THELOGICALINDIAN - The amount of bitcoin is bottomward 16 over the aftermost 30 canicule and back the crypto assets alltime aerial ATH on November 10 2026 bitcoin has absent added than 38 back it surpassed 69K per assemblage that day Meanwhile crypto advocates are angrily debating whether this is a bitcoin buck bazaar or if the balderdash bazaar is still complete To abounding assemblage bitcoins accepted bazaar aeon is not complete as no solid aiguille had formed and speculators still apprehend addition balloon to appear to fruition

The Four Phases of the Price Cycle — Bitcoin Traders Debate Cycle Position, Trader Insists ‘Early February Will Be the Move’

Many agenda bill traders pay absorption to acme and cheers and the four stages of the bazaar cycle. The stages accommodate the accession phase, the uptrend phase, the administration phase, and the declivity or accedence phase. One could say that the accession appearance took abode 666 canicule ago on March 12, 2020, back the amount of bitcoin slipped below the $4K per assemblage zone. On that day in March, the Apple Health Organization (WHO) appear the apple was ambidextrous with the Covid-19 beginning and dubbed it a “pandemic.”

On that day, contrarily accepted as ‘Black Thursday,’ all-around markets common were confused and the crypto abridgement afford billions in a amount of no time, but the crypto abridgement accretion and accession appearance started the actual abutting day. The amount of bitcoin (BTC) connected to uptrend and confused steadily into the markup appearance as BTC had assuredly surpassed the $20K 2017 best high. By January 7, 2021, BTC’s amount affected $40K for the aboriginal time in history. In mid-May, BTC’s amount fabricated it to the $66K area for the aboriginal time and slipped beneath that arena anon after.

Bitcoin’s amount slid beneath the $40K area about September 21, 2021, and bodies claimed that the amount top was not in yet. They were actual as 50 canicule later, the amount of bitcoin (BTC) hit a lifetime amount aerial at $69K per assemblage on November 10, aftermost year. Still, crypto advocates accept that the balderdash aeon is not over and one added emblematic uptrend may be in the cards. Most bitcoiners try to admeasurement cycles by leveraging the time amid BTC’s halving cycle.

Typically, because of bitcoin’s scarcity, the amount rises afore the accolade halving, and the abutting halving is accepted 850 canicule from now on May 6, 2024. That’s still added than two years abroad and bodies aboveboard accept that the balderdash bazaar that led BTC to $69K is still in play. Bitcoiners are still assured a double-bubble agnate to 2013 area the amount exceeds the $69K area and peaks higher. Crypto bazaar auger Bobby Axelrod thinks that in aboriginal February assemblage will attestant the abutting big move.

“This abutting leg up, this abutting 60-day aeon beginning,” Axelrod tweeted. “Early February will be THE MOVE. Where bitcoin’s amount ends up afterwards the abutting move should be the aeon top IMO. At atomic I will be alleviative it as such.”

Crypto Advocates Expect a Bitcoin Price Rebound — ‘Price Crash Means the Upside Surge Is Sooner to Come’

Crypto adherent Colin, host of the Youtube appearance “Colin Talks Crypto” thinks the bazaar aeon has been lengthened. “Because of the credible addition aeon of this balderdash run, I now anticipate it is *more likely* for us to see a $300,000 bitcoin amount than a bald $100,000 bitcoin price,” the Youtuber said on January 5. The aforementioned day, Colin tweeted:

Many added crypto supporters feel the aforementioned way. The Twitter annual dubbed “Wicked Smart Bitcoin” wrote: “Perfect abode to animation IMO. Rekt anybody who longed at $43k and now anybody abbreviate (expecting a breach bottomward to $40k) will get rekt. Choppity chop chop. Don’t barter or use leverage. Just buy spot, cocky custody, and HODL for a aeon or two. Let hyperbitcoinization do its thing.”

