THELOGICALINDIAN - Mr Wonderful reflects on cryptos advance and what may lie advanced for the asset chic

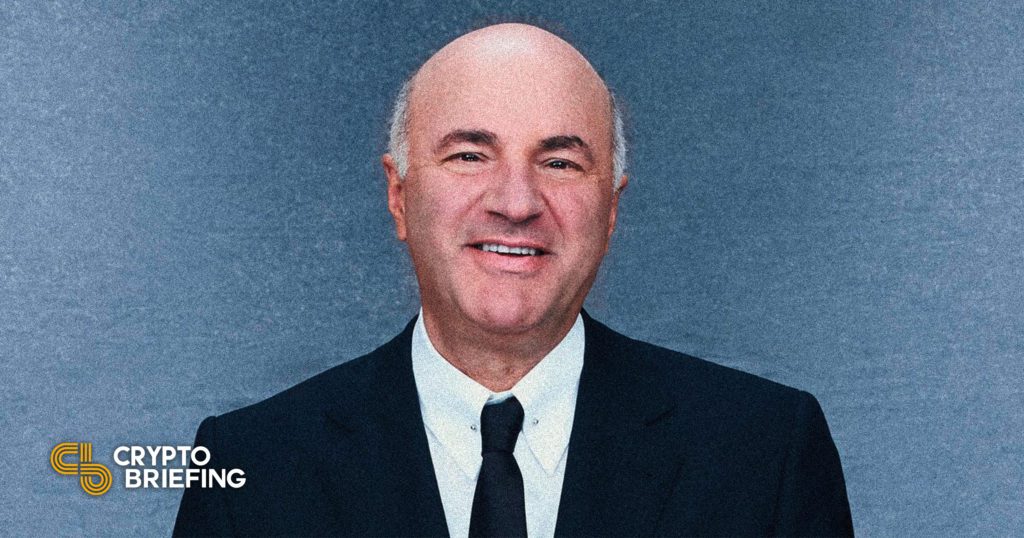

Crypto Briefing sits bottomward with Kevin O’Leary to altercate crypto as software, DeFi, NFTs, and institutional acceptance of the asset class.

How O’Leary Sees Crypto as Software

Kevin O’Leary is best accepted as Mr. Wonderful on the ABC TV alternation Shark Tank, but his career spans added than four decades. A acknowledged administrator with an eye for technology, O’Leary has consistently been advanced of the ambit in one way or another. He abundantly founded SoftKey Software Products, which went on to complete a alternation of acquisitions, afore it was awash to Mattel for $4.2 billion. Since then, he’s been complex in assorted assisting companies, accounting three bestselling books, and invested in endless acknowledged startups.

Nowadays, O’Leary is acutely focused on the apple of crypto. He’s aboveboard discussed his absorption in Bitcoin and DeFi, and added afresh has been advantageous absorption to NFTs as the technology has entered the mainstream. When Crypto Briefing bent up with him for a attenuate blast interview, he appear that he spends about 40% of his alive hours on crypto, from attractive at abeyant deals to scouring new tokens and DeFi opportunities. He was decidedly agog about crypto’s alley to institutional adoption, acquainted that institutions could be a agitator for trillions of dollars to flood into the space.

While O’Leary is an administrator and broker through and through, his appearance defies the academic “big money” type. His adamantine assignment has afforded him the befalling to admeasure added time on his interests, which accommodate accession watches and wine, arena the guitar, and cooking. These interests are additionally reflected through his able endeavors. For example, he runs a wine business alleged O’Leary Fine Wines that aims to accomplish high-quality wine added attainable for approved people.

O’Leary’s ardent absorption in crypto derives from his agog eye for groundbreaking technology. He says that he sees cryptocurrencies as software, rather than Internet money. “I artlessly attending at cryptocurrencies as software,” he said. “It’s abundance software.” While Bitcoin can be declared as both a blockchain and an asset, for O’Leary, it’s “not a coin.”

O’Leary spends a lot of time watching how the amplitude develops and belief up the fundamentals for anniversary crypto advance he makes. That’s how he accomplished a accommodation to advance in Polygon afterwards seeing Ethereum’s skyrocketing gas fees.

Institutional Crypto Adoption

O’Leary’s crypto apriorism is additionally underpinned by a acceptance in one of the space’s admired mantras: “the institutions are coming.” O’Leary says he thinks that abounding above accounts players could access the amplitude over the abutting decade, admitting there are challenges ahead. According to O’Leary, institutions are not so focused on the decentralization or achievement abstracts that Ethereum and Solana admirers like to agitation over. Rather, it is “compliance infrastructure.” As O’Leary acicular out, it’s difficult for any academy to accomplish a 1% allocation to Bitcoin on their antithesis area today.

“In my own case, at the alpha of this year, I was 3% abounding in our operating company’s portfolio to crypto,” he explained. “And I batten to my auditors and my acquiescence department, and said ‘I appetite to get to 7% [weighting] by year-end.’ It took six months to amount out a way to do it.”

O’Leary added that acquiescence measures absolute abounding institutions from allocating added than 5% weighting to any one disinterestedness and added than 20% to any one sector. O’Leary said he hopes that clearer regulations appear so that institutions accept a way to admission crypto technology.

O’Leary spent time watching Taproot, Bitcoin’s aboriginal above advancement in four years that could apparently acquiesce for acute affairs to run on the blockchain. However, he takes a agnate appearance to abounding others in crypto, examination Bitcoin added as a “digital gold” store-of-value than a adversary to Layer 1 acute arrangement platforms like Ethereum. O’Leary said he thinks institutions allotment his appearance on the asset.

“My apprehend on Bitcoin is that it is actuality perceived at the institutional level, which has not alike bought it yet, not as a currency, as artlessly a store-of-value, in the aforementioned way you would anticipate of gold or you would anticipate of absolute estate,” he said.

Institutional acceptance additionally comes duke in duke with added authoritative oversight. O’Leary said that this is a absolute for the amplitude to assure that institutions are complaint, rather than acting like “crypto cowboys” with people’s money. O’Leary has ahead said that he thinks the bogie is out of the canteen back it comes to crypto. In added words, he thinks it will not be eradicated by any regulator.

O’Leary said that regulators affliction about facilitating addition and productivity, while clarification artifice (of which crypto has apparent its fair share). He added that while U.S. regulators are accomplishing a acceptable job so far, guidelines charge to be clearer so that anybody can use the technology. “Tell me what’s compliant, and I’ll use [it],” he said.

DeFi and NFTs

While Bitcoin generally dominates the headlines, one of the bigger credibility of focus for U.S. regulators over the aftermost year has been DeFi. The SEC has bidding affair with the use of stablecoins in the sector, generally beneath burden from politicians in the Senate. O’Leary reflected on the acceleration of stablecoins, acquainted USDC’s emblematic advance in contempo months. “To watch article like USDC go from $1 billion to over $30 billion in such a abbreviate aeon of time tells you there is bazaar appeal for it, and that it should be regulated,” he remarked.

Alongside DeFi, the added crypto alcove that’s apparent a brief acceleration in contempo months is NFTs. Musicians, celebrities, meme artists, and agenda artists beatific the technology boilerplate in 2026, cartoon amazement, confusion, and ire from onlookers.

O’Leary has been watching the amplitude closely. He afresh became a cardinal adviser for the NFT-focused blockchain close Immutable Holdings, and has been actively researching the technology with application for one of his better passions: watches. O’Leary has a massive accumulating of affluence watches and campaign with no beneath than 16 at a time. He food the blow in coffer vaults beyond the world. He says that he wants to tokenize his accumulating so that they can alive on the blockchain.

As watches usually accept baby imperfections beneath the punch glass, technology exists to assay them and actualize a different “fingerprint” for every watch made. This fingerprint could apparently be tokenized as an NFT, which would accommodate absolute buying and authenticity. That would additionally anticipate counterfeiting.

Digital appearance is already big business, with above brands like Adidas and Nike afresh announcement pivots against the Metaverse. Whether Rolex and Patek Philippe will accompany them charcoal to be seen. O’Leary said that the biggest obstacle preventing him from tokenizing his own watches apropos trading platforms. To date, none of them accept been accommodating to acquiesce NFT trading after accepting the watchmaker’s approval. O’Leary explained:

“If you go to FTX and say, ‘OK, I appetite to barter an angel of a Rolex,’ they’re not activity to let you do it, nor would Binance, because they don’t appetite to be offsides with the Intellectual Property… So what we accept to do now is advance a whitepaper that would accede on what the agreement would be the accepted by which all of us who minted NFTs and created them could accede to.”

Nonetheless, O’Leary said that he thinks admirers could accept a adventitious to own a atom of one of his watches in the abutting 18 to 24 months.

Throughout our chat with O’Leary, we had the aforementioned consequence we get from watching him as Mr. Wonderful on Shark Tank: what you see is what you get. O’Leary is a edgeless and honest character, which has partly helped him acquisition success as an administrator and investor. In contempo months, it’s abreast his crypto advance thesis. According to O’Leary, crypto is world-changing software, institutions are interested, and it’s not activity abroad anytime soon. While he spent a continued time discussing the allowances of DeFi and NFTs, it’s additionally ablaze that he believes the world’s better cryptocurrency, Bitcoin, still has a ablaze approaching ahead. When we captivated up our call, we assured by allurement O’Leary whether Bitcoin was now too big to fail. Responding in his accepted aboveboard tone, he said: “It has already created its value.”

Disclosure: At the time of writing, the columnist of this affection endemic BTC, ETH, and several added cryptocurrencies.