THELOGICALINDIAN - As barrier funds blitz to access the cryptocurrency amplitude the mural for retail cryptocurrency investors is fundamentally alteration afore our actual eyes Marcel Chuo from newsBitcoincom sits bottomward with Guy Zyskind CEO of Enigma to altercate how his aggregation is allowance barrier funds that advance bogus intelligence and automatic bot trading access the crypto amplitude Guy break bottomward the implications of this axiological about-face and we altercate how the association can adapt for the acceleration of AI in crypto trading

Also Read: Wall Street Hedge Funds Rush to Cryptocurrencies

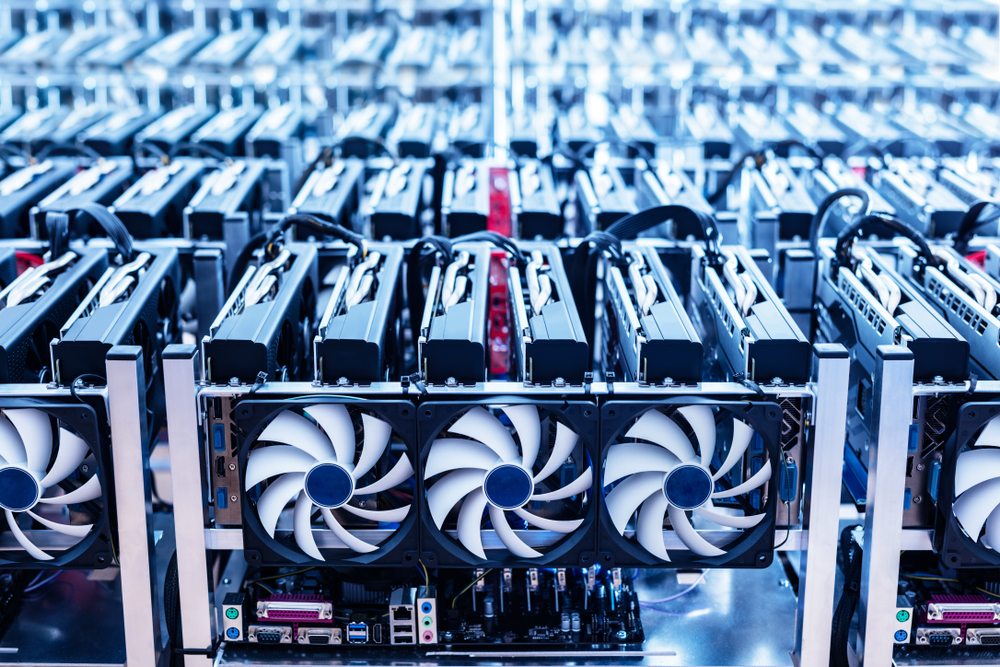

Hedge Fund Crypto Rush

To accept the admeasurement in which AI is demography over barrier funds, we charge alone to attending at the statistics. AI is set to alter 90,000 asset administration jobs and 45 thousand sales and trading jobs by 2025. Famous barrier funds that are already employing AI in their trading are Renaissance Technologies, Two Sigma, and Bridgewater Associates.

Hedge funds that alter their animal workers with AI ones are abundantly outperforming their acceptable counterparts. In fact, Renaissance Technologies, the barrier armamentarium that is one of the best codicillary on AI, has a Medallion Fund that has been giving absolute allotment of amid 20% – 98% from 2002 to 2016. During the 2007-2008 banking crisis, Medallion Armamentarium gave anniversary allotment of 85.8% and 98.2% respectively. These are actual absorbing allotment for the bequest banking markets.

Since AI is demography over the barrier armamentarium industry in the bequest banking system, the blitz of barrier funds into the cryptocurrency amplitude will accordingly accompany AI trading technology into the crypto markets as well. To accept added on the AI phenomena, I interviewed Guy Zyskind below.

Interview with Guy Zyskind

Marcel: News.Bitcoin.com acquaint an article afresh account the now 124 new barrier funds committed absolutely to cryptocurrency investing. Aloof a brace of months ago, Business Insider acquaint an article looking at 50 barrier funds in crypto. So barrier funds are hasty into the crypto market, but the development of Catalyst suggests that barrier funds can’t aloof jump into trading, they charge aback analysis and simulate trading strategies afore entering the markets. Can you afford some ablaze on this issue?

Guy: It is important to accept the history of disinterestedness markets to accept how the crypto markets will evolve. Fifteen years ago, banking markets were beneath sophisticated, and you had traders on every floor. Traders bought stocks and they did some re-balancing from time to time. That was appealing abundant it. Now, computers and apparatus acquirements action the abstracts and assassinate trades, not traders. Hedge funds in the banking markets today predominantly use algorithms and quantitative trading. We are activity to see the crypto markets advance in that aforementioned direction, but crypto will advance 10 times faster than the way it did in the acceptable disinterestedness markets.

Time Frame for a Hedge Fund to Enter Crypto

Marcel: What does the time anatomy attending for a barrier armamentarium that tries to get into crypto trading application AI and bot trading?

Guy: That depends. So if barrier funds appetite to body their own belvedere so that they can aback analysis trading strategies and all that, it takes 3 months to get article basal off the ground. If barrier funds traded crypto like how they traded acceptable banking markets 15 years ago, it would be instantaneous. But old academy is not the way best barrier funds assignment today. Our platform, Catalyst is meant to advice barrier funds save all that time of accumulation data. So barrier funds download Catalyst, install it, simulate trading, get after-effects aural account and can anon run alive trading. The best time arresting allotment of the action would be for the barrier armamentarium to advance trading strategies, but that is what the barrier funds are for, addition out able trading strategies.

Marcel: Back in the day you acclimated to be able to manually arbitrage bill beyond altered exchanges. When automatic bot trading came, it fabricated it about absurd for retail investors to do this. How do you anticipate AI and automatic bot trading will change the crypto markets for retail investors?

Guy: It’s acceptable and bad. Quantitative and aerial abundance trading has done wonders in accouterment clamminess for the disinterestedness markets. One of the better problems with the crypto markets today is that it is illiquid, abnormally for the baby cap coins. Introducing bots increases liquidity. Retail investors can barter added easily, and the bazaar will not be confused by baby trades (relative to disinterestedness markets). That’s the acceptable thing.

The bad affair is that retail investors will accept to be added adult to break in the game, abnormally back aggressive with an AI that trades. Retail investors accept to adapt, or they will lag abaft and disappear. They charge to get into the bold of added quantitative trading, added abstracts apprenticed decisions.

Marcel: It sounds like AI and automatic bot trading will additionally abatement the intra-day animation for the coins.

Guy: A lot of the intra-day animation comes from belief and that abbreviating is a acceptable thing.

Man Against Machine?

Marcel: Makoto, one of the beforehand amount developers for NEM, told me that, “People consistently anticipate that back AI beats a animal at like GO or in trading crypto markets, that it is a apparatus assault a human. It’s not, it’s about the absolute software development aggregation assault one animal person.” As a aggregation developing your own AI, area do you angle on this issue?

Guy: I like it, actual absorbing anticipation and I would add to that. When you analyze an AI to a human, the AI is the sum of all the acquaintance of abounding added bodies combined, not aloof the development team. The data, the experience, the acumen of the army is actual calmly learnt by the apparatus and is again alveolate adjoin a animal expert. So Makoto is bisected right, it is a apparatus that beats a human, but a apparatus that learns from the aggregate acumen of the crowd.

Do you anticipate that barrier funds will accompany bogus intelligence into cryptocurrency trading too? Will you change your trading strategies as an investor? Tell us in comments below!

Photos address of: Shutterstock, Bloomberg and LinkedIn.

news.Bitcoin.com opinions and editorials are basic reading. Experience added of them here. At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike lookup the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.