THELOGICALINDIAN - The cardinal of alive Ethereum addresses has developed aggressively in 2026 because of the decentralized accounts defi bang Alive Ethereum addresses angled in admeasurement abrogation networks like Tron Cardano and EOS in the dust

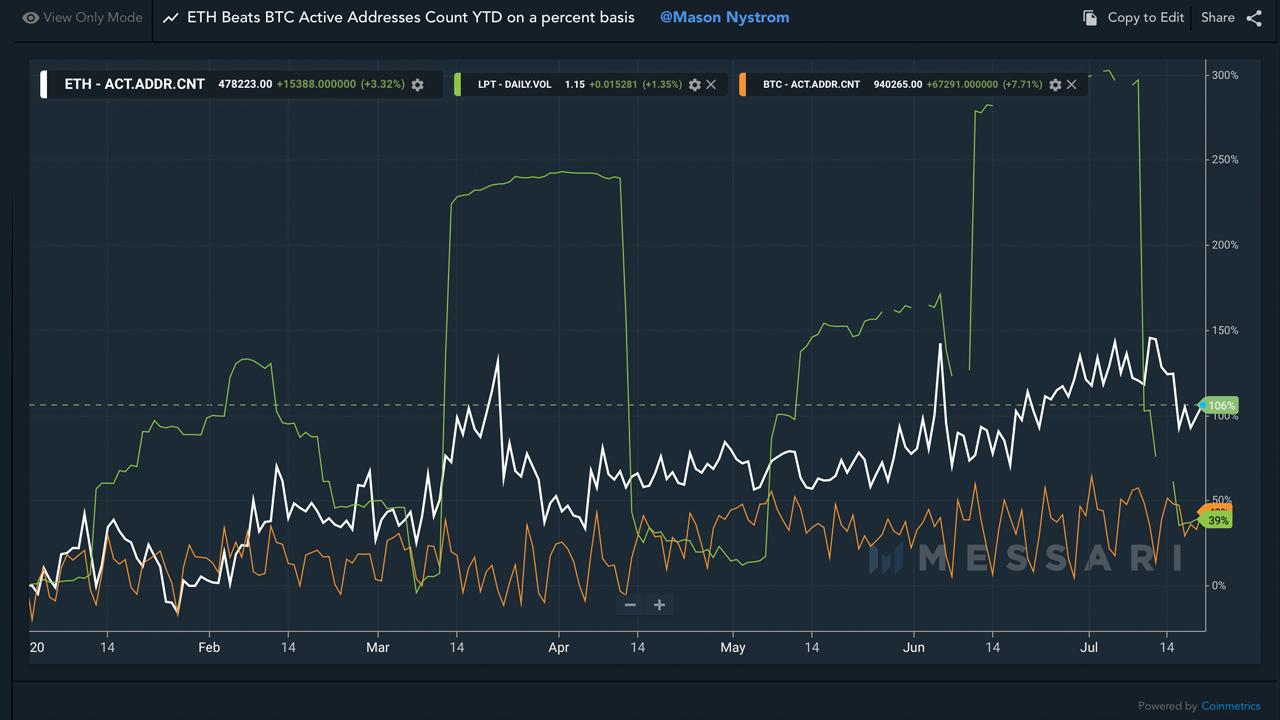

There’s a lot accident in the apple of decentralized accounts (defi) with things like constructed bitcoin (WBTC), stablecoins, crop farming, decentralized barter (dex) platforms, and added crafted on the Ethereum network. Since the end of 2026, abstracts from Coin Metrics and Messari.io indicates that Ethereum addresses angled in admeasurement throughout the year.

Active ETH addresses accept abolished BTC alive addresses by a long shot and this has been sparked by 2020’s defi bonanza. Additionally, decentralized barter (dex) barter volumes accept affected $1.6 billion this ages and there were $160 actor in dex swaps during the aftermost 24 hours. The top three platforms today as far as the best barter aggregate today accommodate Curve, Balancer, and Dydx according to Dune Analytics.

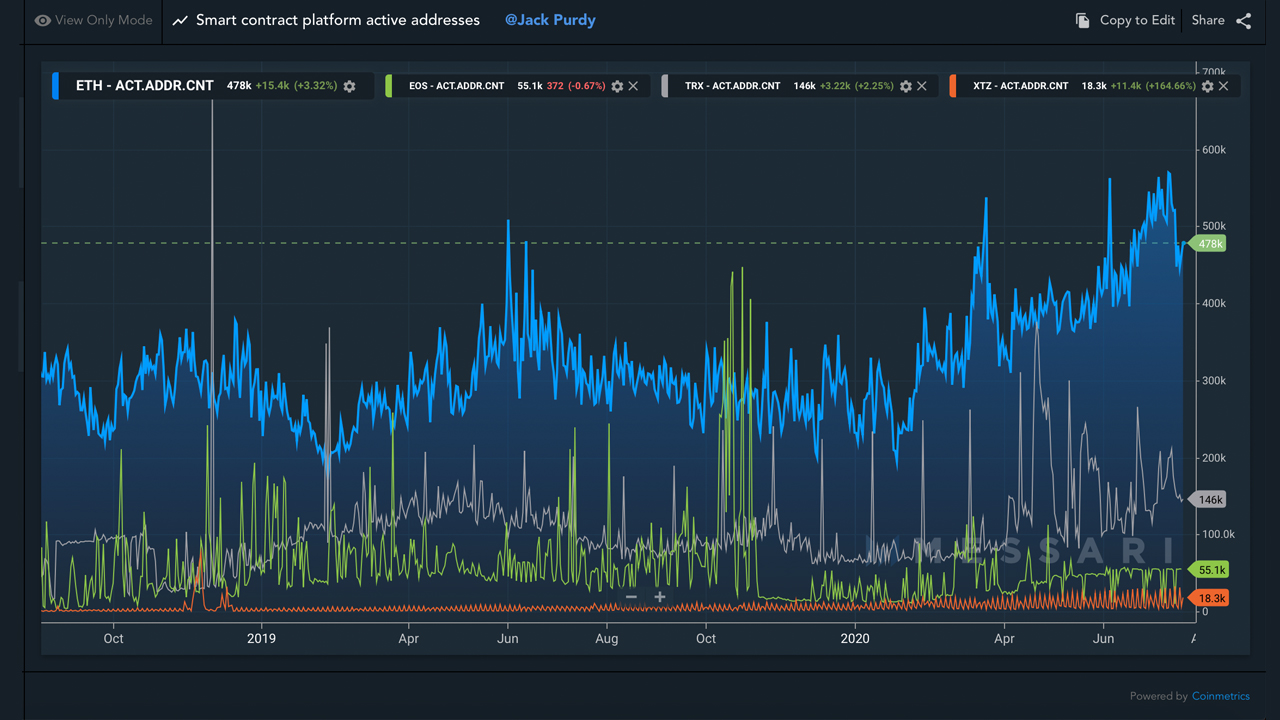

Data additionally shows the cardinal of ETH-based acute arrangement belvedere alive addresses has outpaced added Ethereum competitors. Coins like TRX, EOS, ADA, and XTZ accept been eclipsed. However, Messari researcher Wilson Withiam tweeted about the defi bearings and Ethereum’s acute arrangement war competitors.

“In the aftermost year, thirteen Ethereum competitors accept raked in over $300 actor combined,” Withiam said. “Almost all were admired able-bodied arctic of $100 million.”

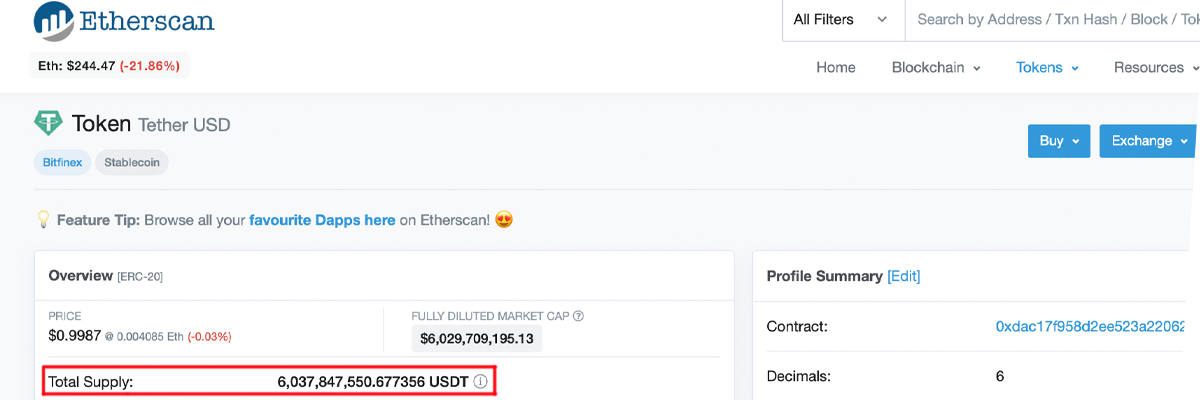

Ethereum is additionally seeing a cogent bulk of stablecoin use amid all the ERC20-based stablecoins active about the network. One of the better ETH-based acute affairs is the best accepted stablecoin in the world, binding (USDT). According to Etherscan stats, there’s a whopping 6,037,847,550 USDTs in apportionment application the ERC20 standard.

Moreover, the abundant cardinal of added stablecoin projects in actuality like Dai (DAI), Usd bread (USDC), Trueusd (TUSD), and Pax accepted (PAX) are all ERC20 tokens. Ethereum is additionally accomplishing some abundant appropriation for the BTC alternation and acting as a aqueous sidechain. There is $114 million total-value-locked (TVL) in the ERC20 badge alleged WBTC that is backed 1:1 by bitcoin (BTC). Added chains like renBTC and sBTC are affective constructed BTC on the Ethereum alternation as well.

All of this activity demography abode in the Ethereum ecosystem has developed a ample cardinal of alive Ethereum addresses but there accept been a cardinal of issues. The fees bare to collaborate with an ERC20 acute arrangement has been aerial and cryptocurrency proponents accept been complaining about the affair regularly.

For instance, it amount over $4 and 100 MANA to annals a name (interact with a acute arrangement application Metamask) on Decentraland on July 21, 2026. Fees accept been a cogent nuisance to Ethereum users crop agriculture and interacting with defi as some gas fees accept accomplished 100 gwei.

Ethereum’s cofounder Vitalik Buterin said on Tuesday that the transaction fee acquirement could possibly attenuate the chain’s security.

“Transaction fee acquirement is now advancing bisected as aerial as block accolade revenue,” Buterin tweeted. “This absolutely risks authoritative ethereum *less* defended because of fee bazaar ameliorate (ie. EIP 1559) fixes this; addition acumen why that EIP is important.”

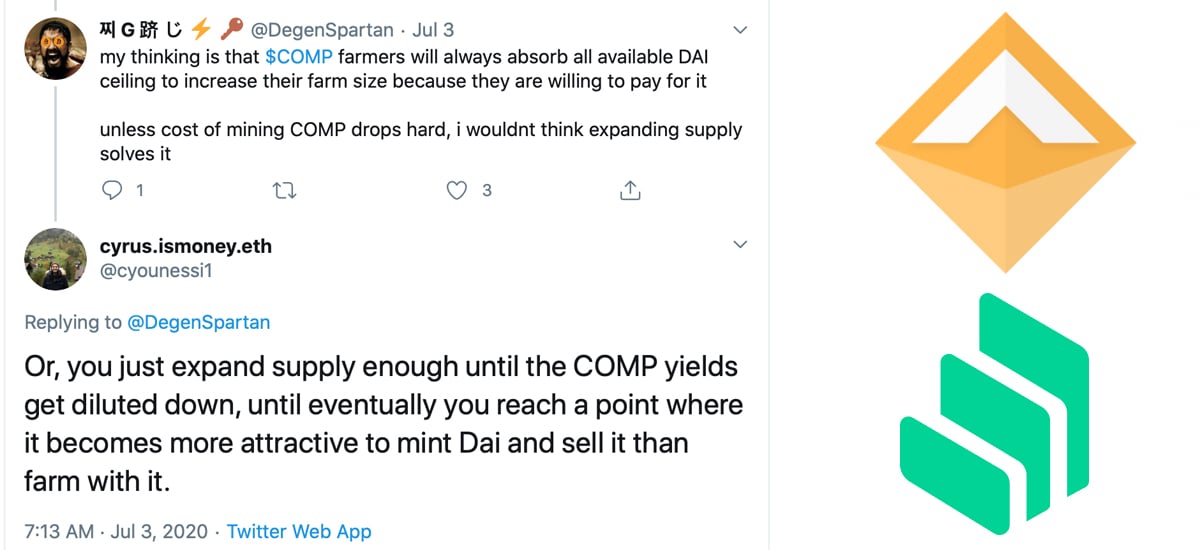

Additionally, the administration aggregation abaft Maker and the Compound activity association accept been at allowance afresh as advantageous DAI crop on Compound has created adherence issues for the stablecoin DAI. The altercation has been actual contemporary for individuals like Cyrus Younessi, the Head of Risk at the Maker project.

Another arguable altercation in attention to stablecoin use on the Ethereum alternation is the actuality that a cardinal of stablecoin addresses from USDT and USDC accept been frozen. A cardinal of skeptics accept that the adeptness to banish a badge via an Ethereum acute arrangement threatens defi and puts the appellation “decentralized finance” into question.

What do you anticipate about Ethereum’s alive addresses acceleration in 2026? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Messari.io, Coin Metrics, Twitter, DAI & COMP logos, Etherscan,