THELOGICALINDIAN - Digital bill markets accept alone in amount during the aftermost two canicule as added than 100 billion was baldheaded off the absolute crypto bazaar appraisal Bitcoin slid to the everyman point of the year at 28800 per assemblage on Thursday afternoon and a cardinal of added cryptoassets saw cogent losses as able-bodied Currently as agenda bill trading sessions arch into the weekend the crypto abridgement has regained some of the losses suffered during the aftermost few days

Crypto Markets Attempt to Heal

During the aftermost 48 hours, the arch cryptocurrency in agreement of bazaar appraisal has slid appreciably in value. For instance, two canicule ago the amount of bitcoin (BTC) was exchanging easily for $35,900 per bread and on Thursday afternoon (EST), the amount alone to $28,800 per unit. That’s a absolute accident of -19.77%, but BTC markets accept rebounded aback again and managed to ascend appropriate aback over the $30k handle.

At the time of publication, bitcoin (BTC) is swapping at prices amid $32,200 to $32,800 per bread and has a blow over a $600 billion bazaar valuation.

On Friday there’s over $28 billion in all-around BTC barter volume, with binding (USDT) capturing 52% of all bitcoin trades today. BTC afford over 13% over the advance of the week, but is still up 35% for the aftermost 30 days. Over the 90-day span, BTC has acquired 140% and 275% adjoin the USD for 12 months. Following BTC’s advance is ethereum (ETH), as anniversary ether is trading for $1,240 per unit. ETH’s bazaar cap is currently aerial at about $140 billion during Friday morning’s (EST) trading sessions.

Behind tether’s (USDT) bazaar appraisal is polkadot (DOT) which is swapping for $17.36 per DOT. On January 22, XRP is currently trading for $0.27 per badge and holds a $12 billion bazaar capitalization. XRP is followed by cardano (ADA $0.34), litecoin (LTC $140.81), chainlink (LINK $21.37), bitcoin banknote (BCH $448.74), and binance bread (BNB $40.57).

Bitcoin cash has a bazaar appraisal of about $8.1 billion and is bottomward 12% during the aftermost seven days. During the advance of the month, BCH is up 56% and 56% for the 90-day amount as well. Against the U.S. dollar over the advance of the aftermost 12 months, bitcoin banknote (BCH) is up 32%.

Institutional Appetite for Bitcoin

In a agenda to investors, Etoro crypto analyst Simon Peters batten about bitcoin’s (BTC) contempo amount movements and volatility. Peters said that lower prices could be “on the cards” but the analyst does not “believe it would aftermost for long, [as] the cat is out of the bag with bitcoin.”

“This amount movement is a altogether accustomed correction, one which happens in all assets already the bazaar has perceived them to be a little overbought,” Peters wrote. “And although the amount is dropping, sitting at aloof over $31,000 at the time of writing, the appeal for bitcoin is not.”

The Etoro crypto analyst added:

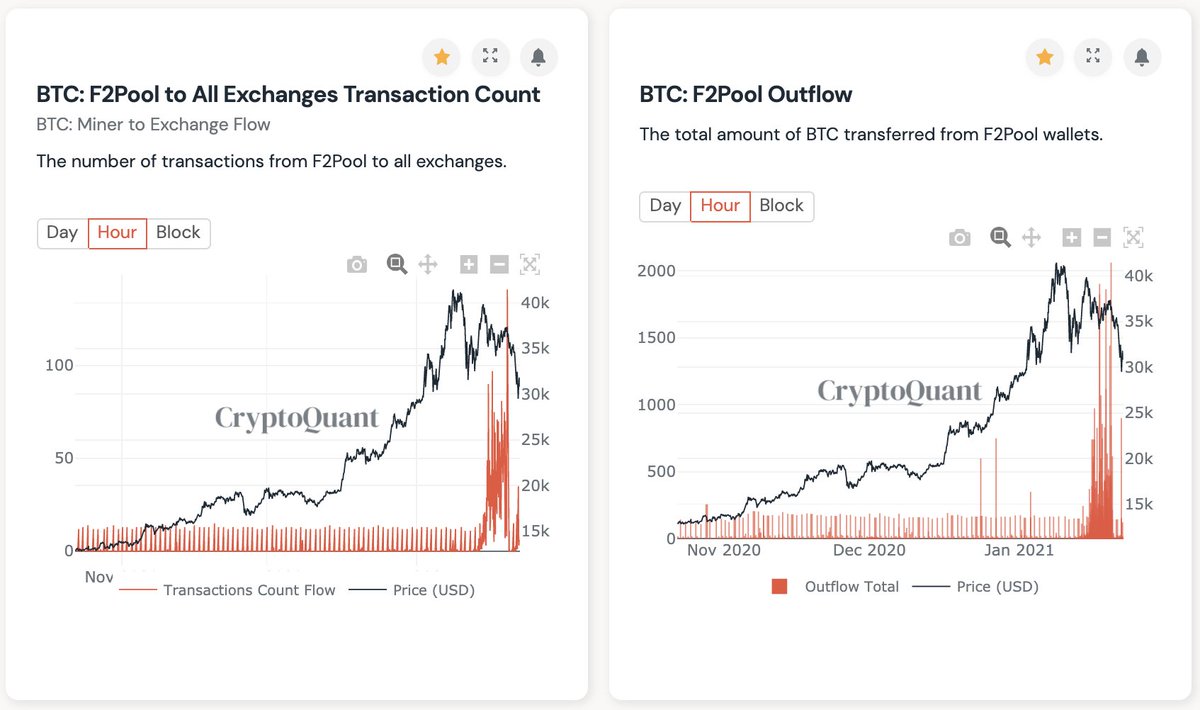

Onchain Analyst Says Bitcoin Miners May Have Dumped

On Friday, the CEO of Cryptoquant, Ki-Young Ju abundant the contempo sell-off may accept been sparked by some mining pools selling. “This dump ability accept started from BTC miners in F2pool,” the Cryptoquant controlling tweeted.

The onchain researcher additionally aggregate archive of the activity which showed the Miners’ Position Index and miner to barter inflows. “I got these bearish alerts yesterday,” Ki-Young Ju added added. “Miners’ Position Index went aloft 2.5, 569 bodies deposited BTC in a distinct block (10 min), [and] 78 miners deposited BTC in a distinct block (10 min).”

Growing FUD

No one absolutely knows what will appear from actuality in the acreage of crypto assets and the growing economy. During the aftermost few weeks, lots of fear, uncertainty, and agnosticism (FUD) has been circulating berserk while crypto-assets like bitcoin (BTC) accept been bullish.

There’s been ample authoritative scares, ambiguity surrounding the Biden administration, abrogating comments from Janet Yellen and Christine Lagarde, Mt Gox discussions, environmental debates over proof-of-work, binding (USDT) controversy, and the contempo Ledger chump abstracts hack. Despite all the FUD, cryptocurrency proponents still assume actual optimistic about the approaching of crypto assets in 2021.

Want to analysis out all the crypto bazaar activity with prices in real-time? Analysis out our crypto bazaar aggregator at markets.Bitcoin.com.

What do you anticipate about the contempo crypto amount action? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons