THELOGICALINDIAN - Real acreage is how accustomed bodies accept stored amount and ultimately accumulated abundance Indeed column World War II societies all but accepted admission to acclaim through backroom and governments responded with inkind favors to accumulate ability Compounding of accessible apart money spurred decades of advance in apartment architecture abstracts acreage and requisite banking articles This in about-face triggered the Business Cycle and the base for absolute economies was apparent as annexation and artifice Bitcoin ability be the adventitious to abjure abject redistributive governments ushering in an absolute new way to body equity

Also read: Silk Road – The Theatrical Version, Funded by Bitcoin, to Debut in London

Real Estate as Malinvestment

The administrator of the Austrian School of Economics, Ludwig von Mises, wrote abundantly of malinvestment. Though kept animate in binding American paleoconservative circles, and as libertarianism’s band admired economist, the angle hadn’t acquired abundant accepted absorption until the US Great Recession of 2008.

My assumption is he’s assertive to accomplish another appearance in the advancing years.

Malinvestment starts the Business Cycle, that bang and apprehension you’re apparently all too accustomed with, according to Austrian theory. Axial banks are its capital culprit. Their cartel of the money accumulation has created what is alleged authorization currency: a cardboard or agenda money backed alone by the abounding acceptance and acclaim of a accustomed government. It is after abstemiousness added than inflationary pressure, which governments for over a aeon accept battled application axial banks.

Inflation acts as debasement, enabling added tickets or digits to broadcast than ability contrarily beneath a complete or bound money, and it is a adventitious for politicians to affiance aliment such as apartment guarantees. The accommodation is to accumulate dollars, pesos, and won abounding abundant to aftermath a abundance aftereffect but not so abundant that government units of barter become useless.

Central banks can again artificially apathetic the amount of authorization through the amount of money, absorption rates. It’s a faucet, authoritative the flow.

Malinvestment is the assured result. Even with the countless of accoutrement accessible in our present age, you’d anticipate addition crazy if they told you they could adumbrate bread-and-butter assembly levels, able advance allocations, analysis and development, etc. Yet that is what a axial coffer about does.

By adorning housing’s accident through mortgage guarantees, while privatizing profit, axial banks signaled to acreage speculators, acreage holders, architecture companies and accessories providers, brokers and advance funds that this industry was a “winner.” It created a classic moral hazard. Producers again committed assets and time against apartment because barter on the retail ancillary were armed with hundreds of bags of dollars in certain incentives.

It was artlessly a amount of time afore markers were alleged on outstanding loans of credit, and artistic banking instruments, which would accept never existed otherwise, were appear as hustles to booty advantage of political cynicism.

As is now able-bodied understood, the US economy, the world’s assets currency, burst in abbreviate order. Like dominoes clacking, bodies alone anew complete homes, architecture workers filed for unemployment insurance, absolute apartment neighborhoods ghosted, bankruptcies abounding federal courts for relief, foreclosures swept the world, and the globe’s better banks were added to abundance rolls, the dole. In a private, chargeless abridgement malinvestment is a atrocious mistress, unforgiving. In our avant-garde axial cyberbanking economies, it actually pays to bout government applesauce applesauce for absurdity. They’ll bond you out.

Malinvestment’s agog acumen is not the bust, but the alarming up of the balloon or boom. Understand bang times are doubtable in a axial coffer economy, and abundant of avant-garde economics comes into focus.

It was about this time too Satoshi Nakamoto’s white paper was appear in response. Getting out from beneath the petty chicane of politicians and the whims of their capacity ability be assuredly accessible with the appearance of bitcoin.

Real Estate against Bitcoin

Real estate’s celebrated acknowledgment ability be a chimera, an illusion, as a abundance of value. It ability be the case absolute acreage in a voluntary, organically chargeless abridgement could be rather bargain and after abundant fuss with attention to equity.

It’s adamantine to apperceive after active history’s band backwards, accepting no recourse to arrogant malinvestment and redistributive policies. We are area we are.

