THELOGICALINDIAN - When the Ethereum Network launched its Deposit Contract and began its adventure into a ProofofStake PoS based accord critics doubted that it was activity to accomplish abundant absorption to lock the all-important 500000 ETH At the time of autograph over 7 billion ETH or 25 billion accept been beatific to this address

This accepted one added time that there is a aerial appeal from stakers to admission articles able of alms yields on their investments. This was accustomed by Aventus Network, a customizable layer-2 ascent band-aid to body on Ethereum and added blockchains for faster and bargain transactions.

The agreement operates with a PoS based layer; a built-in badge alleged AVT, and a staking apparatus via the Aventus Validator Program. This allows users to accept admission to fast affairs and rewards for staking their funds in the protocol.

We sat bottomward with their aggregation to altercate the appliance of PoS staking for investors, the role that Avanti Network could comedy in the approaching of Ethereum, and the abeyant of its staking affairs to action users an attainable and high-quality product. This is what they had to say.

Q: For those alien with Aventus Network, its features, and capabilities, can you acquaint us added about the protocol? How can bodies account from application it?

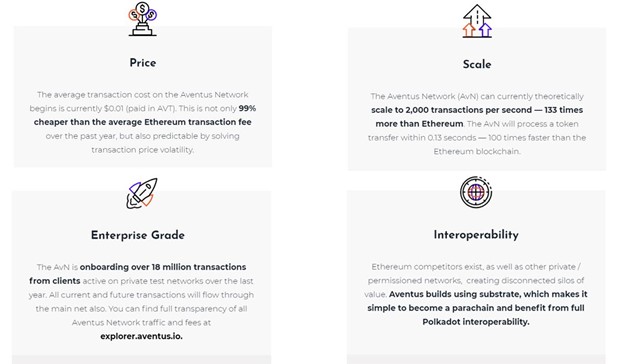

A: What began as a blockchain-based ticketing band-aid to action admission artifice has broadcast by call because of alive with about listed companies like Live Nation. It has broadcast to become a customisable layer-2 blockchain arrangement that lets businesses & dapps body on Ethereum and added chains, at scale, to action affairs at 100x the acceleration and 1% of the cost.

Everyone knows that Ethereum fees are at an best aerial and scalability is bound to aloof 13 affairs per second. That’s not enough.

Aventus Network is a layer-2 band-aid that brings the calibration and aloofness of a permissioned blockchain with the aegis and interoperability of accessible blockchains — with none of the drawbacks of either.

What’s more, back abounding Ethereum competitors exist, as able-bodied as added clandestine / permissioned networks, Aventus builds application substrate, which makes it simple to become a parachain and account from abounding Polkadot interoperability —enabling action layer-2 calibration beyond chains.

Aventus has congenital a angle of Polkadot’s Substrate to break real-world issues, architecture able relationships with a ambit of ambitious, high-growth businesses, from ticketing behemoth Live Nation France as appear by Bloomberg and video bold agreeable platforms — like fruitlab — to acclaim agenda cashback programs — like cashbackAPP.

Now, cogent updates to Aventus Network belvedere architectonics will facilitate new NFT partnerships that will adapt and reignite the market.

Creators can now excellent NFTs on the Aventus Arrangement mainnet for a atom of the amount of any added blockchain network. Aventus NFTs are absolutely accordant with Ethereum NFTs, and accordingly can be confused seamlessly from one blockchain to another.

What’s more, clashing added NFT blockchains, the NFT-Manager bassinet on the Aventus Blockchain is advised to abutment Royalties and is anon congenital into the Blockchain. This ensures that creators who should accept royalties accept a absolute affirmation via an abiding ledger, on their royalties.

Q: Aventus Arrangement leverages a Proof-of-Stake based layer, what are its advantages back compared to added networks, abnormally those accurate by a Proof-of-Work accord algorithm? Do you accept there are improvements in activity burning and aegis to the network?

A: According to abstracts from the Cambridge Center for Alternative Finance, Bitcoin mining consumes added activity than Argentina.

However, comparing Bitcoin mining to all added blockchains is like comparing the abuse of oil refineries with garden centres.

Bitcoin uses a awful able but energy-intensive proof-of-work (PoW) accord mechanism. PoW is a decentralised accord apparatus that needs arrangement associates to expend astronomic accomplishment in analytic accidental algebraic puzzles to advance arrangement security. It requires astronomic amounts of activity which increases as added miners accompany the network.

Other blockchains, like Aventus Network, use a Proof-of-Stake (PoS) accord apparatus to defended the arrangement by adjustment the arrangement participants’ incentives through circuitous bread-and-butter bold theory.

This agency that awful actors are economically disincentivized from bent behaviour as they are appropriate to own and pale a minimum of 51% of the network’s staked bill or tokens to affirm adulterine transactions.

In accomplishing so, added arrangement nodes are still calmly able to atom such awful behaviour and the bad amateur forfeits their absolute stake.

When the bazaar cap of projects ranges from a few billion to abounding billions of dollars, it becomes bread-and-butter suicide to abuse the network.

By absence the PoW consensus, PoS blockchains abate activity acceptance by added than 99%, application aloof a atom of the activity compared to bitcoin.

In that sense, PoS blockchain networks can alike be a behemothic bound advanced for businesses anxious with blooming accreditation back it comes to any of the above use cases.

Q: How does the Aventus Validator Program operate? It is all-important to accept AVT participate in it, if so, how can users admission the token?

A: Using a Proof-of-Stake bulge validator model, the Aventus Network pays Validators their allotment of fees from every transaction candy on the bulge to which they pale their $AVT.

The arrangement relies on AVT holders as Validators who action affairs in acknowledgment for a fee. The Aventus Arrangement will barrage with 10 nodes, anniversary with an according anticipation of alternative to action affairs (i.e. 10% probability).

Each bulge will acquire fees associated with the candy affairs at a accepted boilerplate of $0.01 per transaction. And anniversary bulge will accept a absolute pale of 250,000 AVT.

Validator transaction fee rewards are paid in admeasurement to the bulk of AVT a Validator assembly with a node. E.g. If a holder owns 25,000 of a node’s 250,000 AVT, they will accept 10% of all transaction fee rewards from that node.

Validators will be able to abjure their proportional allotment of transaction fees associated with their nodes on a account basis.

Validators will be able to drop any bulk of AVT to any of the 10 nodes application the Ethereum acute arrangement provided. The acute affairs accept undergone a aegis analysis by an absolute third party.

The Validator Registration Program is currently 80% abounding and will abutting anon at 100%.

Users can acquirement $AVT from Uniswap, Mercatox, or HitBTC and annals to pale now at https://www.aventus.io/ecosystem/.

You can acquisition a step-by-step adviser on how to pale at https://medium.com/aventus/the-step-by-step-guide-to-the-aventus-validator-staking-program-e3ccf4b47c8e.

Q: What are the requirements to become an Aventus Network validator, and why should users pale their armamentarium with AVT as against to a altered staking program? For example, why not use ETH and lock it on the ETH 2.0 Deposit Contract for the rewards?

A: There are abounding staking programs, like the ETH 2.0 Deposit Contract, for example, however, as Aventus advocate Blake said, “ I’m actual blessed with these earnings, you would not see annihilation like this earning amount at a bank. The staking anniversary acknowledgment amount is currently at 11.60%.

The balance are additionally on par or bigger than crypto lending / earning platforms like Nexo etc.

In accession to all this, these staking rewards becoming are not diluting your aboriginal backing as Aventus has a anchored supply.

A lot of staking rewards with added projects may action abundant college earning ante but in absoluteness you are not absolutely earning annihilation as those staking rewards are advancing from minting added tokens and abacus to the absolute badge supply. So if you saw 100% APY with a activity that mints to accord out staking rewards again basically afterwards a year if you did not pale you’d be adulterated 50%. If you did pale for the abounding year you would in aftereffect not be adulterated as that 100% APY you acquire would annul the concoction so in aftereffect you accretion 0 and lose 0.”

Users can accept their adopted badge and staking affairs and could accept to alter beyond many.

Q: Since its launch, Aventus Network has circumscribed partnerships with important players in the crypto space, can you accommodate added capacity as to the newest collaborations onboarding the agreement and how they appulse the Aventus Staking Program and its incentives?

A: It’s true, we accept partnered with abounding ample companies like Live Nation France and had an acceding to action 58m affairs to the network.

Each new affiliation adds to the transaction aggregate and, naturally, to the transaction fees paid to Validators in the staking program.

We accept some actual agitative new partnerships advancing in the NFT amplitude and aim as a arrangement to ability one billion affairs in the abutting brace of years — which agency a lot of fees for stakers.

What’s more, as new ally onboard, they crave buying of the $AVT badge too to action transactions, which is agitative for anyone staking to AvN nodes.

Q: In the accepted inflationary bread-and-butter outlook, with the CPI afresh before 5.3% back August 2026 per the U.S. Labor Department, how all-important is it for investors and bodies to accept admission to articles able of alms returns, such as the Aventus Validator Program?

A: Aggrandizement wipes out savings. To action that and assure one’s wealth, it’s all-important to acquire through investments and assets programs at a amount that matches or outpaces inflation.

Blockchain projects like Aventus accomplish such programs attainable to about anyone with some money and an internet connection.

Q: Currently, there are abounding alternatives blockchains arising on the aback of Ethereum aerial transaction fees, and arrangement congestion. In this context, is Aventus Arrangement and layer-2 ascent solutions a axial allotment of the adaptation of Ethereum? Or do you accept the approaching of accessible blockchains is interoperable with abounding inter-connected blockchains alms abounding use cases?

A: As there is with email account providers, so there will be with blockchains. Gmail users can accelerate emails to hotmail users, Yahoo users etc.

Currently, interoperability and scalability are above apropos in the blockchain space. Multiple blockchains animate fair antagonism — a above advantage to decentralisation vs centralisation in that no one has absolute control.

Ethereum, after convalescent scalability will ache beneath the weight of accepted appeal and consecutive gas fees until it bleeds users into added blockchains and loses its acceptability as the arrangement of best for blockchain building.

Layer-2 solutions like Aventus Network advice break both of these problems by convalescent scale, abbreviation fees, and acceptable in the advance appear interoperability.