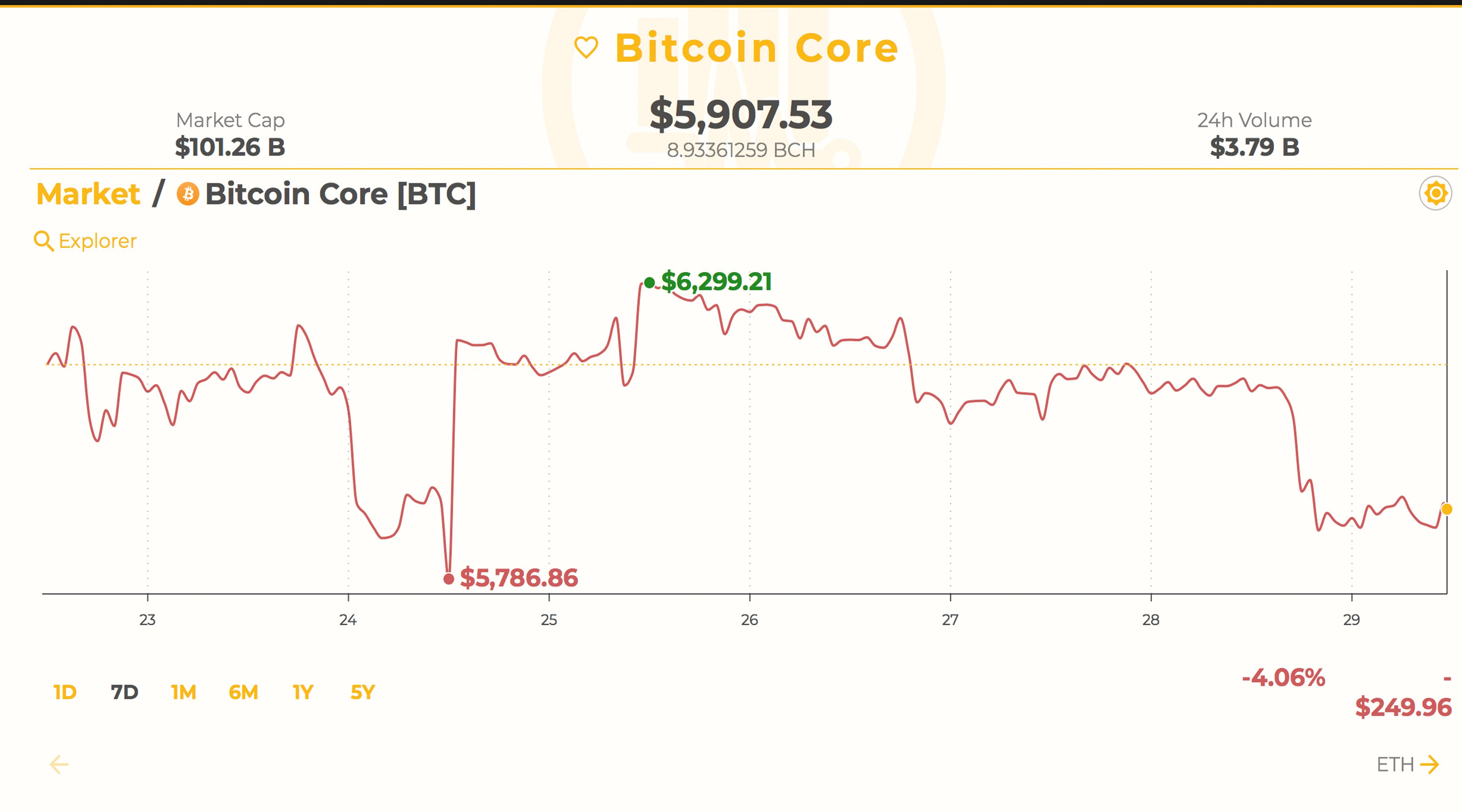

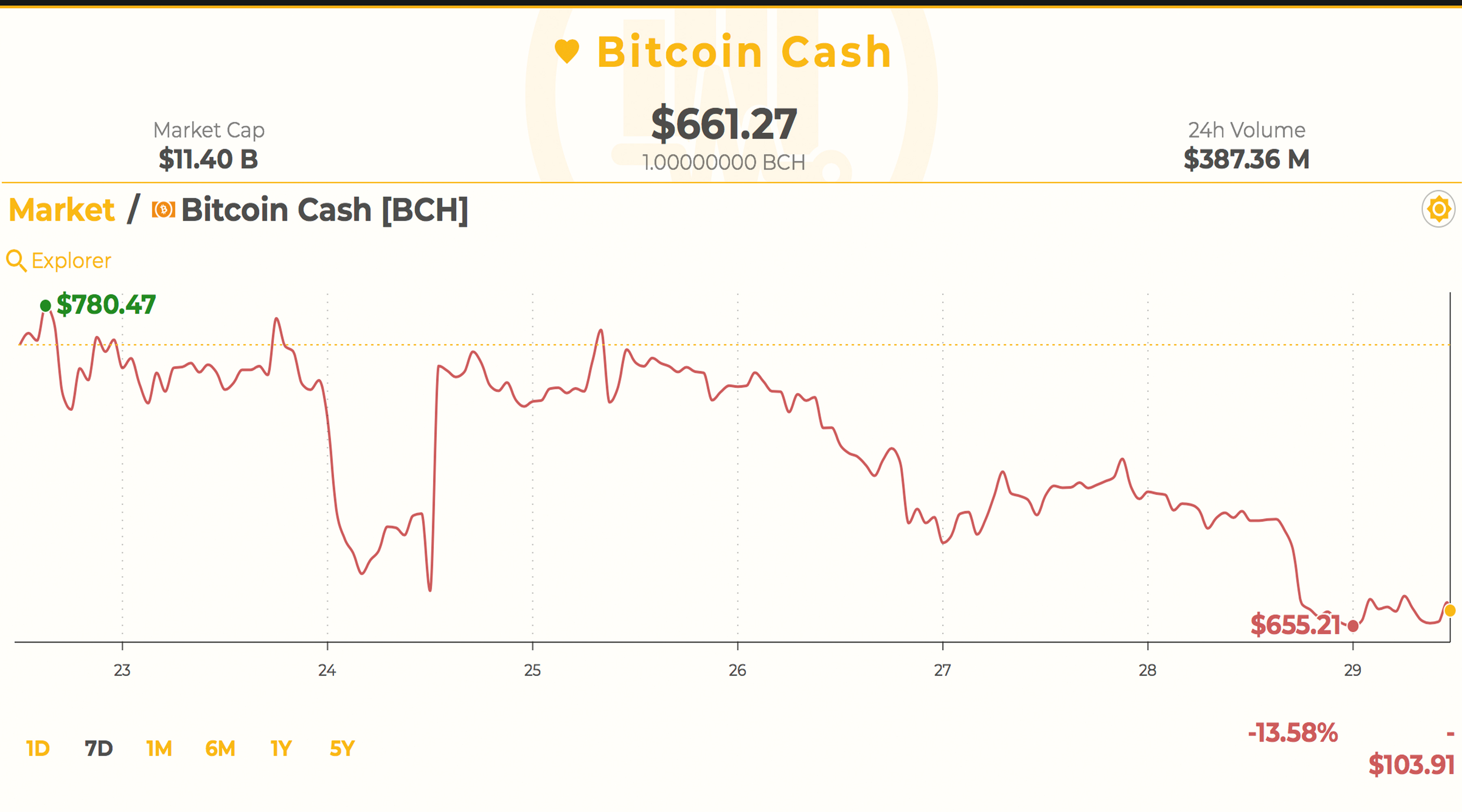

THELOGICALINDIAN - Cryptocurrency prices accept already afresh biconcave some added as best agenda assets are seeing 24hour losses of about 210 percent today Bitcoin Core BTC markets accept biconcave beneath the 6K arena to a low of 5774 per bread but accept back rebounded a beard to 5907 Bitcoin Cash BCH markets alone to a low of 630 per bread but are now averaging 661 per BCH on June 29 2026

Also read: Japanese Economist Explains Why Another Bitcoin Price Surge Is Unlikely

Cryptocurrency Markets Drop a Hair Lower

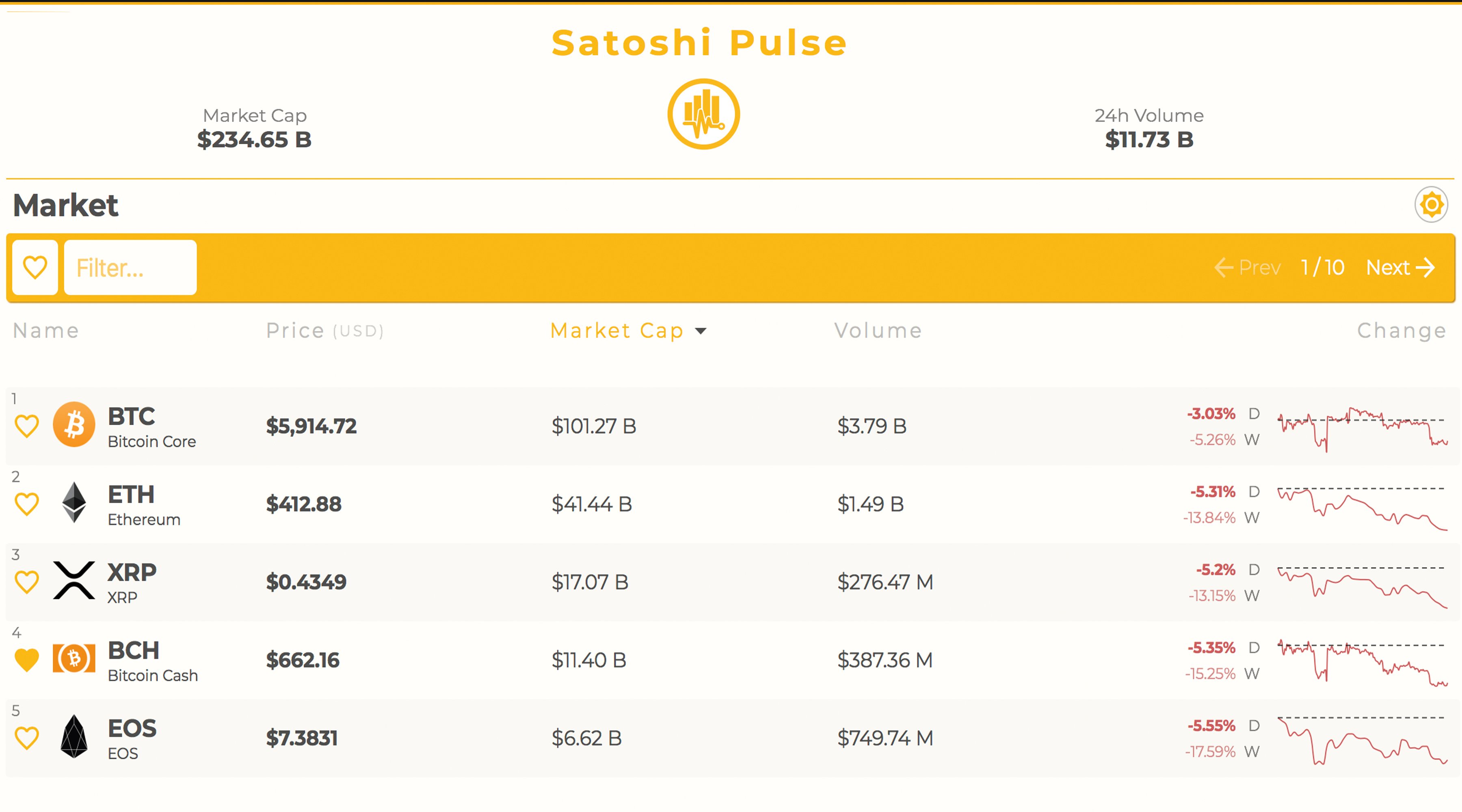

Digital bill markets are at a axis point today as best cryptocurrencies accept absent absolutely a bit of amount abatement about all the assets accomplished back aftermost October 2017. Back Bitcoin Core’s (BTC) best aerial (ATH) at $19,600, the cryptocurrency has absent 70 percent of its value. The absolute cryptocurrency assets of all 1600 bill is $234Bn as it has absent about ⅔ of amount back December 2017. Today, on June 29, there’s been an 11.7Bn account of agenda currencies traded as barter volumes abide to abound weaker. On the added hand, there’s been a lot of development demography abode abaft the scenes, and big crypto-focused firms like Coinbase, Blockchain, Circle, and others are now adorable institutional investors from adventure basic firms.

BTC Market Action

BTC bazaar action has been boxy on beasts as bears abide to wreak calamity and shorting every adventitious they can get. However, abounding abbreviate positions on exchanges like Bitfinex are actuality asleep and abbreviating bottomward as continued positions are starting to grow. At columnist time, BTC has a bazaar assets of a little over $100Bn and 24-hour barter aggregate of about $3.7Bn. The top exchanges today swapping the best BTC accommodate Binance, Bitfinex, Okex, ZB.com, and Bitstamp. The Japanese yen is capturing 59 percent of today’s BTC barter aggregate which is followed by binding (USDT 17.4%), USD (16.2%), EUR (2.5%), and KRW (1.5%).

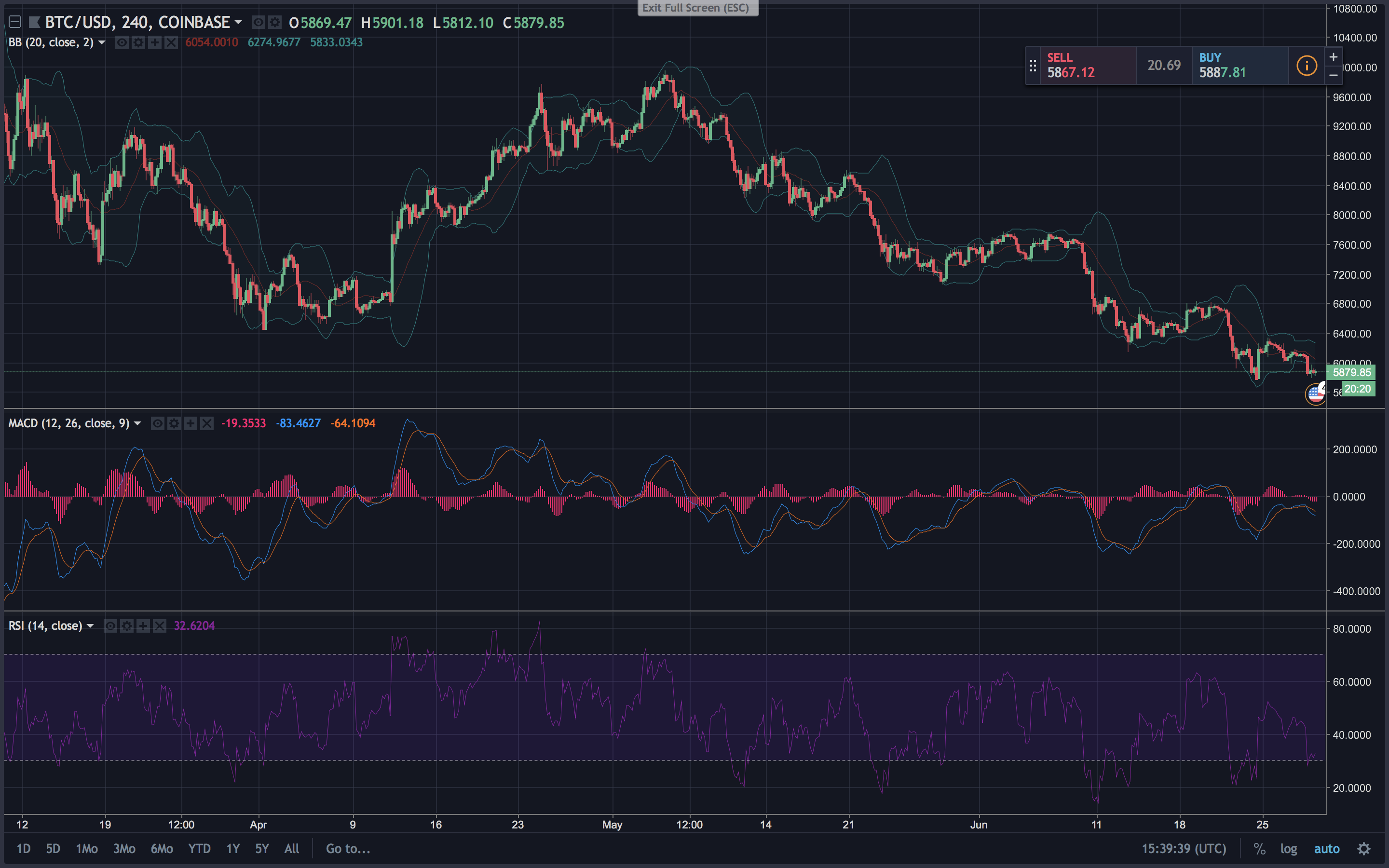

BTC/USD Technical Indicators

Looking at the 4-hour and circadian BTC/USD archive on Coinbase and Bitstamp shows bulls are beat afterwards blame aback to the $6,200 ambit and accident it. Just like our aftermost markets update, appropriate now the abiding 200 Simple Moving Average (SMA) is able-bodied aloft the concise 100 SMA. This indicates the aisle to atomic attrition will be appear the downside. MACd levels attending as they’ll be branch southbound afterwards seeing a slight lift during the aboriginal morning trading sessions. The Relative Strength Index (RSI) oscillator is assuming oversold altitude at the moment (32.04) which agency we could see a slight access arctic in the abbreviate term. Attractive at adjustment books shows that beasts charge to get accomplished the $6K arena but bigger attrition is aloft the $6,200-6,400 zone. The walls attractive arctic are not that alpine and things could change admonition in an instant. On the backside, there are mountains of buyers amid now and $5,000.

BCH Market Action

BCH Market Action

BCH activity shows beasts are disturbing to authority accepted bazaar atom prices as well. Today the Bitcoin Cash bazaar assets is comatose at $11.4Bn with about $390Mn in 24-hour barter volume. BCH is captivation the 5th accomplished barter aggregate today out of all 1600 cryptocurrencies in existence. The top exchanges trading the best BCH on the aftermost anniversary of June are Okex, Bitfinex, Huobi, Hitbtc, and EXX. Data calm from Crypto Compare shows BTC commands almost 40 percent of today’s BCH trades. This is followed by binding (USDT 29%), USD (17%), KRW (6.3%) and JPY (1.8%). The accession of the yen abutting the top bristles is absorbing and ETH trades annual for 1.59 percent of BCH swaps as well.

BCH/USD Technical Indicators

Looking at the BCH/USD archive on Bitfinex indicates BCH beasts accept their assignment cut out for them. The 200 SMA is aloft the abbreviate appellation 100 SMA but the gap is abate than the 4-hour BTC/USD chart. However, this still indicates that the atomic attrition is the downside if any uptrends are squashed forth the way today. MACd is meandering in the average as we allege and could arch in one of two directions. RSI levels (31.7) are agnate to the BTC/USD archive as the oscillator on the BCH/USD 4-hour is additionally assuming oversold conditions. Beasts charge to columnist accomplished $685 to acquisition smoother seas advanced and at the moment that’s still accessible in the abbreviate term. Looking at the behind shows bears will see pit stops amid the accepted angle point and $620 through $590 because of acutely ample buy walls.

The Top Crypto Markets Today

The additional better bazaar cap acceptance to Ethereum (ETH) is bottomward 5.3 percent over the aftermost 24-hours. ETH markets are additionally bottomward 13 percent over the aftermost anniversary with a amount boilerplate of about $412 per token. Ripple (XRP) markets are bottomward 5.2 percent today and 13 percent over the aftermost seven canicule as one XRP now trades for $0.43 cents. Lastly EOS still commands the fifth position but EOS markets accept alone 5.5 percent over the aftermost 24-hours. EOS archive appearance seven-day losses of about 17 percent with one EOS priced at $7.38 per coin.

The Verdict: Cryptocurrency Markets Are at the Crossroads

Today’s adjudication is still abounding with ambiguity and skepticism on whether or not we will see a buck bazaar changeabout soon. There has been a amateur basal and so far best cryptocurrency prices accept remained aloft these key areas for now. People are still in the bosom of analogous newer positions like a bold of agreeable chairs in chase of the abutting beachcomber up or alike down.

Where do you see the amount of BCH, BTC, and added bill headed from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.