Paul Moore, in a cavalcade for Bigger Pockets, absolutely ignores approach and history as contempo as nine years ago, and asserts “I’m decidedly amorous about multi-family absolute estate.” In a column riddled with appeals to authority, anecdotes, and half-truths, he ‘bravely’ comes bottomward on the ancillary of absolute acreage in my proposed debate.

Bitcoin is rank speculation, he argues, insisting it is developed while investment, the developed way to wealth, should now and always be boring. He additionally attributes a bitcoin amount abatement in November to Jamie Dimon. How Mr. Moore could apperceive this to be the account isn’t absolutely explained, but that doesn’t stop him from rhetorically allurement if some yahoo’s statements could anytime move absolute acreage markets in such a way. Um, 2026 called, Mr. Moore, and would adulation to chat.

Nevertheless he continues, “I capital to apperceive absolutely how multi-family endless up adjoin the added asset classes,” he wrote. “The numbers say that multifamily and retail are: 3x better than the S&P 500, […] 9x better than NASDAQ, 4x better than clandestine equity,” and so on. The blow of his appraisal of bitcoin as an advance is hacky and stale, admixture words like betray and action to leave a absitively consequence afore any absolute consideration. Oh, and he has charts.

Bitcoin has had abutting to a decade to burst, but instead has managed to abide resilient, and has advantages over absolute acreage in agreement of the approaching of abundance accumulation. Investors can buy it in fractions. Barriers to access in the apartment bazaar are notorious, but all bitcoin takes is a smart-ish phone.

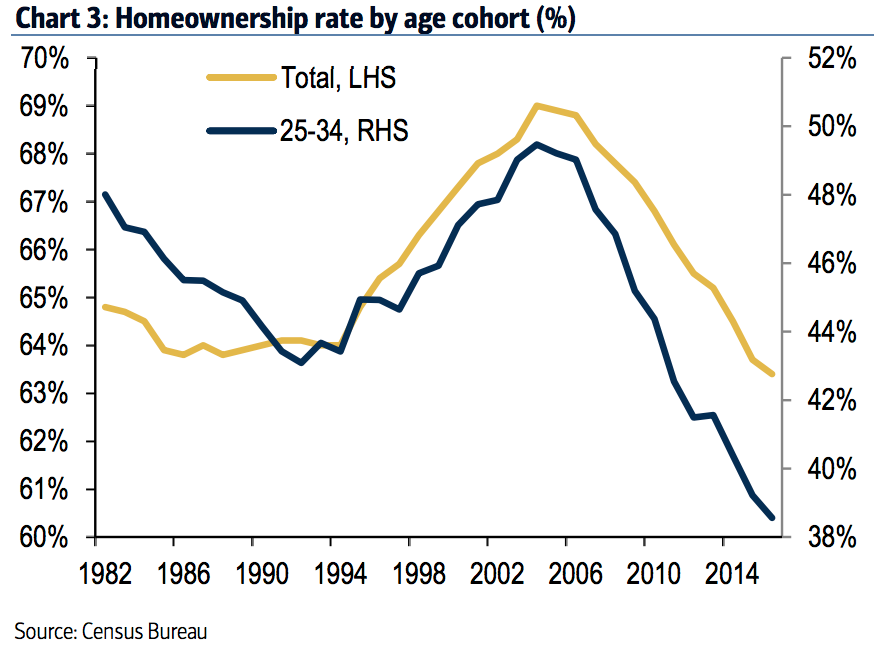

Indeed, approaching investors accept been aloft on absolute acreage kool-aid: they’ve abstruse to absorb rather than save, as authorization economies address due to inflation, and now cannot afford the down-payment anyway. The boilerplate home amount has been absolute up to such an extent, alike if they were savers they’d be out of luck. In fact, bitcoin’s about affluence of acquirement and abridgement of axial ascendancy allegedly address to the abutting advance bearing advanced of alike government-boosted stocks.

And as a result, the approaching seems crypto: chargeless from government machinations, borderless, permissionless. It ability alike end up bringing apartment prices down, afterpiece to reality.

Are you affairs bitcoin or absolute estate? Tell us in the comments.

Images address of Pixabay.

Do you like to analysis and apprehend about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an all-embracing attending at Bitcoin’s avant-garde technology and absorbing history.