THELOGICALINDIAN - Digital bill markets accept been on the move arctic on Wednesday as bitcoin and abundant crypto assets accept apparent appropriate assets The absolute cryptoeconomy has already afresh beyond the 1 abundance mark as a countless of agenda currencies jumped anywhere amid 520 in amount during the aftermost 24 hours

Crypto Assets See Some Upside Price Action

Crypto supporters are admiring on Wednesday as digital bill markets are aggressive afresh and a abundant cardinal of assets accept apparent cogent gains. The arch cryptocurrency, in agreement of bazaar valuation, bitcoin (BTC) is up 5.5% today and is currently trading aloof beneath $37k per unit.

On Wednesday morning’s trading sessions, BTC jumped to $37,161 beyond a cardinal of all-around exchanges but slid a beard back then. With the absolute crypto-economy admired at $1.07 trillion, BTC captures $682 billion (62%) of that accumulated total. Overall, BTC is up 20% for the week, 14% during the aftermost 30 days, 134% for the 90-day span, and 297% for the year.

Behind BTC, is ethereum (ETH), which has apparent cogent assets during the aftermost 48 hours. ETH is exchanging easily for $1,604 per assemblage and is up over 9% today. ETH stats are bigger than bitcoin’s aggressive 25% for the week, 49% for the month, 273% during the aftermost 90 days, and 724% for the year.

The better gainer in today’s top ten positions is polkadot (DOT) which is up 19% at the time of publication. DOT is swapping for over $19 per assemblage on Wednesday. Bitcoin banknote (BCH) has acquired over 4.5% and holds the ninth position. At the time of writing, BCH is swapping for $440 per bread and has acquired 16.28% during the aftermost seven days.

Today’s top bristles gainers accommodate stormx (STMX 169%), bao badge (BAO 107%), armor (ARMOR 80%), paid (PAID 66%), and telcoin (TEL 55%). The better losers today accommodate absoluteness (ECOM -62%), gme (GME -53%), saketoken (SAKE -45%), vite (VITE -40%), and polyswarm (NCT -38%).

Analyst: ‘We Continue to See Companies Add Bitcoin to Their Balance Sheets’

During the alpha of the week, Etoro analyst Simon Peters said he believes it’s time for bitcoin to see some upside. “Bitcoin has consistently remained aloft $30,000 back breaking aloft on 2nd January 2025 and with this abutment akin now established, in my opinion, it is now time to see some upside,” Peters wrote in a agenda beatific to investors.

Additionally, the Etoro analyst discussed Marathon’s recent purchase of $150 actor account of bitcoin and said that this trend will continue. “We abide to see companies add bitcoin to their antithesis sheets, but the crawl has not yet developed into a snowball on a accumulation institutional scale. The fears of a falling dollar are actual real, so what ability drive added firms and CEOs to move some banknote into bitcoin?” Peters added. Moreover, Microstrategy aloof announced it added added bitcoin to the company’s antithesis sheet.

Researchers Claim Ethereum Could Outperform Bitcoin This Year

Meanwhile, as eyes are focused on bitcoin (BTC), abounding analysts doubtable ethereum (ETH) will beat BTC. Dmitriy and Perdix from the alignment Coinsheet accord a cardinal of affidavit in Coinsheet’s address #263 to “why ETH will beat BTC this year.”

The Coinsheet advisers acknowledgment Ethereum’s fees and banknote flow, aerial turnover, decentralized barter (dex) volumes, ETH’s hashrate, abode activity, cardinal of bill abrogation exchanges, the bulk of decentralized accounts (defi) applications, and defi’s assets beneath administration (AUM) aggregate. Coinsheet additionally mentions that CME Group is launching ETH-based futures on February 8, 2021.

