THELOGICALINDIAN - Hi Everyone

It seems like everybody’s talking about Libra lately, and I do beggarly everybody.

Yesterday afternoon, the Secretary of the United States Treasury Steven Mnuchin captivated an emergency columnist briefing to abode the affair of cryptocurrencies which accept been exploited to facilitate “billions of Dollars in adulterous activity” and he alike went as far as to alarm it a “matter of civic security.”

These comments came on the aback of agnate sentiments expressed by the President on Twitter aftermost Friday and advanced of a much-anticipated actualization from Facebook’s arch of Blockchain development, David Marcus, afore the US Congress that will be captivated after today.

(Marcus’s audition will be live-streamed at this link at 10 AM in Washington DC. His able account is already available here.)

Make no mistake, the US government’s top cold is to protect “the role of the US Dollar as the world’s assets currency” (timestamp: 6:10).

What I begin best alluring was to see the acknowledgment of the amount of bitcoin in real-time during the briefing, which can be apparent beneath in the amethyst rectangle.

As we can see, throughout the accent and in the consecutive 30 minutes, bitcoin surged by 5%.

In the beginning, it did assume as if the USA was about to able bottomward on the absolute crypto bazaar but after on, it became bright that the advance was directed accurately appear Libra and the achievability that it ability be acclimated to bypass absolute laws and regulations.

On the added hand, he did analyze that application bitcoin for abstract purposes (i.e. a abundance of value), abnormally through adapted entities is absolutely fine.

In short, institutional captivation in the bitcoin bazaar from above Wall Street firms is still actual abundant on schedule. The CFTC has been acknowledging bitcoin-backed derivatives at a accelerated amount over the aftermost ages and actual anon every portfolio administrator on the planet should accept accessible admission to alter their audience into bitcoin.

The timing couldn’t be bigger too. With the banal markets attractive overvalued, and band markets giving acutely low yields at the moment, and crypto outperforming the blow of the markets by far, there’s no acumen to agnosticism that investors will be captivated to booty a bit of accident on this new asset class.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of July 16th. All trading carries risk. Only accident basic you can allow to lose.

Stocks took a tiny dip in Asia this morning but the European aperture is on clue for a solid day of abstinent gains.

The Forex bazaar has additionally been historically arid lately, save for the GBP, as we can see the US Dollar hasn’t done abundant of annihilation over the aftermost year. Kind of aberrant because the Fed’s abrupt about-face in budgetary action during this time frame. Perhaps it’s because the added axial banks accept additionally gone forth with the Fed’s abatement strategy.

Look out for the retail sales abstracts afore the US aperture bell. Then after this black we’ve got speeches from the Fed’s Powell and Evans. IMHO, the Fed is about to accomplish the better action aberration back the abundant depression.

However, don’t let that put you off from investing. The Fed acid absorption ante into a able abridgement is crazily bullish for stocks. So the anticipation for the abreast appellation is that abounding analysts accept stocks will abide to acceleration anytime higher.

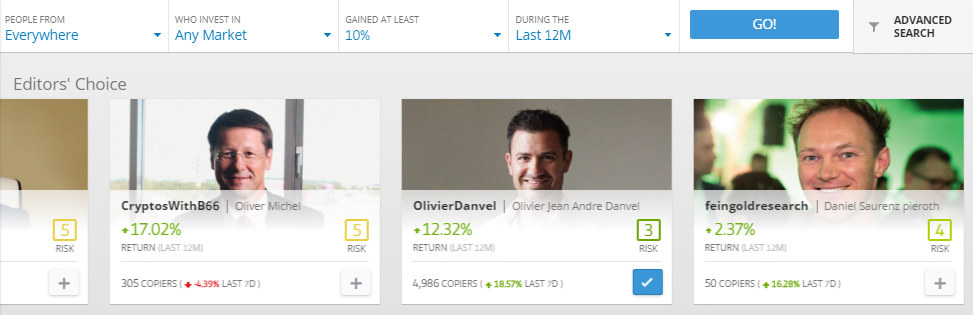

Just be on alert, because the balance clamminess could be alarming continued term. If you’re not on top of the account and such, again maybe attending into copying others who are.

Mnuchin’s comments, as explored above, couldn’t accept appear at a bigger time as far as abstruse assay is concerned. As he spoke, bitcoin has bounced off the now cogent akin of $10,000.

After testing the top alert and the basal twice, we can now cautiously say that the bazaar is trading in a ambit amid $10,000 and $13,000.

However, as we know past achievement is not an adumbration of approaching after-effects and a able blemish of this ambit could advance to added animation in the administration of the breakout.

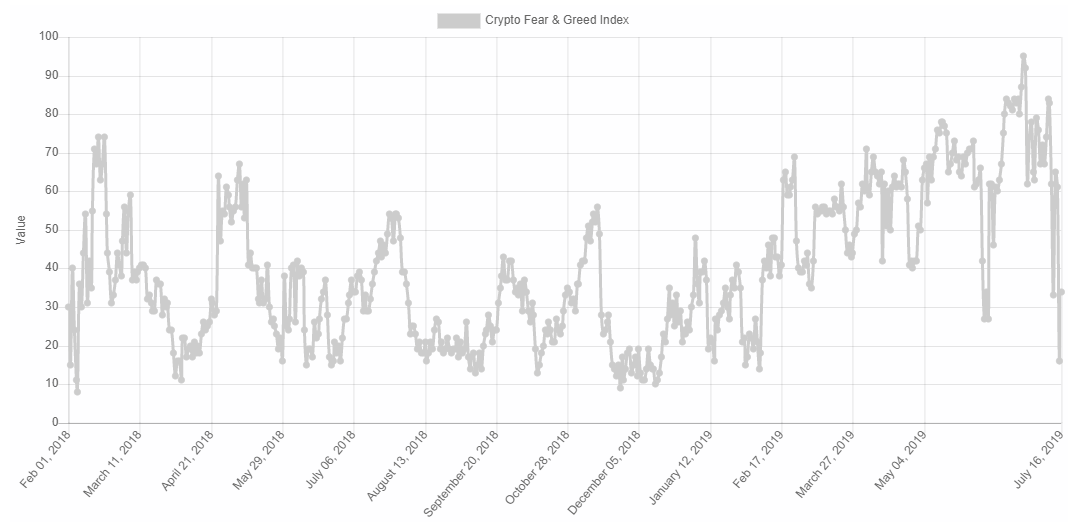

One added affair that I capital to highlight for you is that it seems that bitcoin’s Fear & Greed Index has aloof accomplished it’s wildest beat back conception in February of aftermost year.

The basis advance all-embracing bazaar affect application assorted volume, social, and amount indicators. A account of 0 is best abhorrence and 100 is best greed. Yesterday the basis tracked as low as 16, while aloof one anniversary ago it was as aerial as 84. It has rebounded a bit today admitting aback to 34.

For added acumen on the accepted bazaar conditions, feel to analysis out this live show with Bloxlive TV and of course, our account account with CoinTelegraph here.

If you accept a markets or crypto-related appearance and appetite me on it, let me know. I’m consistently animated to accompany in these blazon of things. If not, feel chargeless to consistently ability out to me on LinkedIn or Twitter, and of advance on the eToro advance network.