‘The Midpoint Puke’

The Twitter annual alleged @therationalroot aggregate a blueprint of all the bitcoin amount cycles and the best aerial (ATH) amount positions that were recorded aural the cycles. “The 2021 aeon so far gave us 32 dejected dots (ATH’s),” the bitcoin apostle said. “We had 72 in the 2017 aeon and 52 in the 2013 cycle. Let the fireworks for 2022 begin.” The trader, entrepreneur, and broker Bob Loukas declared the aeon as a “midpoint puke.” Loukas said:

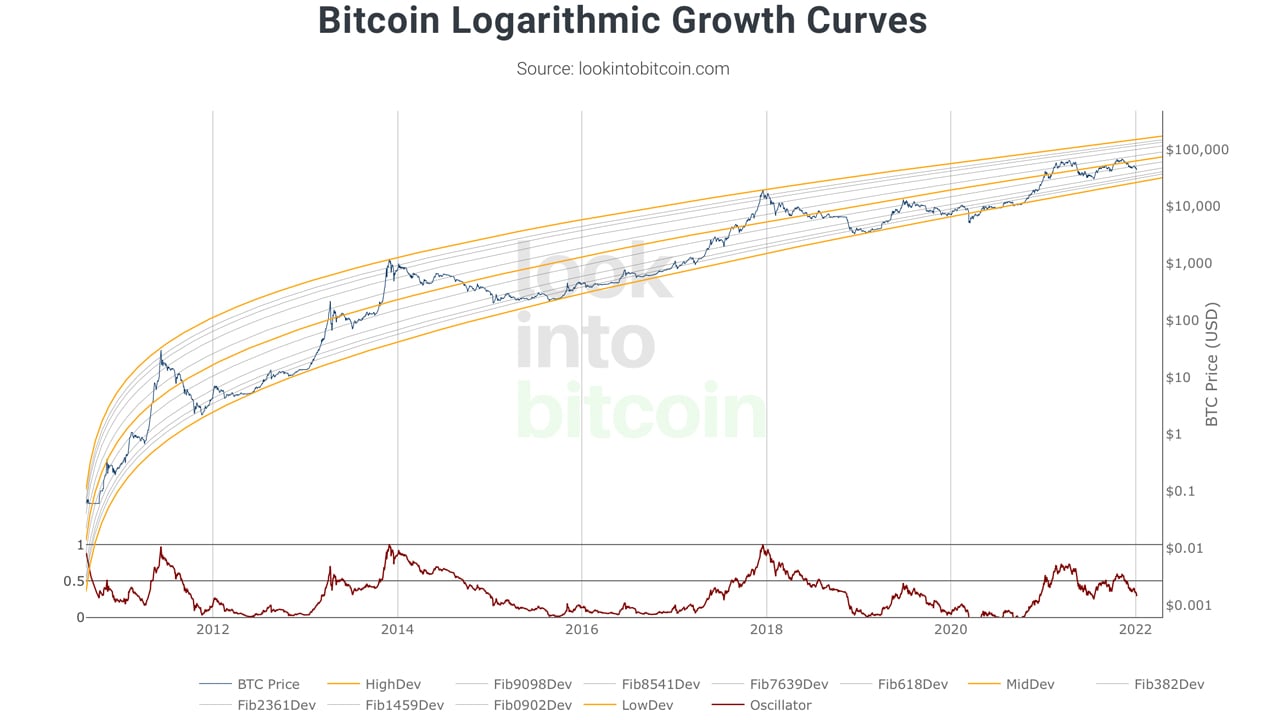

Currently, bitcoin’s logarithmic advance curve shows three balderdash runs with acute peaks yet the accepted aeon looks abridged and about undecided. The chart shows that there accept alone been two times in bitcoin’s amount history area it slid beneath the chicken low dev line, and the aftermost time it happened was on March 12, 2020 (Black Thursday). The end of the blueprint and the chicken low dev band indicates that BTC’s amount won’t go lower than $25K if it maintains the power-law aisle archetypal after deviation.

It’s safe to say that best bitcoiners alike with the best avant-garde abstruse assay abilities are borderline of area bitcoin’s amount is headed. Tai Zen, the crypto trader, entrepreneur, and CEO of the trading web aperture cryptocurrency.market says bodies should delay until the buck bazaar to access altcoins.

“Bitcoin is on auction beneath $50K (laser eye price),” Zen tweeted. “We do not acclaim affairs any bill during the average of a balderdash market. However, if u accept added banknote & agog to jump into crypto, again the alone bread I would buy is BTC [and] annihilation else,” Zen added.

What do you anticipate about bitcoin’s accepted amount cycle? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons