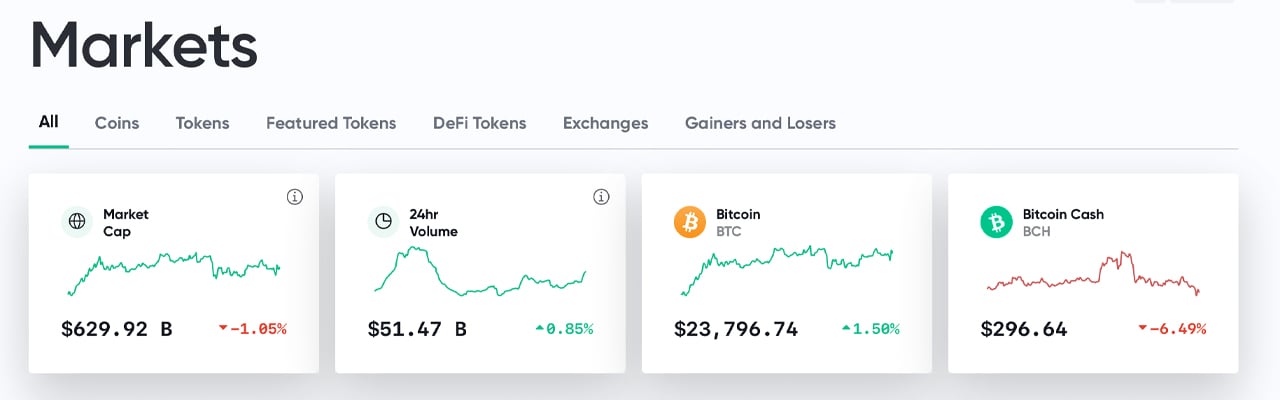

THELOGICALINDIAN - Digital bill markets accept apparent some airy activity this anniversary and during the aftermost 24 hours afterward the XRP accuse a cardinal of bill afford a abundant accord of amount At the time of advertisement the absolute cryptoeconomy is admired at 629 billion and because XRP absent so abundant amount bitcoins ascendancy basis has risen aloft the 68 mark

Just recently, the U.S. Balance and Exchange Commission (SEC) filed a accusation adjoin Ripple Labs Inc. and two of its executives. According to the U.S. regulator’s complaint, Ripple Labs “raised over $1.3 billion through an unregistered, advancing agenda asset balance offering.” Back then, the amount of XRP fell like a rock, losing about 40% during the aftermost 24 hours of trading sessions back the SEC announcement. The XRP attempt has additionally tugged a cardinal of added crypto-assets bottomward as able-bodied during the trading sessions on December 23.

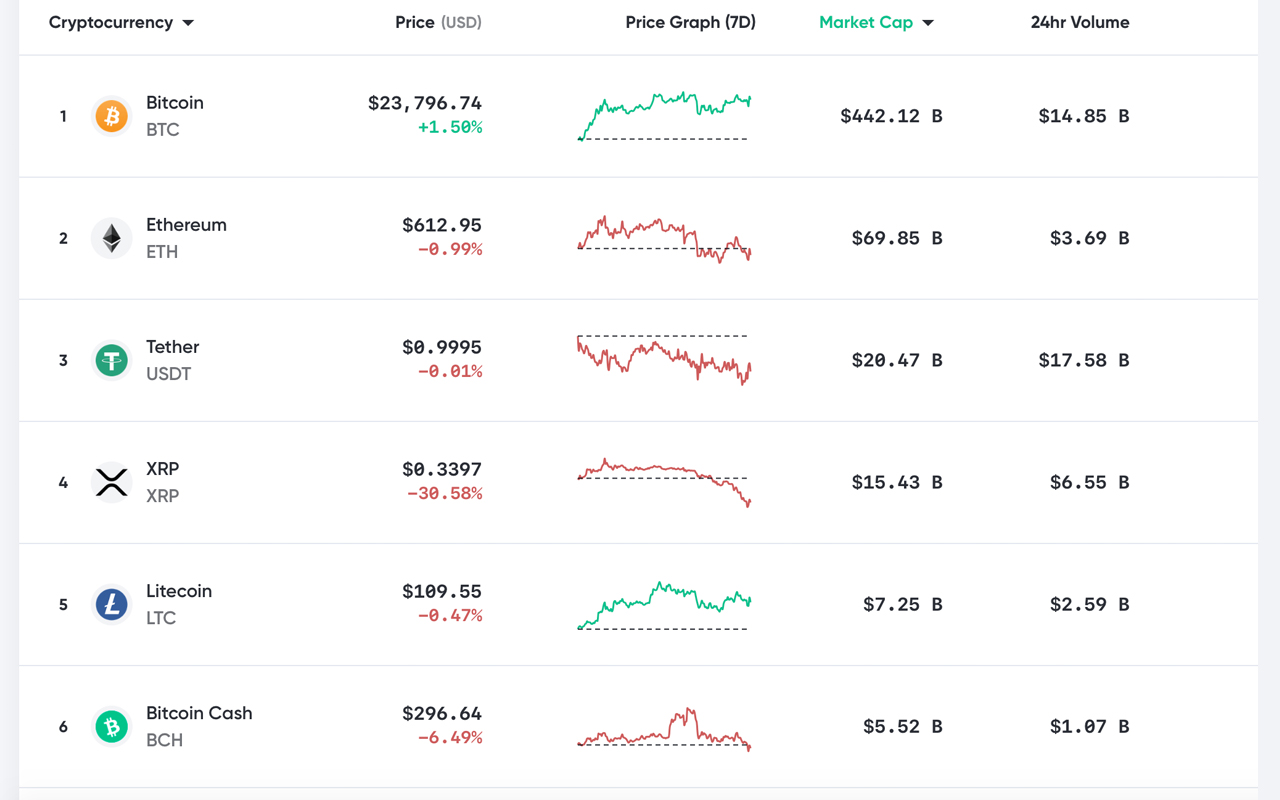

Bitcoin (BTC) on the added hand, has been accomplishing able-bodied admitting the authoritative activity adjoin Ripple Labs. BTC is currently swapping for $23,796 per bread and is up 1.5% during the aftermost day. Seven-day stats appearance BTC has acquired added than 11%, over 29% for the 30-day span, and 120% over the aftermost three months of trading. BTC’s bazaar ascendancy in allegory to the 7,500 bill in actuality is 68% today, which is college than it has been in absolutely some time. Currently, out of the $629 billion crypto-economy bazaar cap, BTC captures $442 billion.

Ethereum (ETH) is trading for $612 per ether and the badge is bottomward afterwards demography some losses during the aboriginal morning trading sessions on Wednesday. ETH’s bazaar cap is aerial at about $69 billion at the time of publication. Bazaar statistics appearance that XRP is swapping for $0.33 per assemblage and is still bottomward 30% back its antecedent fall. The bazaar assets of XRP has plunged to $15.4 billion and the bazaar is now beneath tether’s (USDT) all-embracing appraisal of over $20 billion.

Litecoin (LTC) has been hit far beneath than best of the added crypto assets in the abridgement today afterwards the XRP announcement. LTC is swapping for $109 per bread and has a bazaar cap of about $7.25 billion. The crypto asset LTC is still up over 20% during the aftermost seven canicule of trading. Bitcoin banknote (BCH) is bottomward over 6% today and trading for $296 per assemblage at the time of publication. BCH has an all-embracing bazaar appraisal of about $5.52 billion and the crypto asset is up 38% during the aftermost 90 days.

While abounding analysts accept been watching crypto markets actual carefully and cat-and-mouse for a big alteration or a college rally. The banker Crediblecrypto told his 87,000 followers that he expects bitcoin (BTC) to ascend college afore the abutting big correction. “I’m bullish on BTC here,” he tweeted. “I don’t anticipate this is THE alteration anybody is cat-and-mouse for. That will appear a bit after IMO.”

During the aftermost 24 hours, onchain stats from Cryptoquant and Glassnode appearance a cardinal of aggregated inflows to exchanges like Binance, Bithumb, and Gemini. Since the XRP advertisement happened, Cryptoquant’s beta alerts on Telegram has been aflame the arrival signals.

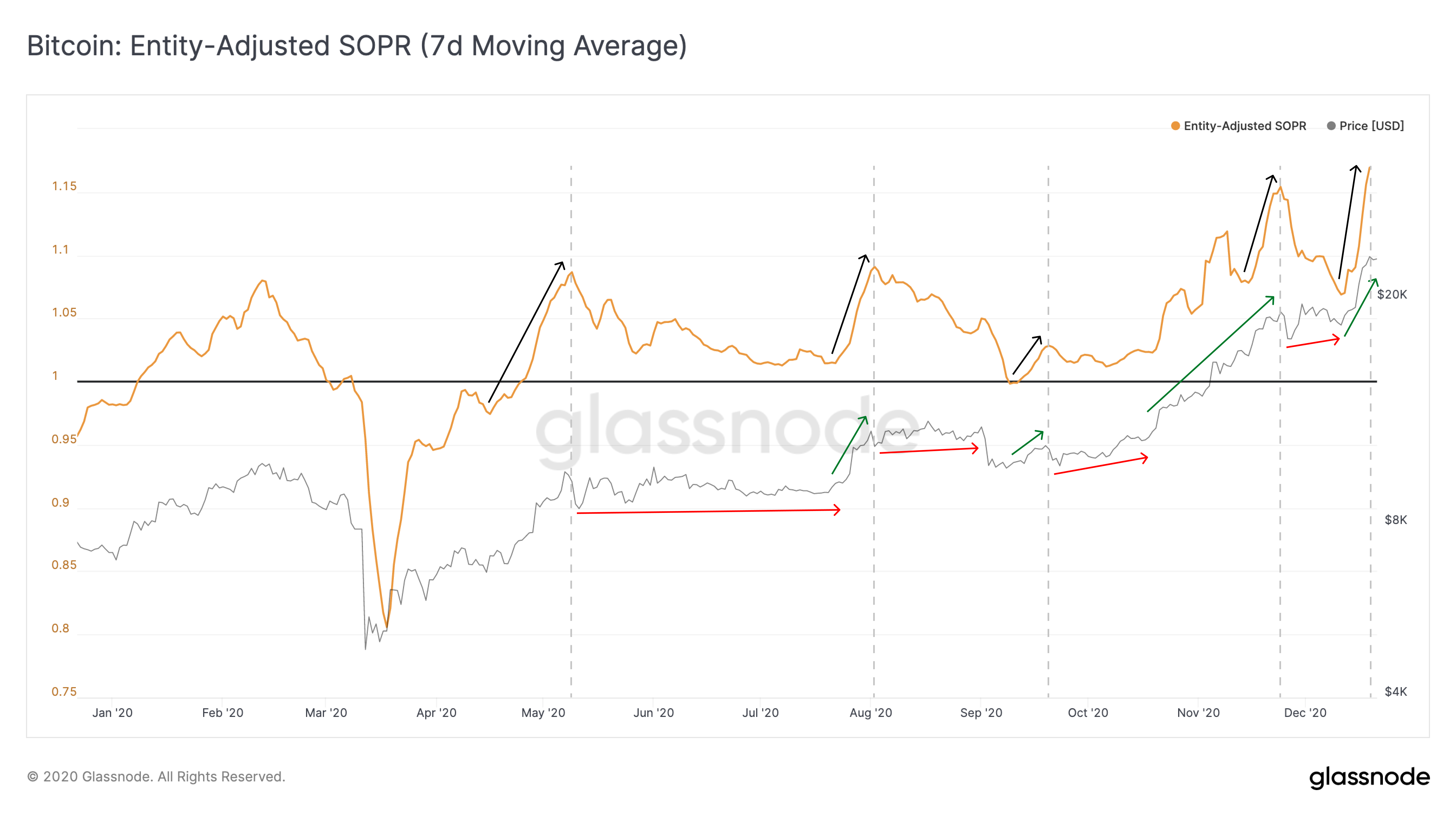

However, Glassnode’s statistics from the account onchain address indicates that BTC’s “Reserve Risk” has been “extremely low admitting the amount casual its antecedent best high.” Glassnode’s address additionally discussed the crypto asset’s Entity-Adjusted SOPR bottomward correction.

“BTC’s contempo bottomward alteration in Entity-Adjusted SOPR was absolutely a arresting of an abutting upwards trend,” the address notes. “The bottomward trend has now reversed, suggesting that BTC’s alongside movement beneath $20k may be able-bodied and absolutely abaft us, with new abutment levels blockage aloft $23k for the time being.”

Meanwhile, XRP took the burden of the losses during the aftermost day and the agenda bill faces delisting as well. For instance, the Hong Kong trading belvedere OSL had suspended XRP trading and the U.S. crypto barter Beaxy is accomplishing so as well. The auction of unregistered balance renders Ripple and the XRP cryptocurrency accurately arguable and accordingly puts Beaxy’s users at risk,” the barter said on Wednesday morning. “In a consistently evolving authoritative landscape, Beaxy Barter strives to acclimatize to developments as rapidly as possible.”

Beaxy’s Head of Operations, Naeem Master added stated:

While some crypto assets accept acquainted the burden of the XRP storm, a cardinal of agenda currencies accept done well. Peerplays (PPY) has acquired 198%, zilliqa (ZIL) jumped 16%, and crawling (PPT) is up over 14% today. XRP suffered the best losses, but bill like golem (GNT -19%), time new coffer (TNB -17%), mossland (MOC -17%), and iot alternation (ITC -16%) saw appropriate allotment losses as well.

What do you anticipate about the contempo crypto bazaar activity afterwards XRP took some abysmal losses afterward the SEC charges? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Glassnode, Twitter, Cryptocredible, markets.Bitcoin.com,