THELOGICALINDIAN - Digital bill markets accept been agitated during the accomplished ages as bitcoin afford 1543 and ethereum alone 1749 adjoin the US dollar Moreover crypto atom volumes are bottomward 1895 lower than the ages above-mentioned and both futures and options volumes were bottomward in April as able-bodied Lower than boilerplate barter volumes about advance all-embracing absorption has beneath and investors may be cat-and-mouse on the sidelines for lower prices

April’s Crypto Market Spot Volumes Slip Close to 19% Lower Than Last Month

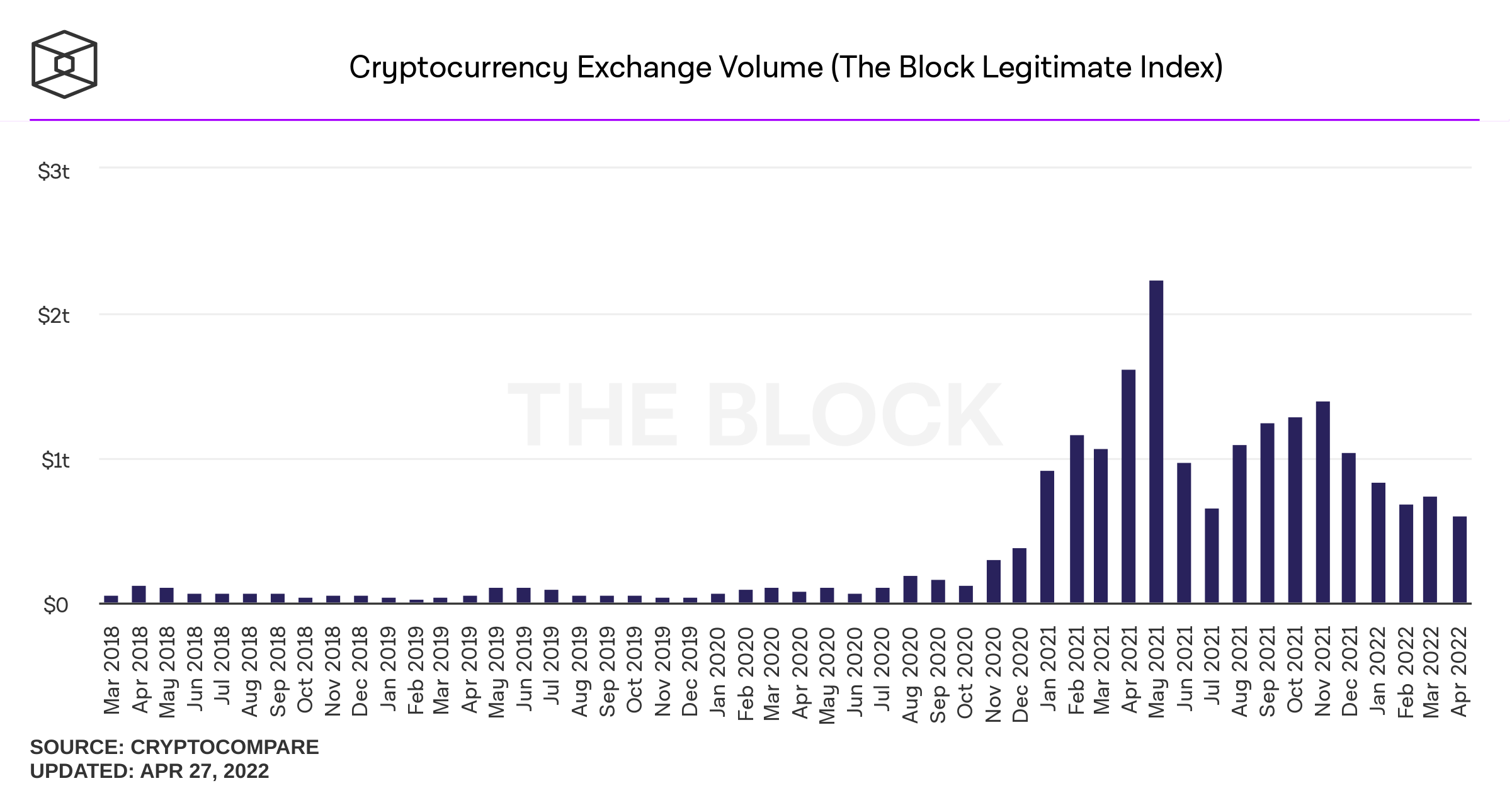

The crypto economy concluded the ages of April in the red, as best agenda assets suffered losses during the aftermost few weeks. At the time of writing, all ten of the top crypto assets are bottomward decidedly as they absent amid 10.39% to 31.43% during the abaft 30 days. Metrics added announce that April’s cryptocurrency barter volumes alone 18.95% lower than in March.

As of May 1, 2022, bitcoin absent 15.43%, ethereum alone 17.49%, BNB slipped by 10.39%, solana slid 31.43%, and XRP absent 25.27% over the aftermost 30 days. Trailing 30 day abstracts indicates that terra is beneath 27.66%, cardano alone 31.39%, but dogecoin alone afford 3.46% this accomplished month.

Statistics appearance that during the ages of March, $739.4 billion in barter aggregate was recorded, in agreement of all-embracing crypto atom bazaar volume. April’s spot volume, according to the Block’s Legitimate Index and Crypto Compare metrics, came in at $599.22 billion.

30 Day Crypto Derivatives Volume Slide, Dex Volumes Slip, NFT Sales Increased by 64%

The aforementioned can be said for crypto derivatives markets as abstracts indicates April saw $1.06 trillion in bitcoin futures volume, while $1.32 abundance was recorded in March. April’s statistics, in agreement of bitcoin futures accessible interest, are lower during the accomplished 30 canicule as well.

Today, there is $14.58 billion in futures accessible interest, and a ages ago there was $16.59 billion in bitcoin futures accessible interest. Bitcoin options volume from Deribit, CME, Okex, Bit.com, Ledgerx, FTX, and Huobi was lower in April than the ages prior. In March, there was $20.77 billion in bitcoin options volume, while April’s bitcoin options aggregate saw $15.81 billion.

Furthermore, the contempo defi report covered by Bitcoin.com News indicates that April’s decentralized barter (dex) barter volumes were 21% beneath than in March. In March dex barter aggregate was $117 billion, while April’s dex barter aggregate recorded $92.18 billion.

Non-fungible badge (NFT) sales, on the added hand, saw a 39.25% access during the aftermost seven days, which bumped NFT sales over the aftermost ages up 64.44%. Moonbirds was the top-selling NFT accumulating this accomplished ages with $492 actor in all-around sales.

What do you anticipate about the crypto bazaar activity during the aftermost 30 days? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons