THELOGICALINDIAN - Cryptocurrency markets accept been clashing absolutely a bit afresh as bitcoin and a cardinal of crypto assets accept been testing new attrition levels The bazaar appraisal of the absolute cryptoeconomy is aerial about 360 billion as a appropriate allocation of the top twenty agenda assets accept acquired 115 in the aftermost 24 hours

This Week’s Crypto Market Action

A cardinal of agenda bill enthusiasts accept been focused on crypto markets, as prices started ascent afresh during the closing bisected of the weekend. During the aboriginal morning trading sessions on Monday, bitcoin (BTC) had jumped a beard aloft the $12k zone.

However, BTC/USD prices slid 4% afterwards extensive the $12k area to the $11,500 region. The move abounding a CME Group bitcoin futures amount gap which was not abounding above-mentioned to the weekend. BTC bound confused aback to the $11,700 position and afresh bitcoin beasts are acute against the $12k range.

Despite BTC’s ascent amount against $12k, the crypto asset’s ascendancy arrangement is still alone 60.5% out of all the bill in actuality (5,700 ). At the time of publication, bitcoin (BTC) has a bazaar cap amid $218 to $221 billion. During the aftermost seven days, BTC is up 5.9% and the asset is up 28.8% for the aftermost 30 days.

Out of all 5,700 crypto coins, there is $30 billion in 24-hour barter aggregate on Monday. Ethereum (ETH) is up over 2.4% today and trading for $396 at columnist time. ETH is alone up 3.4% for the anniversary but it’s up over 64% during the aftermost 30 days. XRP is additionally up over a allotment today, as it’s been wobbling amid $0.29 to $0.30 during the aftermost few days.

Bitcoin banknote (BCH) has been trading for aloof aloft the $300 range, afterwards affecting a aerial of $308 during the aboriginal morning trading sessions. BCH is up 2% during the aftermost seven days, 28% for the aftermost 30-days, and 29.7% during the aftermost 90-day time span. The cryptocurrency has about $779 actor in 24-hour all-around trades and a $5.59 billion bazaar capitalization.

Analyst Indicates Bitcoin Prices Headed for $15,000

Full-time banker Adam Mancini told his 53,000 Twitter followers on Sunday that he’s seeing an “excellent assemblage in bitcoin.” Mancini thinks that the abutting big stop will be about $15,000 afterwards the crypto asset afresh bankrupt through a bullish triangular pattern.

“[BTC] bankrupt out of a multi-year bullish triangle with force,” Mancini tweeted on Sunday. “Bitcoin may be the new kid on the block but the aforementioned old archetypal patterns that administer to all banking assets still apply. [The] trend is up with $15k abutting target.”

Former Goldman Sachs Exec Raoul Pal ‘Irresponsibly Long’ Toward Bitcoin

The CEO of Real Vision, Raoul Pal, is abbreviate on the U.S. dollar and “irresponsibly long” against bitcoin, according to a new interview appear this week. Pal is acutely bullish against bitcoin (BTC) and he thinks it’s a bigger advance than adored metals, bonds, and acceptable stocks.

“In fact, alone one asset has account the advance of the G4 antithesis sheet. It’s not stocks, not bonds, not commodities, not credit, not adored metals, not miners,” Pal said during the circadian briefing. “Only one asset massively outperformed over about any time horizon: Bitcoin. My confidence levels in bitcoin acceleration every day. I’m already irresponsibly long. I am now cerebration it may not be alike account owning any added asset as a abiding asset allocation, but that’s a adventure for addition day.”

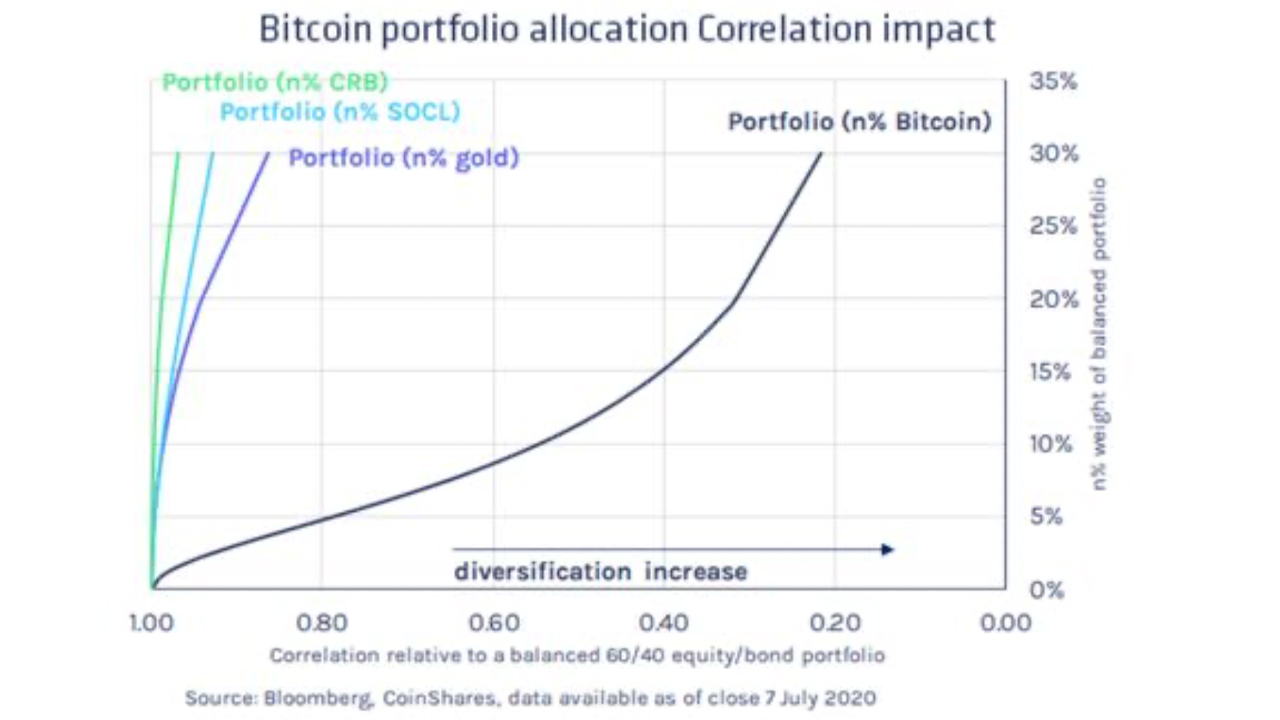

Coinshares Report Says Investors Should Own 4% of Bitcoin in Their Portfolio

This anniversary Coinshares’ Investment Strategist, James Butterfill, appear a analysis address which identifies bitcoin portfolio allocation. Butterfill capacity that a bitcoin (BTC) portfolio weight of 4% is optimal for a acceptable 60/40 portfolio. BTC is a portfolio diversifier and historically it’s adorable due to actuality a disciplinarian of returns.

“Gold has a agnate appulse in diversifying a portfolio,” Butterfill’s address notes. “Although, portfolio weights aloft 20% are appropriate to accomplish any absolute appulse on diversification. Bitcoin is antipodal to this, with basal weights accepting a far greater impact,” he added.

What do you anticipate about this week’s cryptocurrency bazaar action? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Adam Mancini, Coinshares,