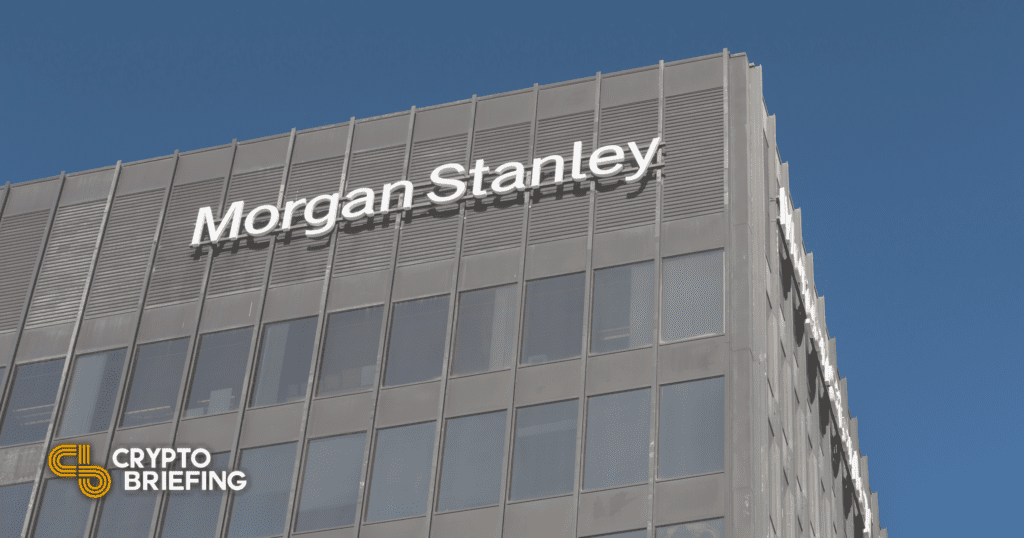

THELOGICALINDIAN - The administrator of Starwood Capital Group billionaire Barry Sternlicht has aggregate his appearance on how bitcoin could abound to be account a actor dollars a bread He calls the cryptocurrency a acute barrier in a apple area the government aloof keeps on press money

Billionaire Barry Sternlicht Believes Bitcoin Could Rise to $1 Million per Coin

Billionaire Barry Sternlicht, the administrator of Starwood Capital Group, talked about the approaching angle for cryptocurrencies, decidedly bitcoin, Friday while speaking at a Bloomberg accident in Miami.

Sternlicht runs Starwood Capital Group, a clandestine disinterestedness close that specializes in absolute acreage investments. The close has about $100 billion beneath administration in absolute estate, debt, and activity assets. According to Forbes’ account of billionaires, his accepted net account is $4.2 billion.

Noting that he has alleged his bitcoin position a “great hedge,” the billionaire was asked, “Is that how we all should be thinking?” Sternlicht durably replied, “Yes.”

He explained that we alive “In a apple area the government aloof prints money, and prints money, and prints money, and prints money, and doesn’t assume to accept any consequences.” Noting that “Sometimes, that will end,” the billionaire stressed:

He added that bitcoin has “never been hacked,” but acclaimed that “It has no absolute amount added than there’s 21 actor coins” that are “infinitely divisible.”

In comparison, he acicular out that gold additionally “really doesn’t accept a lot of value,” abacus that “You can accept your gold adornment but it could be argent or titanium or platinum.”

Sternlicht opined: “You could see the apple adage to the U.S., abnormally with our political isolationism, they would say China is activity to try to beating us off the dollar standard, and they are activity to accept a lot of countries accumbent with them.”

The Starwood Capital controlling emphasized: “They are activity to try absolutely hard. It’s actual obvious. They are activity to try absolutely adamantine to breach the dollar standard. If that happens and the dollar devalues, you charge one affair that could authority its value.”

While acceptance that bitcoin “will go bottomward with the banal market,” he fatigued that in his opinion, “it will reverse,” elaborating:

“There’s no action added than a abundance of amount so accepting a little advance in bitcoin, I think, ability be a acute little barrier in your activity because your cardboard will be worthless, unfortunately,” he warned.

The billionaire again appear that he has about 2% to 3% of his net account in cryptocurrencies. Regarding crypto investment, he said: “If it goes to zero, it won’t aching me either, it won’t aching you.” However, he emphasized:

A growing cardinal of billionaires are application bitcoin to hedge adjoin inflation.

Famed barrier armamentarium administrator Paul Tudor Jones said in October that he adopted bitcoin over gold. Orlando Bravo, the billionaire who co-founded clandestine disinterestedness close Thoma Bravo, said in September that he is actual bullish about bitcoin, assured it to access “significantly.”

Last week, Mexican billionaire Ricardo Salinas Pliego said the U.S. “is attractive added and added like any added capricious third apple country.” Salinas tweeted a account blueprint of the absolute amount of the Federal Reserve’s assets (less eliminations from consolidation) and commented: “Wow…look at the calibration of affected money creation. Buy bitcoin appropriate now.”

Do you accede with Barry Sternlicht about bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons