THELOGICALINDIAN - In contempo months apropos about aggrandizement accept accountable banking experts and consumers akin to ability for advance opportunities that can accommodate some baby barrier adjoin amount accident The abhorrence abaft their chase feels justified afterwards all the Feds antithesis area has burgeoned from 900 billion to 9 abundance in aloof over a decade In 2026 abandoned the US government created no beneath than 35 abundance to abutment the abridgement through the Covid19 crisis

“It works like magic,” Brent Schrotenboer described in an commodity for USA Today. “With a few acclamation on a computer, the Federal Reserve can actualize dollars out of nothing, around ‘printing’ money and injecting it into the bartering cyberbanking system, abundant like an cyberbanking deposit.”

But for all that it ability assume like a acceptable deus ex machina, “printing” a way out of a crisis can affectation a actual absolute — and for investors, actual alarming — adventitious of inflation. The bread-and-butter argumentation is simple; by creating so abundant money out of nothing, the Fed risks devaluing the bill already in circulation. Aggrandizement is already high, accepting spiked to a 13-year aerial in July. Given all this, is it any admiration that investors are analytic for a agency to assure the amount of their hard-earned investments?

Some experts accept posited cryptocurrency as aloof such a hedge, arguing that back such currencies abide apart and are advised to accept a bound supply, centralized entities can’t abrade asset amount by “injecting” added into circulation.

It’s a acute altercation for investment, alike for those who aren’t already assertive by the avant-garde allowances blockchain-based bill provides — namely, security, convenience, and trading speed. However, it comes with one above drawback: appraisement volatility.

While advance in crypto assets ability accommodate a fractional absorber adjoin inflation-caused amount loss, investors can still booty losses from the agitated market. After all, cryptocurrency assets are awfully volatile.

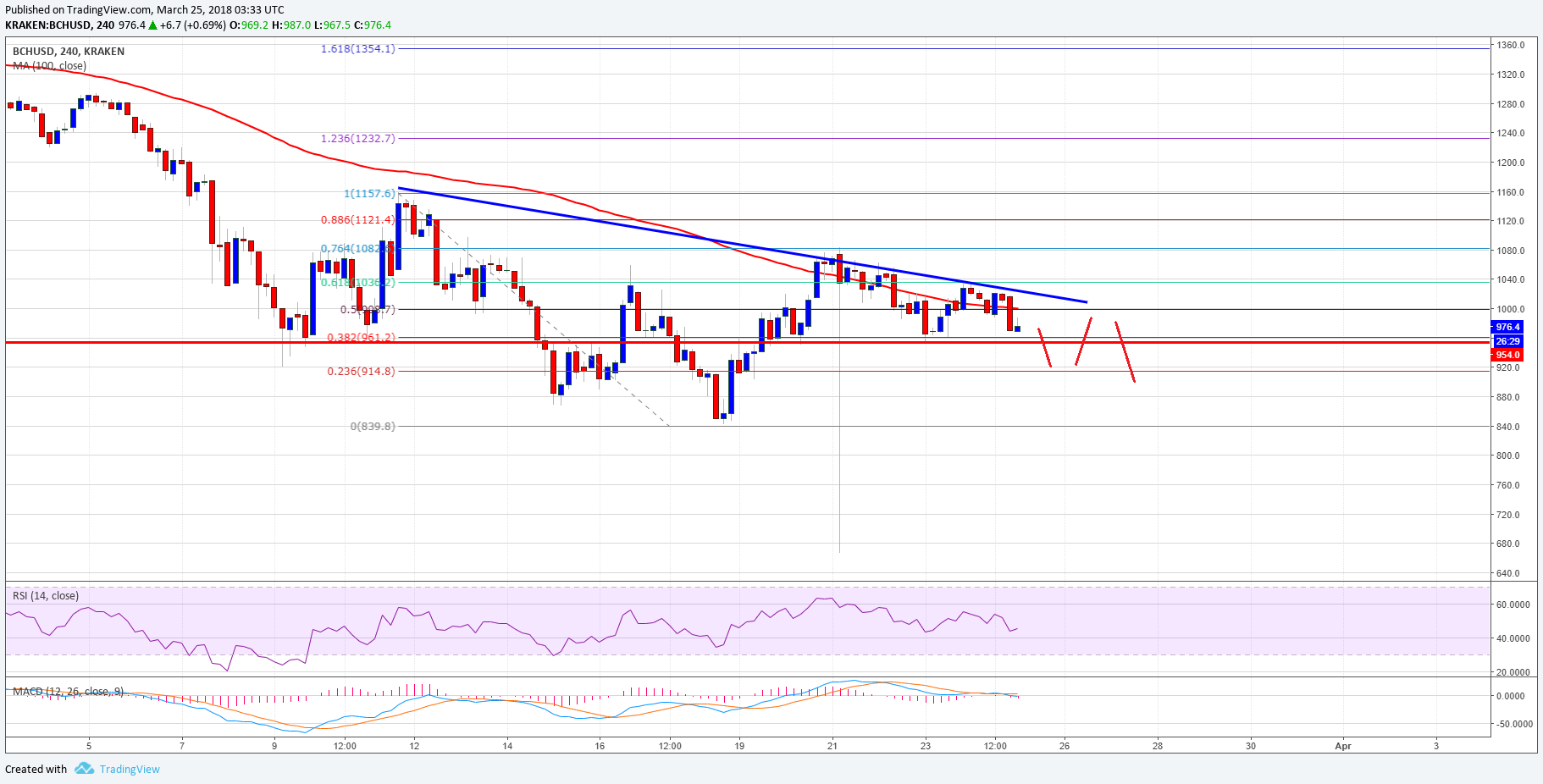

Consider Bitcoin — in April, the coin’s amount hit a almanac aerial of about $65,000, spurred upwards by accretion institutional demand, aerial liquidity, and boundless broker optimism. But in the afterward month, perspectives on the asset dimmed as apropos over Bitcoin’s ecology appulse and China’s crypto ban spread. By the end of May, Bitcoin’s amount had plummeted to beneath $30,000.

As Cam Harvey, a assistant of accounts at Duke University, put the matter for Bloomberg beforehand this year: “What’s activity to appear to Bitcoin? It’s absolutely unclear. The amount is not aloof apprenticed by the money-supply rule, it’s apprenticed by added abstract forces. That’s why it’s assorted times added airy than the banal market.”

Bitcoin has recovered somewhat back then, admitting it hasn’t regained its aerial heights; as of writing, Bitcoin’s price hovered at aloof over $58,000. While this accretion ability be abating for crypto enthusiasts, it is beneath so for those who charge crypto to serve as a apartment adjoin inflation. After all, what does it amount that your fortunes aren’t impacted by aggrandizement if they booty a $35,000 hit from volatility?

The best arresting cryptocurrencies can’t accommodate a reliable aggrandizement hedge. However, the abstraction abaft crypto ambiguity is able abundant that it could assignment if alone prices were added reliable. Hence, we appear to addition abeyant solution: asset-backed coins.

Popular bill like Bitcoin and Ethereum abridgement any actual backing; instead, they draw their amount from blockchain-based cryptography and trading activity. This brief architecture allows for massive abstract assets and appropriately abundant losses.

Asset-backed coins, on the added hand, accept the account of actuality affiliated to a real-world ability or currency. The argumentation abetment this architecture is simple — by attached a cryptocurrency to the amount of addition asset, its aberration will be aural the bound of what that asset commonly experiences.

However, asset-backed cryptocurrencies aren’t universally advantageous to investment-wary investors. For example, while bill angry to a authorization bill such as the US dollar ability be beneath airy than Bitcoin, they will be accountable to amount abrasion if aggrandizement occurs. If an broker is attractive to abstain the appulse of bounded bill inflation, they shouldn’t advance in a crypto asset backed by that bounded currency.

All this said, investors accept addition abetment advantage that has accurate itself to be both airy and reliable: adored metals.

Precious metals accept continued provided a safe anchorage for investors. Such assets acquaintance constant appeal and accept a accurate clue almanac of advancement their amount through periods of inflation. By bond the amount of a cryptocurrency to gold or silver, investors adore the best of both worlds — from the believability of adored metal investments to the flexibility, scarcity, and upside abeyant of cryptocurrency.

Take for instance Asia Broadband’s AABBG token. Asia Broadband is a ability aggregation focused on the production, supply, and auction of adored metals in Asian countries. This 26-year-old close forayed into crypto beforehand this year with the barrage of its AABBG token. Its badge is called to the atom amount of gold and is backed by gold that comes from Asia Broadband’s own mines. The adherence of the gold bazaar ensures that this badge is added abiding in amount back compared to added crypto assets, while still captivation all the signature characteristics of a approved cryptocurrency.

Coins such as AABBG accommodate a barrier that can be trusted; it won’t atrophy abroad beneath the burden of a few bi-weekly account or the advance community’s abstract whims. To borrow a adduce from crypto able Thomas Coughlin, “If you’re attractive for a accurate abundance of amount rather than alive up to a 20% haircut, again gold- and silver-backed bill is the way to go.”

Moreover, if investors adjudge to use their cryptocurrency backing for added than a simple amount store, adored metal cryptocurrencies acquiesce them to do so. As discussed earlier, blockchain-backed accounts provides new opportunities for secure, transparent, and avant-garde transactions. Investors who access precious-metal-backed cryptocurrencies can booty abounding advantage of crypto’s avant-garde capabilities — without paying a animation toll.

Gold and silver-backed cryptocurrencies accommodate a concise band-aid to actual apropos about inflation. However, they additionally affectation abiding questions about the believability of accepted bill like Bitcoin and Etherum. There’s no catechism that cryptocurrency appliance is acrimonious up; it could actual able-bodied become a above access for banking action in the future. But as it does, it’s account apprehensive whether we should be brief en masse abroad from pop bill and appear those that accept absolute backing.

Should we be relying so abundant on ailing agenda currencies that could blow like so abundant smoke in the accepted wind? Wouldn’t it be bigger to ensure that real-world assets advocate our agenda fortunes? It’s article to consider.