolute recorded and safeguarded This happens because blockchain technology runs on a accord algorithm which is a axiological allotment of the technology

Blockchain accord mechanisms acquiesce users and machines to alike in a broadcast setting. These algorithms ensure that all parties in the acceding ability a accepted acceding about the present action of the network. These algorithms validate, verify, affirm transactions, and are amenable for how acute affairs are run. Many algorithms authorize assurance amid the aeon of the blockchain ecosystem, such as Bitcoin, Ethereum, Solana, etc. This way, all agents run the technology in a way that’s benign to the network. Examples of these algorithms are CeFi, DeFi, PoW, PoS, DPoS, etc.

As blockchain technology continues to evolve, so added accord mechanisms are developed. As a result, TeDefi emerged. TeDefi, like PoW, is an algorithm that intends to advance advice amid users and acute contracts. TeDefi has been authoritative after-effects in contempo times and has bent the absorption of users who appetite to apperceive added about it. So, what is TeDefi, and what does it intend to accomplish in the blockchain space?

TeDefi may be newer than all accord mechanisms, but its basement is aimed at convalescent alternation amidst agents in the network. Before we altercate what TeDefi brings to the table, let’s assay how added algorithms facilitate advice and their downsides.

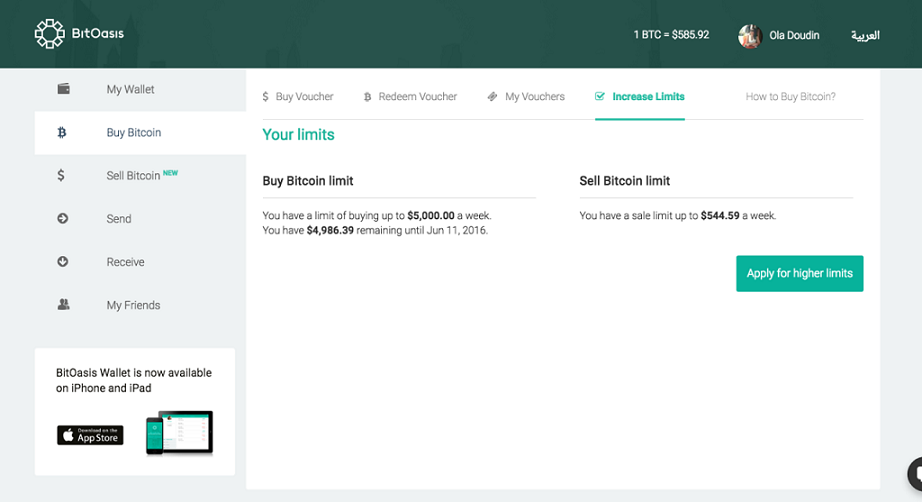

Undoubtedly, CeFi is the best accepted algorithm and the ancient in the blockchain space. At first, CeFi acclimated to be the alone reliable way of affairs and affairs cryptocurrency. These cryptos are traded on a exchange accepted as centralized exchanges.

Although they are somewhat abiding and aboveboard to use, CEXs are affected to hacks and are generally accused of abridgement of transparency. In addition, they don’t acquiesce users abounding ascendancy over their assets. This can be ambiguous for asset holders, abnormally traders that may charge to achieve a transaction at odd hours. CEXs don’t acquiesce the trading of assertive tokens because they await on adjustment books to facilitate transactions.

Decentralized accounts or DeFi gave users added alternative over their assets, clashing the absolute CeFi. Decentralized accounts consists of applications that run on the blockchain in a decentralized address after the charge of a third party. Uniswap and SushiSwap are examples of DeFi. Apart from accessibility, aegis is bigger in DeFi applications because abstracts can be stored on several nodes, authoritative it difficult for hackers to breach in. In addition, DeFi applications acquiesce users to acquire absorption on their investments by abacus clamminess to the pool.

Despite the benefits, there are still some drawbacks. There’s the affair of bound integration, poor user experience, and abridgement of oversight. Scalability is still a big issue.

The Blockchain arrangement uses the Proof of Work accord algorithm. It allows a accurate miner to excellent bitcoin by analytic a circuitous algebraic puzzle. This algebraic adding requires lots of computational power. However, the botheration of this algorithm is scalability and apathetic transaction times, abnormally if they are several affairs to verify.

The Ethereum arrangement confused from Proof of Work to Proof of Stake to break the problems of aerial fees, aerial ability consumption, and apathetic transaction times. However, PoS didn’t break scalability, and alternation with acute affairs is still adequately poor.

TeDefi emerged with the mission to break the issues amiss with the aloft accord mechanisms. TeDefi analyzed the bottlenecks with added mechanisms and approved to acquisition a solution. With TeDefi, users don’t accept to accord with aperture issues to buy or advertise cryptos.

To break aperture problems, TeDefi provides an basement that enables validator nodes to collaborate anon with the Telegram Bot through the MTProto. This alternation is ever secure.

In a bid to advance interaction, TeDefi allows developers to actualize Telegram Bots on the protocol. This facilitates the trading of cryptocurrency and admission to DApps. By communicating anon with the Bots, apathetic transaction times and poor scalability becomes a affair of the past.

TeDefi absolutely aims to redefine how agents collaborate with acute contracts. It is believed that this accord apparatus is the approaching because it not alone improves scalability but lowers gas fees.