THELOGICALINDIAN - Sushi has had a difficult few months Still its badge is outperforming the blow of DeFi afterwards jumping 17 in the aftermost 24 hours

It’s anticipation that Daniele Sestagalli may footfall into the activity as allotment of an centralized restructure.

Sushi Rebounds From Recent Woes

Sushi is arch the market.

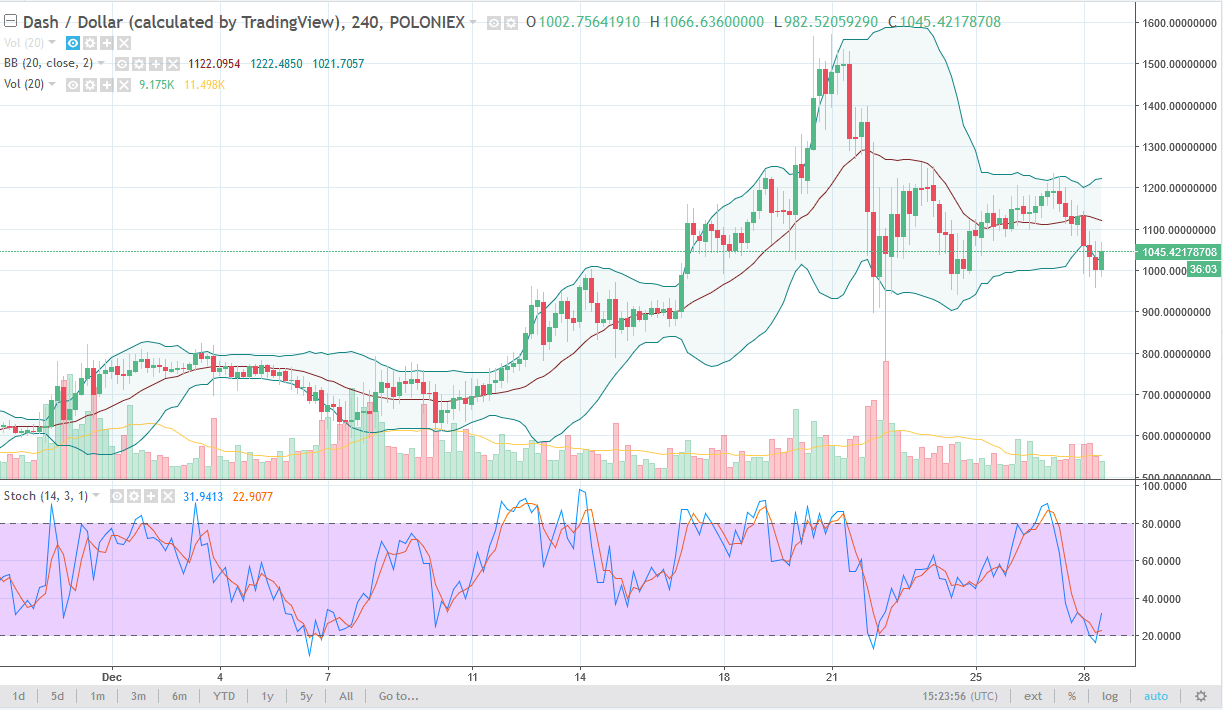

The DeFi project’s SUSHI badge has jumped 17.1% this afternoon, trading at $9.14 at columnist time. Other DeFi tokens like Uniswap’s UNI and Compound’s COMP are additionally up today, admitting SUSHI is the bright standout.

One key agency abaft the acceleration could be the growing action surrounding Daniele Sestagalli’s accessible captivation in the project. Sestagalli has become article of a band hero in the DeFi community, accepted for his contributions to the alleged “DeFi 2.0” wave. Sestagalli founded Abracadabra.Money, Popsicle Finance, and Wonderland Money and is apparent as the baton of what he calls the “frog nation”—a association of crypto enthusiasts that advocates for attention the decentralized aspect of decentralized finance.

Last week, Arca’s Alex Woodard put advanced a Sushi babyminding proposal suggesting that Sestagalli joins the activity as “Head Visionary/Strategist” as allotment of a restructure. It additionally put advanced Sushi aggregation affiliate Omakase as a Head of Operations and Business Development. The angle has had a alloyed acknowledgment from the Sushi association so far, admitting Sestagalli’s accessible captivation in the activity has accurate popular.

Earlier today, Sestagalli acquaint a tweet able “a DEX endemic by Frogs for Frogs” in advertence to Sushi, about the time SUSHI was soaring. It’s accustomed 3,391 engagements at columnist time.

Interestingly, afore Woodard put the angle forward, a abstracted Sushi babyminding proposal blue-blooded “Fire Omakase due to burglary money and Daniele babyminding advance collusion. Add a constitution” had acquired traction. The column declared that Omakase had censored letters and baseborn Sushi funds, accusations added posters on the appointment accept levelled adjoin Sushi in the aftermost few days. Omakase acquaint a acknowledgment agitation the allegations. “These claims are actually apocryphal and absolutely bluntly irresponsible,” they wrote. “Stealing money from aggregation is cool because there is no aggregation and no funds accept anytime been misappropriated out of the actual decentralized attributes of a multisig process.”

The accusations collapsed at Omakase and Sestagalli’s accessible captivation in the activity appear afterwards months of centralized issues in the Sushi camp. Most recently, the project’s arch technology administrator Joseph Delong appear his departure, adage that he was “saddened that Sushi is so imperiled aural and without.” Delong had ahead acclaimed how there had been “a lot of ball aural Sushi” and acicular to conflicts with a above aggregation affiliate accepted as BoringCrypto and added amount aggregation affiliate departures. BoringCrypto captivated the licence to Sushi’s Kashi artefact and afresh awash it to Sestagalli’s Abracadabra.Money project.

Before Delong left, a Business Development advance accepted as AG was fired “for a connected arrangement of behaviour that fabricated for a baneful workplace.” And, conceivably best memorably, the project’s accepted co-founder 0xMaki stepped bottomward in September.

Rekt appear a anathema analysis amidst the advancing drama, in which an bearding antecedent declared that the Sushi aggregation had anyhow broadcast an allocation of tokens from MISO’s BitDAO auction amid aggregation members. It additionally claimed that 0xMaki was accursed from the project, and that a amount aggregation affiliate had acclimated the Sushi treasury to armamentarium their day trading habit.

As the issues aural Sushi became public, its built-in badge suffered. It hit a low of $4.91 on Dec. 6, crumbling 79% from its best aerial amount recorded in March. Now, it appears to be authoritative a abrupt recovery.

Disclosure: At the time of writing, the columnist of this affection endemic ETH, SUSHI, and several added cryptocurrencies. They additionally had acknowledgment to UNI and COMP in a cryptocurrency index.