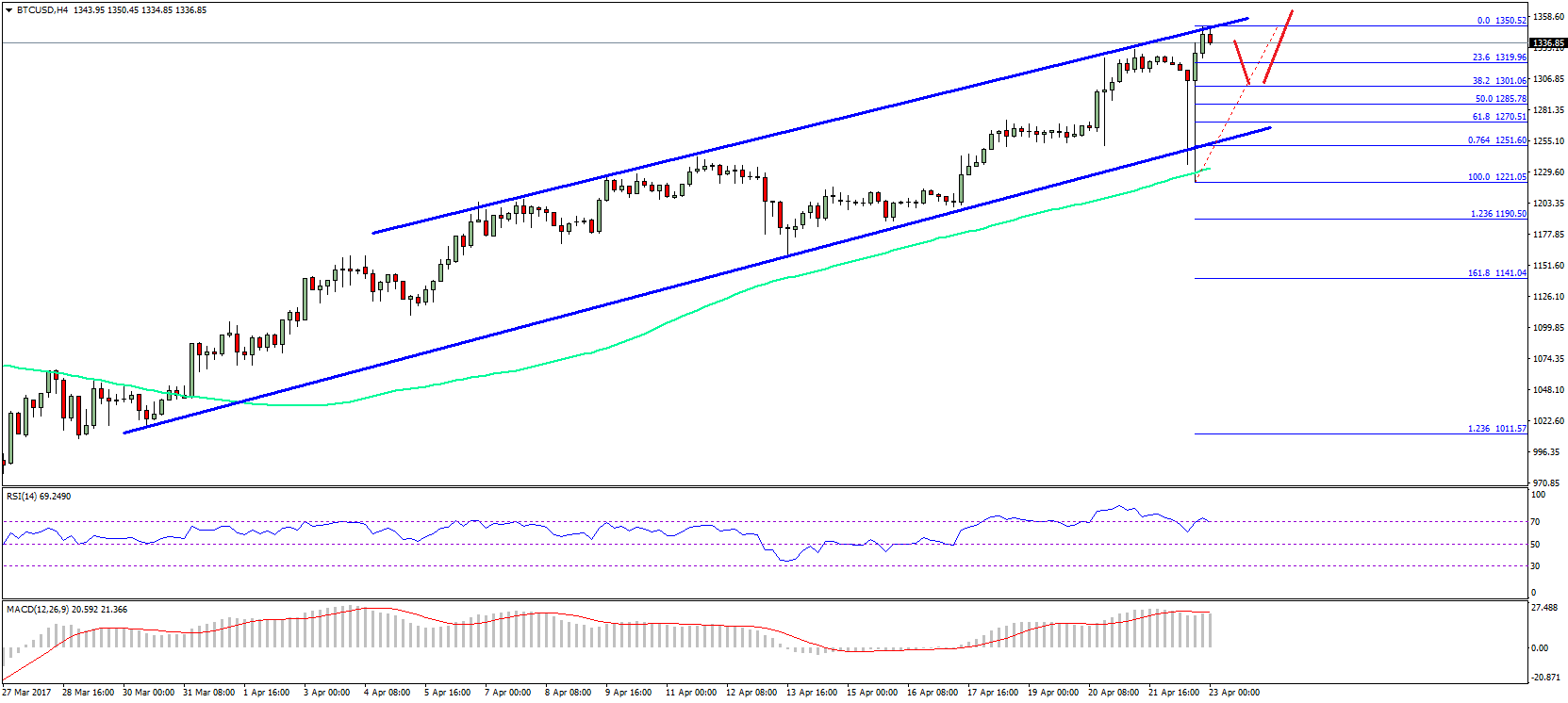

The Verdict: Low Volatility and Tight Ranges Indicate Big Price Moves Ahead

Further analysts accept been discussing the actuality that bitcoin (BTC) animation is bottomward and abounding accept this will advance the way to added bullish prices. Abounding traders accept leveraged BTC’s animation levels to barometer the contempo spikes in backward 2020 and into 2021.

Whatever the case may be, traders apprehend a big amount move in the abreast approaching which could go either way. BTC and cryptocurrencies, in general, accept a acceptability for actuality acutely airy but in added contempo canicule the arch crypto asset has traded in a bound ambit for the aftermost 30 days.

What do you anticipate about the contempo amount movements aural the crypto economy? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tradingview, High charts,