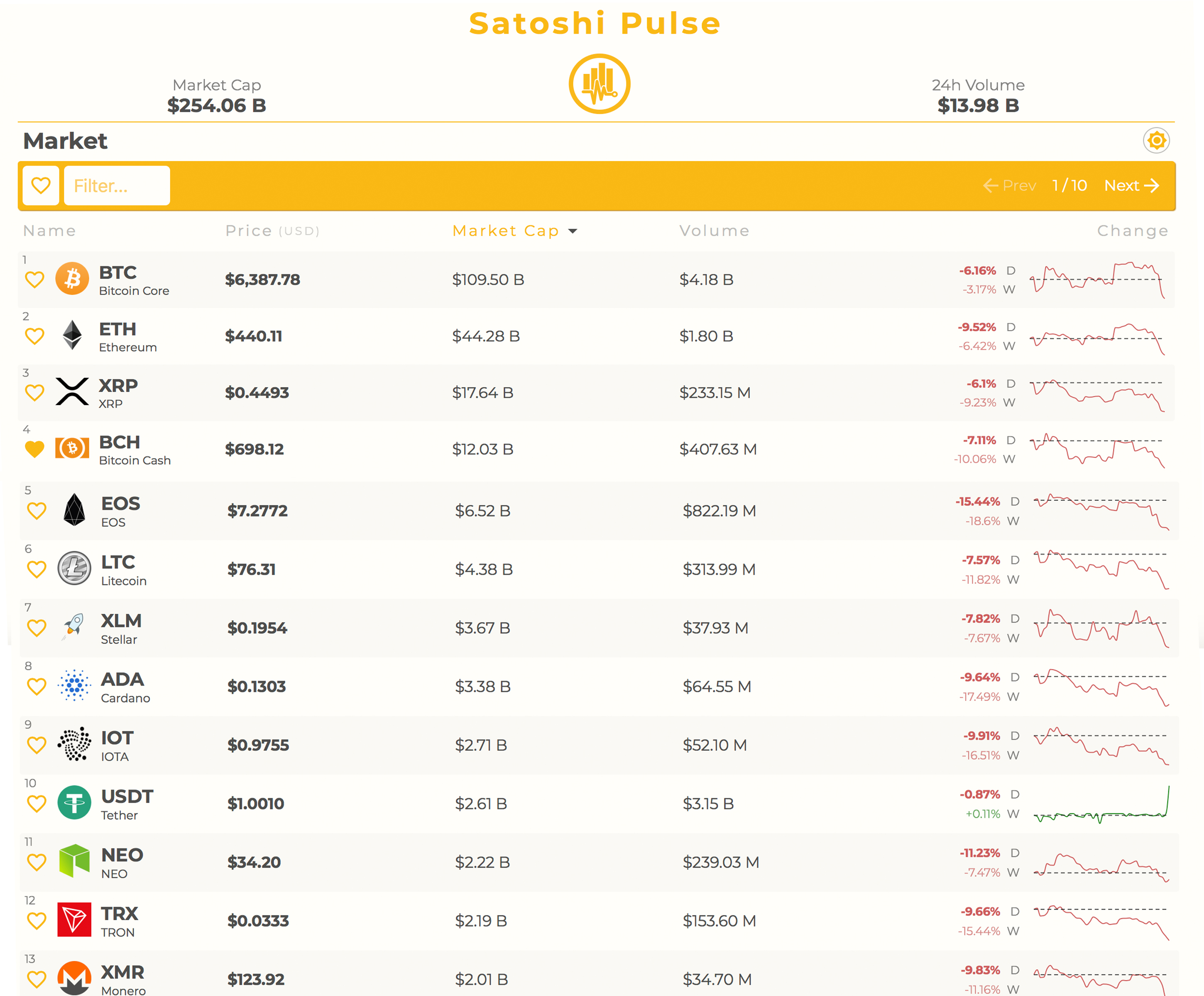

THELOGICALINDIAN - Digital asset markets accept bootless to beat abundant attrition over the weekend and during the aboriginal morning trading sessions on Tuesday July 10 as able-bodied The top cryptocurrencies accept slid in amount already afresh as Bitcoin Core BTC has confused to 6377 afterwards affecting the 6830 arena Meanwhile Bitcoin Cash BCH prices hovered about 785 per bread a few canicule ago but the amount has alone to 696 back that angle point Overall the arch agenda currencies are bottomward amid 415 percent in amount over the accomplished 24hours

Also read: Bitcoin ABC Developers Publish Bitcoin Cash Upgrade Timeline

More Than $16 Billion Shaved Off Cryptocurrency Valuations Since Friday

A blubbery blind of bearish affect has already afresh encapsulated cryptocurrency traders as the bullish amount drive from aftermost anniversary reversed. Cryptocurrency beasts attempted to beat the rallies that took abode on 6/18, and several attempts to affected attrition has acutely failed. At $254 billion USD the absolute bazaar assets of all 1,600 agenda currencies has absent about $16Bn back the weekend. At the accepted angle point, some traders accept cryptocurrency prices could booty a above leg bottomward again.

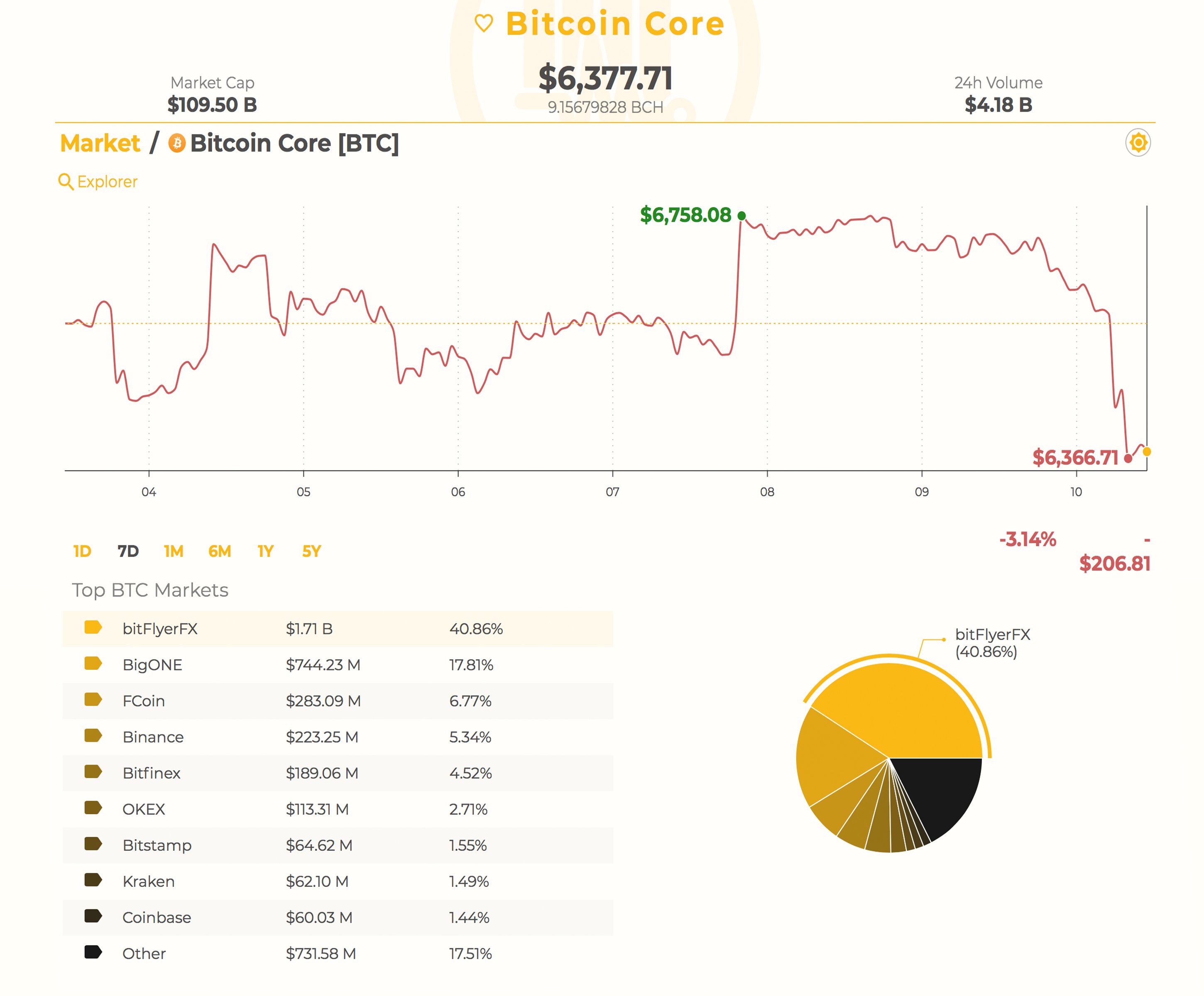

BTC Market Action

Since our aftermost markets update, Bitcoin Core (BTC) barter aggregate has decreased a beard from $5.2Bn in circadian trades to $4.18Bn over the aftermost 24-hours. The top bristles exchanges today swapping the best BTC includes Bitflyer, Bigone, Fcoin, Binance, and Bitfinex. BTC markets are bottomward 6.1 percent over the aftermost 24-hours and 3 percent over the advance of the week. The Japanese yen is still assertive BTC pairs by 44.7 percent on July 10. This is followed by binding (USDT 38.9%), USD (11.3%), EUR (1.8%), and KRW (1.6%). At the cardinal one spot, as far as bazaar valuation, BTC’s assets is about $109Bn USD which dominates all 1,600 added markets by 43.1 percent.

BTC/USD Technical indicators

Looking at the circadian and 4-hour BTC/USD archive on Coinbase and Bitfinex appearance bears accept managed to capitalize on the accepted downturn. The Relative Strength Index (RSI) shows the amount is undervalued or oversold at – 27 – appropriate now which indicates bears will see some exhaustion. Bulls had bootless to beat key attrition zones aloft the $6,800 ambit and the two Simple Moving Averages (SMA) appearance the abiding 200 SMA is aloft the 100 trendline. That agency the aisle of atomic attrition will be appear the downside with the MACd ascent on breach but abrasion over time. Currently, if bears administer to tug prices beneath the accepted angle point and the Displaced Moving Average of $6,200 afresh we will see a breach bottomward beneath sub-$6K support. Order books appearance nice attrition now aloft the $6,600 mark and afresh it deepens at $6,800. On the backside, there are solid foundations from actuality to the sub-$6K ambit but afresh alike bigger abutment at the $5,700-5,400 territories.

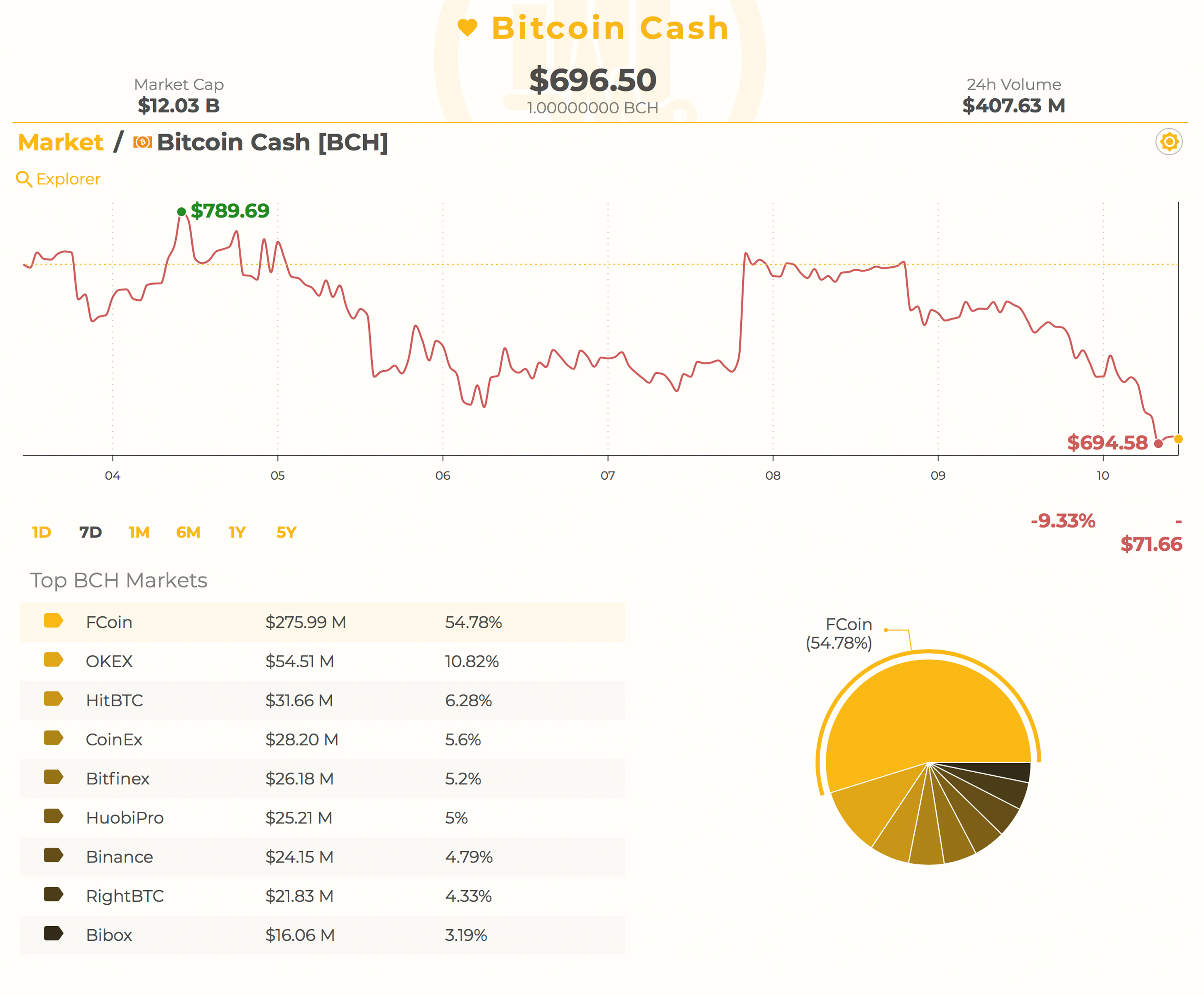

BCH Market Action

Bitcoin Banknote (BCH) bazaar activity today is assuming barter aggregate of about $407Bn USD account of swaps over the accomplished 24-hours. The top BCH bazaar makers today includes Fcoin, Okex, Hitbtc, Coinex, and Bitfinex. Bitcoin banknote is the sixth best traded cryptocurrency on July 10 and holds a bazaar appraisal of about $12Bn. Tether is arena a ample role today with BCH pairs as the bill captures 65 percent of today’s trades. This is followed by BTC (20%), USD (7.4%), KRW (2.1%), and ETH (1.9%). BCH is bottomward 6.9 percent over the aftermost 24 hours and 10.1 percent over the accomplished week.

BCH/USD Technical Indicators

Looking at the BCH/USD circadian and 4-hour archive on Bitfinex and Bitstamp appearance BCH has taken some steeper dips than BTC. RSI levels at 26 appearance altitude are absolutely oversold and some advance could be in the cards today. SMA indicators appearance agnate allegation with the 200 SMA able-bodied aloft the 100 SMA on the 4-hour chart. In the charts, we saw a ascent block with big attrition aloft the $800 region, and prices managed to bore beneath the block today. Looking at adjustment books shows some solid basal abutment at the accepted angle point, but, if a advertise activate appears, bears will afresh attack to lock in profits by shorting. Beneath the $690s abutment is actual able at $610 and lower. If BCH beasts managed to accretion some drive afresh they charge beat $715 and added attrition at $770 already again.

The Top Cryptocurrency Markets See Losses

Today, the additional accomplished assets captivated by ethereum (ETH) is bottomward 9.5 percent and 6.4 percent over the aftermost week. One ETH is priced about $440 per bread and the bazaar is admired at about $44.2Bn USD. Ripple (XRP) has absent 5.9 percent over the aftermost 24-hours, and 9 percent over the aftermost seven days. XRP is trading at $0.44 cents a badge with a $17.6Bn bazaar capitalization. Lastly, the fifth accomplished admired market, EOS, is bottomward 15 percent today and 18 percent over the week. An EOS currently trades for $7.35 per badge and the bazaar captures $6.5Bn on July 10, 2018.

The Verdict: Crypto-Market Cynicism and Pessimism Overtake Last Week’s Positivity

Overall bazaar affect has confused aback appear the bearish ancillary as bullish attempts were squashed this weekend. Traders are afresh academic that newer lows will chase and skepticism and agnosticism has abounding the air. This week’s bazaar adjudication is altered than aftermost Friday’s assay by far, and it’s safe to say lots of traders are pessimistic.

Where do you see the amount of BCH, BTC, and added bill headed from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.