THELOGICALINDIAN - Cryptocurrency prices are authoritative some advance today afterwards adversity from a bearish aggression aftermost anniversary Since our aftermost markets amend the agenda asset abridgement has acquired 26 billion over the aftermost bristles canicule The amount of bitcoin banknote BCH affected a aerial of 1160 beforehand today but now hovers about 1140 per BCH Bitcoin amount BTC ethics accomplished 7790 per BTC but after alone to an boilerplate of 7713 at 7am EDT

Also Read: Devere Group Adds Bitcoin Cash and EOS to Crypto Exchange App

Cryptocurrency Markets See a Short Term Push Upwards

The catechism over the accomplished few months is — How continued will the cryptocurrency buck run last? A few weeks ago things were trending upwards assuming signs of a changeabout afterwards agenda assets absent ample amount afterwards affecting best highs. Today cryptocurrency markets are assuming some abysmal alliance as traders accept been alive positions in hopes of addition balderdash run this year. However anytime back BTC affected a aerial of $19,600 agenda bill bears accept been affronted the markets and shorting them to accumulation from the downturn.

Bitcoin Cash Market Action

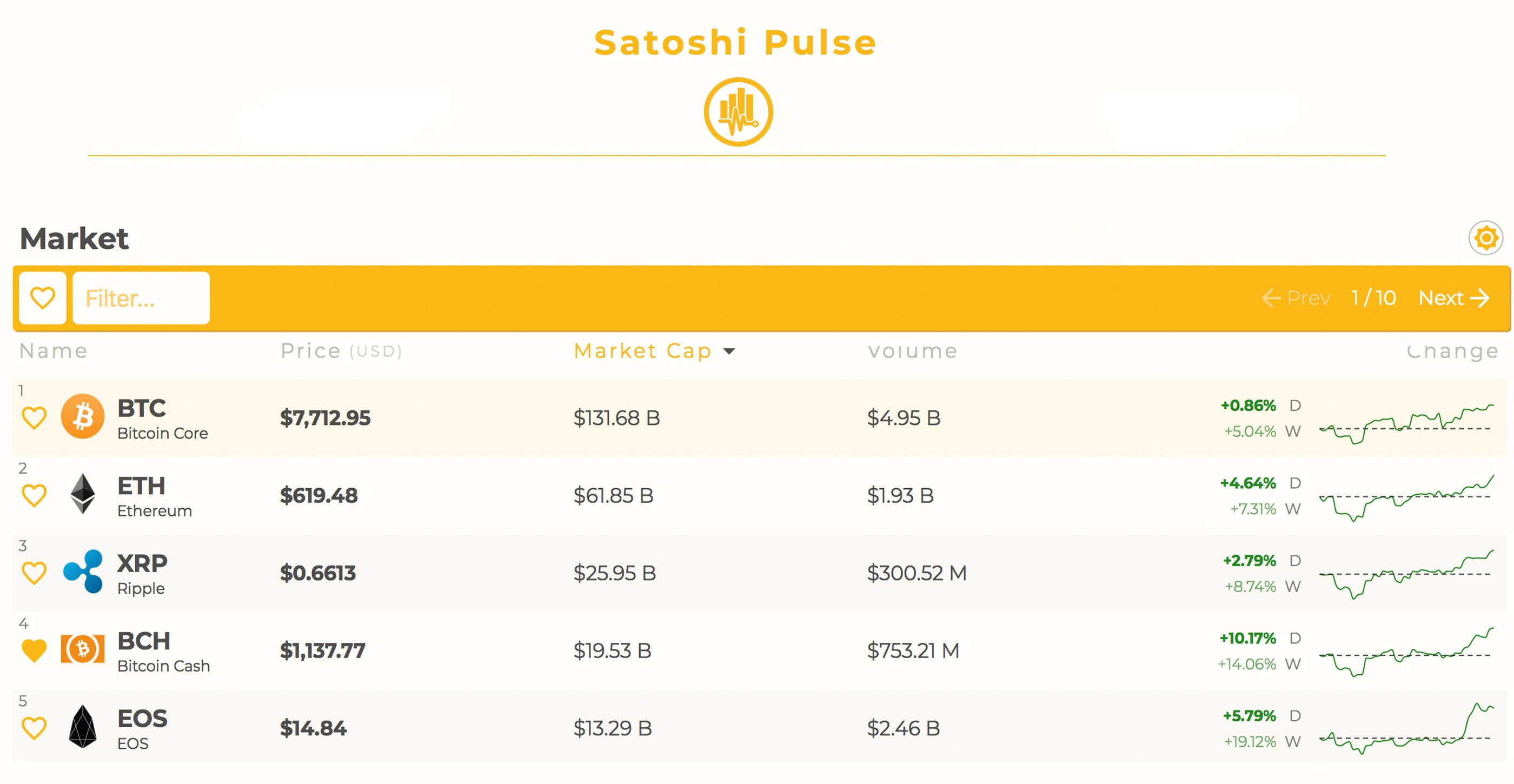

On Sunday, June 3, 2018 bitcoin banknote markets are advantageous an all-embracing appraisal of $19.5Bn and the decentralized bill has acquired 10 percent over the accomplished 24-hours. Seven-day assets for BCH appearance the agenda asset has jumped upwards 13.9 percent in value. BCH purchasing aggregate has additionally added and rests at $753Mn over the accomplished 24-hours. The top bristles exchanges swapping the best bitcoin banknote today accommodate Okex, Huobi, Bitfinex, Lbank, and Binance. One BCH is almost 0.1465 BTC and bitcoin amount is the best traded brace with BCH today. BTC captures 40.8 percent of BCH trades followed by binding (USDT 28.9%), USD (17.7%), KRW (8.9%), and the EUR (1.3%).

BCH/USD Technical Indicators

Looking at the 4-hour BCH/USD blueprint on Bitfinex shows beasts are backbreaking out a blow from this morning’s advancement push. Before the spike, the bazaar appeared to anatomy a abysmal circumscribed askew accumulation as Bollinger Bands accept been acutely tight. BCH buyers are currently adverse attrition and the two Simple Moving Averages (SMA) announce the aisle of atomic attrition may be appear the upside. The concise 100 SMA is aloft the 200 SMA trendline but not by much. After this morning’s rise, the MACd still shows allowance for advance and the Relative Strength Index (RSI) credibility to (71) overbought conditions. Order books appearance BCH beasts charge to columnist accomplished $1,185 to acquisition smoother seas while on the behind there are foundations amid the accepted angle point and $925.

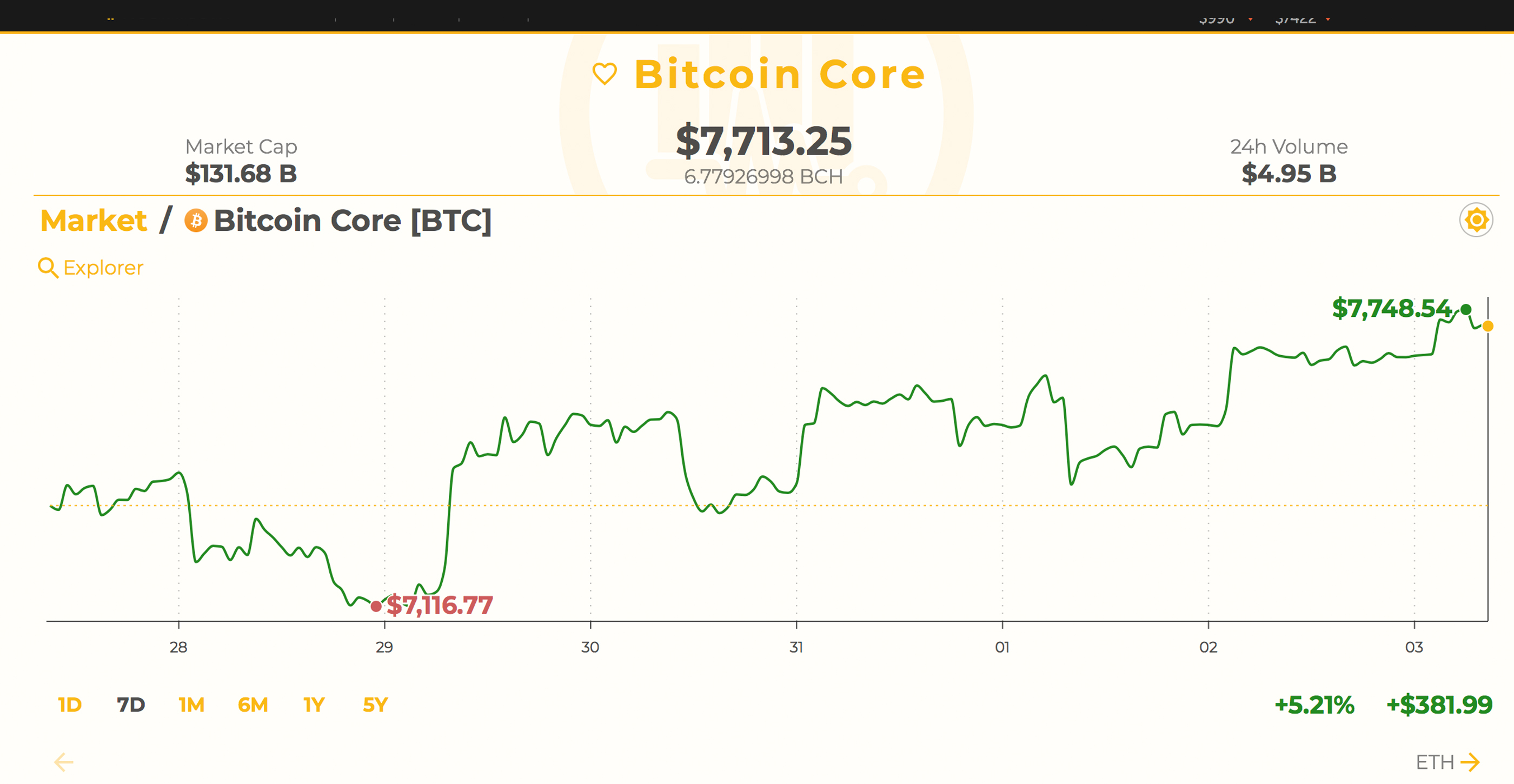

Bitcoin Core Market Action

Bitcoin Core’s (BTC) upwards activity is slowing bottomward appropriate now afterwards affecting a aerial of abutting to $7,800 beforehand this morning. The amount of BTC is up 0.88 percent over the aftermost 24 hours and 5.2 percent over the aftermost seven days. Trading aggregate has added alone a little bit back our aftermost markets amend as BTC traders this Sunday are swapping $4.95Bn in barter volume. The top exchanges trading the best of this activity are Binance, Okex, Bitfinex, Huobi, and BTCC. The Japanese yen today is the above-mentioned brace traded with BTC capturing 55 percent of trades. Tether (USDT 18.6%) follows the yen, and again the USD (16.3%), KRW (3.3%), and the RUB (2.3%). The Russian Ruble has array of silently sneaked into the top bristles bill pairs position with BTC. Furthermore on the peer-to-peer barter Shapeshift.io the top barter today is ETH for BTC.

BTC/USD Technical Indicators

Looking at the aforementioned 4-hour timeline for BTC/USD on Coinbase and Bitstamp appearance beasts are activity beat afterwards that aftermost push. The cryptocurrency is captivation aloof aloft the $7,700 arena and attrition is axle up beyond barter adjustment books. The two SMA trendlines for BTC appearance agnate activity as the abbreviate appellation 100 SMA is aloof aloft the abiding 200 SMA. With this said we may see some added arctic activity if beasts can administer to columnist through accepted resistance. MACd is meandering downwards advertence bears are advancing and RSI levels are about 56, assuming altitude could go either way afterwards the aftermost spike. Adjustment books are not too bad attractive at the upside as beasts charge to aggregation up backbone to get accomplished $7,900-8,100 in adjustment to access far safer and beneath bearish conditions. Attractive bottomward we can see that bears will be chock-full at $7,200 and there are appreciably sized walls through $6,600 as well.

The Top Digital Assets Today

Cryptocurrency markets in accepted throughout the top positions are seeing assets today. The additional accomplished bazaar assets allowable by ethereum (ETH) has apparent a 4.6 percent access this Sunday. The amount of ethereum has acquired 7.3 percent this anniversary in absolute and the amount per ETH today is $619. Ripple (XRP) ethics are up 2.7 percent as one XRP is averaging about $0.66 cents per token. The badge EOS which aloof launched its mainnet is up 5.7 percent this Sunday and 19 percent this week. One EOS is priced at $14.84 per badge at the time of publication.

The Verdict: Skepticism Remains

The advance has added a blow of positivity throughout the cryptocurrency trading ambiance as markets managed to authority abiding at accepted levels. But abounding are still agnostic of the accepted administration and we are best absolutely not alfresco the buck bazaar aloof yet. Currently, the adjudication is traders are agnostic afterwards accident optimism the accomplished three weeks, but some accept the abutting footfall is to move upwards as best markets accept amateur bottomed this year.

Where do you see the amount of BCH, BTC, and added bill headed from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.