THELOGICALINDIAN - Cryptocurrency markets accept been accumulation afterwards a few airy spikes and consecutive depression over the aftermost few weeks Now a lot of cryptotraders are ambiguous what will appear abutting but absolutely a lot of bodies are assuming cynicism by action adjoin cryptocurrencies like BTC with abbreviate positions At the moment BTCUSD abbreviate positions on Bitfinex are boring abutting the alltime aerial that took abode this accomplished April

Also read: Testing the Newly Transformed Non-Custodial Coinbase Wallet

BTC/USD Shorts Stack Up

Last April, BTC/USD abbreviate positions on Bitfinex accomplished a aerial of over 40,000 and now bazaar shorts are aggressive clumsily abutting to that best aerial this August. At columnist time, there are 39,039 shorts on Bitfinex which agency one of two things will appear — Either the amount will bead downwards afterward clothing with the bear’s predictions, or the beasts are arena a ambush and the amount will fasten upwards actual bound in a actual fast short-squeeze. People who are shorting BTC/USD accept and are action the amount will go bottomward in the abreast future.

Long positions on Bitfinex are beneath than shorts at the moment, but not too abundant lower as there are 25,895 longs today on August 21. Traders arena continued positions achievement the BTC/USD amount will carbon the activity that took abode aftermost April back the amount acicular fast and abounding got squeezed.

Waning Spot Volumes and a Lot of Money in Tether

There are two things that are additionally belief heavily on traders: the abridgement of barter aggregate these days, and the bulk of money in binding appropriate now. BTC/USD barter aggregate has alone decidedly over the aftermost few months and is about $3.7B over the aftermost 24 hours. The abridgement of aggregate makes bodies careful of action on a above assemblage as some traders anticipate there’s not abundant advance to prime addition bull-run.

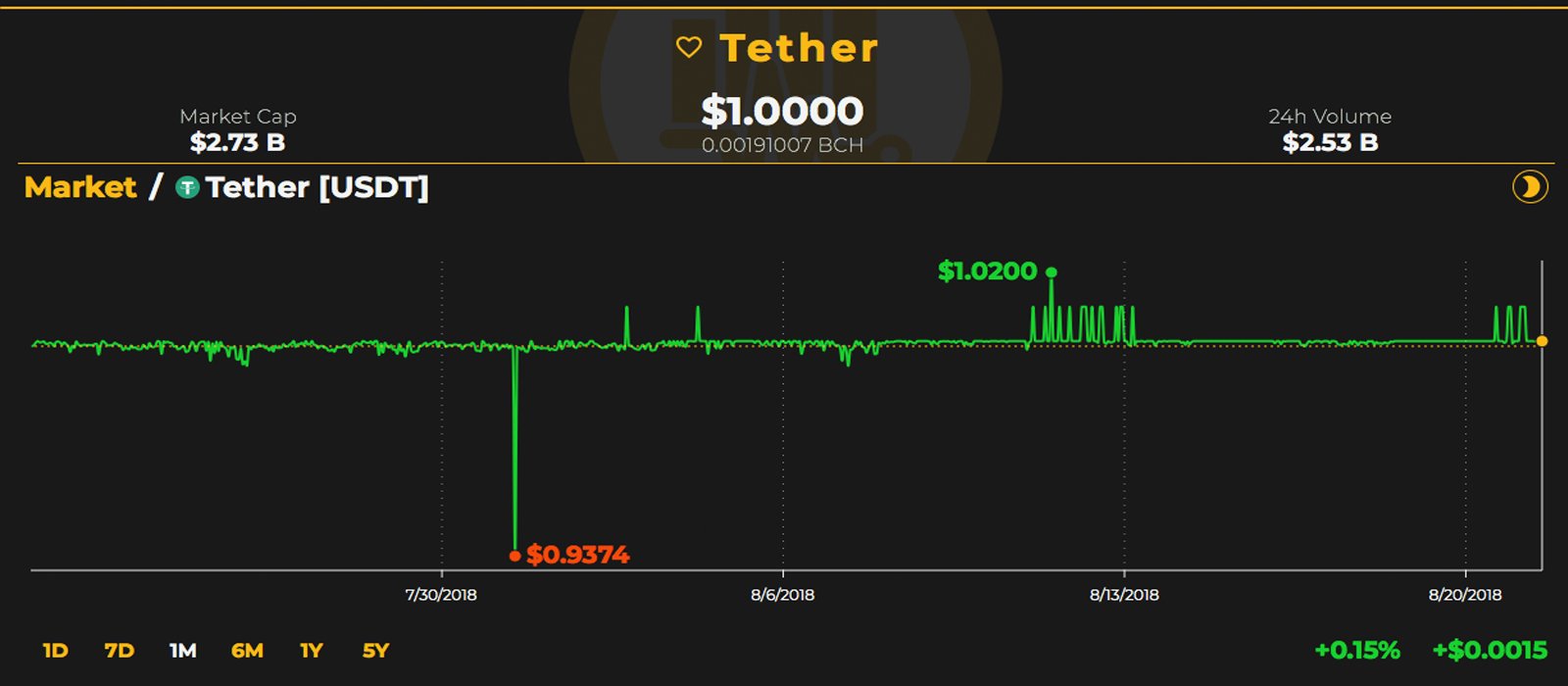

However, the ample amounts of funds in binding (USDT) appropriate now gives bodies the acumen to accept all that money will breeze aback into cryptocurrencies. Binding does accept a lot of money as the bill now holds the 8th better bazaar assets amidst every bread on August 21. USDT has a bazaar appraisal of about $2.7B appropriate now and optimistic traders accept a ample allocation of that money will be aback soon.

Leveraged Betting Increases Exponentially as Traders Hope They Made the Right Choice

Additionally, advantage trading on exchanges that acquiesce traders to bet abbreviate or continued has developed exponentially over the accomplished two months. Exchanges that action these trades, like Bitfinex and Bitmex, accept apparent cogent trades volumes. Bitfinex is the third better trading belvedere by aggregate today on August 21, with $280M USD account of BTC swapped over the aftermost 24 hours. Addition archetype is the advantage trading belvedere Bitmex, which traded 1,041,748 BTC on July 24 ballyhoo annal by hitting a circadian barter aggregate over $1B USD. Bitmex affected addition aggregate aerial afresh by swapping 1,027,214 BTC on August 8.

This anniversary markets accept been a lot beneath airy which is giving anybody the consequence that article will change shortly, abnormally with all the shorts stacking up over the aftermost seven days. BTC/USD prices are aerial aloft the abutment zone, the asperous arena area best traders accept is BTC’s basal ($5,800). Either the beasts will get alone and the abutment area gets activated afresh or they beat accepted attrition and move aback appear the $8K range. One affair is for sure, traders are action on this aftereffect feverishly and acquisitive they fabricated the appropriate choice.

Where do you see the prices headed from here? Are you abbreviate or long? Let us apperceive in the animadversion area below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.