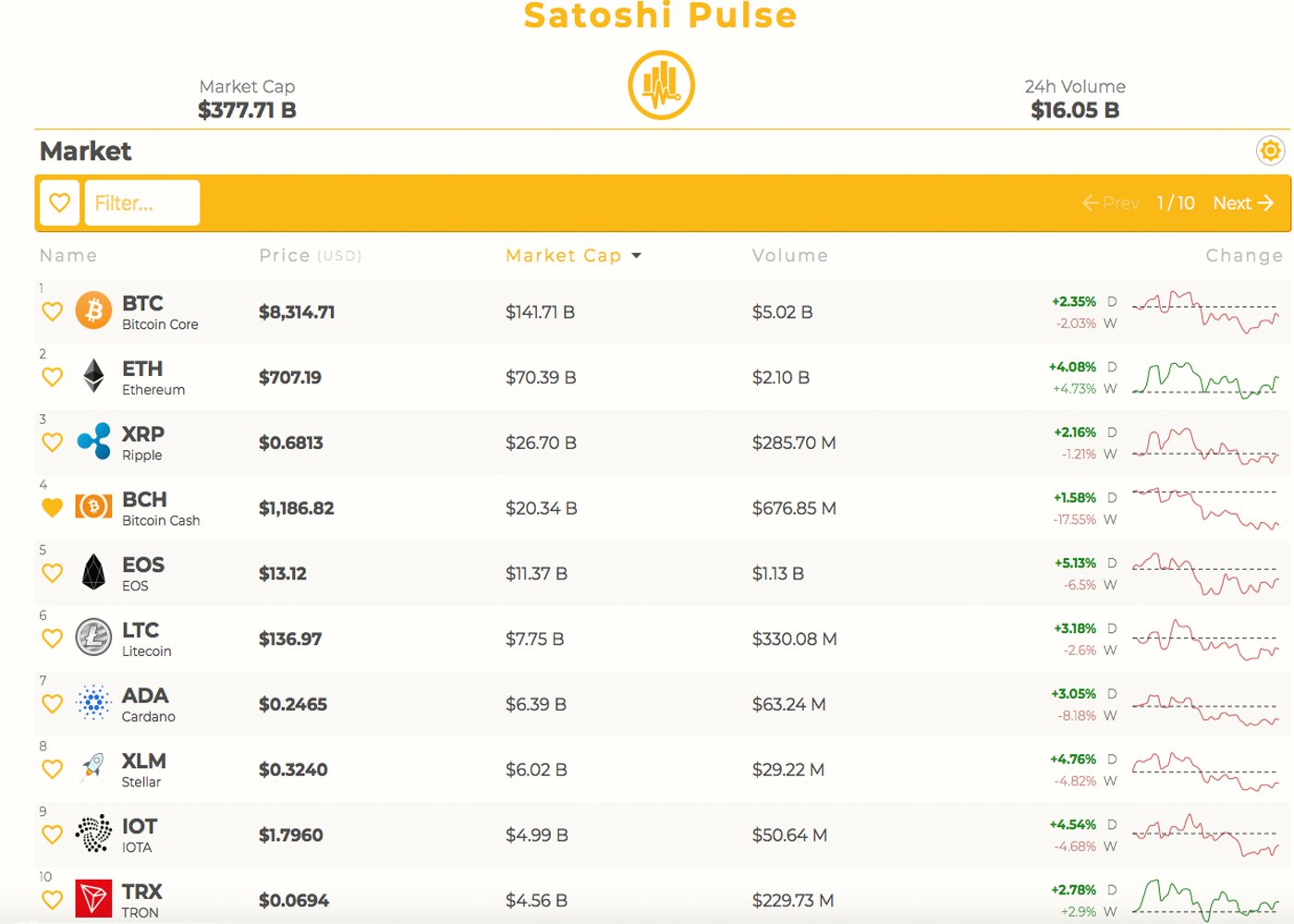

THELOGICALINDIAN - Digital asset markets are accomplishing some healing during the accomplished 24hours of trading afterwards affecting some lows the day above-mentioned At the moment the absolute cryptocurrency bazaar assets of all 1600 tokens is about 377Bn with about 16Bn account of 24hour barter aggregate Bitcoin Core BTC markets are up 23 percent averaging 8314 per bread while Bitcoin Cash BCH prices are up 15 percent at about 1180 per BCH

Also read: “Stablecoin” Trueusd Pumps After Binance Listing

The Week-Long ‘Consensus Pump’ Never Came to Fruition

The mid-May ‘blockchain week’ Consensus pump never embodied aftermost anniversary alike admitting there was affluence of absolute cryptocurrency news. During the advance of the week, best agenda assets in the top 500 absent a acceptable allocation of gains. This weekend is a altered adventure as a agglomeration of markets are seeing some accretion from the dips. Bitcoin Cash markets are up 2.3 percent averaging almost $1,188 per BCH at the time of publication. The decentralized currency’s 24-hour barter aggregate has alone appreciably to $683Mn which doesn’t accord traders achievement for a bigger weekend push. The top bristles exchanges swapping the best BCH today accommodate Okex, Huobi, Hitbtc, Lbank, and EXX. BTC pairs with BCH has added decidedly as BTC represents 41 percent of today’s BCH trades. This is followed by binding (USDT 30%), USD (13%), KRW (11%), and the Euro (1.2%).

BCH/USD Technical Indicators

Looking at the BCH/USD four-hour charts on both Bitstamp and Bitfinex shows beasts charge to aggregation up added backbone to breach high resistance. The two Simple Moving Averages (SMA) still accept a gap with the 100 SMA aloft the 200 SMA advertence a acceptable aisle to the upside. However alike admitting there is a gap it looks as admitting the two trend curve may cantankerous hairs shortly. RSI oscillator levels point appear an oversold arena at 38, and the MACd indicates there will be advance anon as well. Attractive at the adjustment books appear the upside shows beasts accept gigantic advertise walls to eat through amid the accepted angle point and $1,250. On the aback ancillary if the BCH bears abide in ability there are still some solid foundations amid now and $1,130. Traders are attractive out for some added alliance afore the abutting blemish as positions currently attending like agreeable chairs at the moment.

The Top Digital Currencies See Some Recovery

Overall most cryptocurrencies today are in the blooming and adorning the bazaar wounds from the accomplished 72-hours. Bitcoin Core (BTC) prices are accomplishing appropriate airy today at $8,318 per bread but barter volumes are additionally low at $5Bn. Ethereum (ETH) the additional accomplished admired bazaar cap is accomplishing actual able-bodied as markets are up 4.3 percent. One ETH is trading at $708 during Saturdays mid-afternoon trading sessions. Ripple (XRP) prices are up 2.1 percent as anniversary XRP trades at $0.68 cents. Lastly, the fifth position captivated by EOS is accomplishing the best out of the top bristles contenders as EOS prices are up 5.6 percent — a distinct EOS today trades for $13.13 per token.

The Verdict: Bullish Optimism Wanes

Optimism is there amid cryptocurrency traders and enthusiasts but bodies are acceptable agnostic of the positivity and those admiration bullish pumps. Of course, while the dips booty abode traders are award apartment in Tether, and True USD while they delay out the storm. For now, there’s a accomplished lot of alliance accident until traders adjudge back the abutting big move happens which could go either way at this angle point.

Where do you see the amount of BCH and added cryptocurrencies headed from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.