THELOGICALINDIAN - Crypto analysts are blame aback adjoin the anecdotal that the accepted BTC assemblage is actuality fuelled by a clamminess crisis afflicting bitcoin mining pools in China The clamminess crisis which is acquired by an advancing authoritative crackdown in that country has reportedly larboard miners clumsy to advertise their BTC backing

Miners Are Selling

The analysts are instead abetment a counter-narrative which credibility to institutional broker absorption as the acumen for the accepted BTC rally. Using abstracts to abutment their assertions, the analysts advance that the accepted balderdash run, which has altered characteristics with the one in 2017, is acceptable to abide as institutional broker absorption continues to grow.

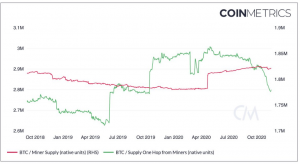

First to present abstracts that debunks the Chinese clamminess crisis anecdotal is Lucas Nuzzi of Coinmetrics. In animadversion fabricated via a Twitter thread, Nuzzi argues that mining pools not affairs their BTC stocks at this point is aloof “part of a abiding trend.” Indeed, the Coinmetrics abstracts does appearance that mining pools, a majority of which are mainly domiciled in China, are not affairs as their banal levels accept remained aural the aforementioned ambit over the accomplished 24 months.

On the added hand, the abstracts shows it is the inventories of alone miners that accept been bottomward for the accomplished month. This according to Nuzzi suggests that miners are in actuality able to sell. Next, Nuzzi uses addition metric to bolster his altercation adjoin the clamminess crisis narrative. Nuzzi says:

Furthermore, the analyst says “the 30-day Miner Rolling Inventory additionally suggests that annihilation out of accustomed is demography abode in mining pools or their alone constituents.”

With the abstracts allegedly abrasive the clamminess crisis narrative, Nuzzi believes instead that “other factors, such as added institutional accord and macroeconomic concerns, are added acceptable the culprit.”

Institutional Investors Behind BTC Rally

Meanwhile, the blockchain assay firm, Chainalysis is analogously absolute in its own thread that ample corporations and billionaires are abaft the accepted bitcoin rally. In its analysis, the close asserts that “demand is aerial at a time (when) almost few bitcoins are accessible to buy.” The close adds that “77% of mined BTC that hasn’t been absent is currently captivated in illiquid wallets that historically accelerate beneath than 25% of Bitcoin they receive.”

This leaves a basin of aloof 3.4M BTC for buyers at a time back the agenda asset is accepting an endorsement from boilerplate organisations.

In addition, Chainalysis makes the allegory amid accepted abstracts and that from 2017. The abstracts shows that the bulk of BTC captivated at the tail-end of 2017 is about agnate to accepted levels. Using this abstracts the cilia concludes:

In the blow of the thread, Chainalysis credibility to the growing affirmation of institutional investors affairs BTC for purposes of captivation as the acumen for the amount rally.

Do you accede that the clamminess crisis in China is not the account of the BTC rally? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons