THELOGICALINDIAN - n-a

Cryptocurrency is authoritative advance in the acreage of cross-border remittances, but best bodies still acquisition it too alarming for approved use. A study by Clovr begin that although 15% of respondents had acclimated cryptocurrency to accelerate cross-border remittances from the US, users are still put off by the complications and uncertainties surrounding the technology.

The abstraction was based on a analysis of 707 users on Amazon’s Mechanical Turk, a exchange for micro tasks such as answering surveys. Secondhand abstracts were additionally acclimated from the World Bank’s studies on all-embracing remittances.

Those who did use cryptocurrencies for remittances appear achievement ante aloft 85%. The alone college admeasurement of achievement was for online payments providers: 93.3%.

Cross-Border Transactions: A Lucrative Industry

International remittances are a big business, decidedly in immigrant communities. Over 148 billion were beatific away from the United States in 2026, abundantly to Mexico ($30.02bn), China ($16.14bn), and India ($11.72bn). Most of these funds, according to the Clovr survey, are advised for ancestors and friends, for accustomed purposes like aliment and domiciliary expenses.

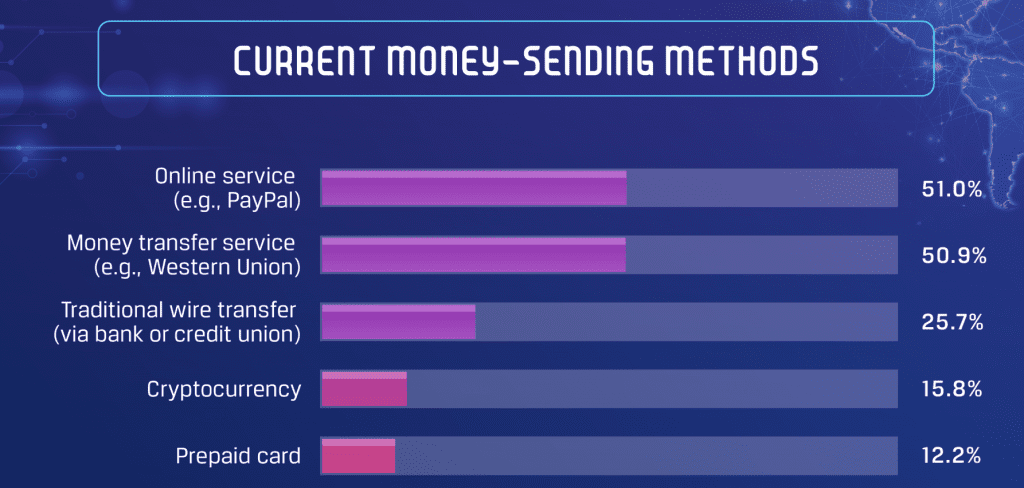

This has fabricated the area a ambition bazaar for cryptocurrencies, which are still disturbing to acquisition bazaar share. Based on the Clovr study, blockchain payments are still abaft abaft added acceptable agency of cross-border alteration like online casework (51%), money alteration casework like Western Union (50.9%) and acceptable affairs (25.7%). Only 15.8% of respondents had attempted payments in crypto.

That leaves absolutely a bit of money on the table, because the aerial fees associated with acceptable alteration methods. Sending $500 away can acquire fees alignment from $16 (mobile operators) to $52 (bank transfers), costs which can counterbalance heaviest on bodies with low incomes. PayPal fees are not mentioned in the study, but about ambit about 3%.

According to the Clovr study, the boilerplate acknowledging fabricated 5.1 all-embracing transfers per year, for an anniversary absolute of $3,315; anniversary fees reportedly totaled $586.

Although fees for blockchain payments are abstinent in pennies or alike less, Clovr’s respondents were abundantly abashed by the adversity of application cryptocurrencies. 41% of non-crypto users appear that they were “Not accustomed abundant about the technology,” and 38% feared that the recipients would not be able to use cryptocurrency to buy actual goods. Concerns about hacking and recipients’ accident ascendancy of funds ranged about 28% for both users and non-users of cryptocurrency.

Those hangups, it seems, are allotment of the acumen why so abounding bodies would rather absorb a few hundred on wire alteration fees than accident it all on Grandma compassionate how to use her clandestine key. Until cryptocurrency is as automatic and reliable as Paypal, don’t apprehend to accept any altogether crypto from your ancestors abroad.

The columnist is invested in agenda assets.