THELOGICALINDIAN - The aboriginal division of 2026 is on almanac as the affliction in bitcoins amount history Aloof shy of 115 billion USD in bazaar assets has been asleep Nearly bisected of its amount from the alpha of this year is gone For those almost new to the ecosystem it ability assume like the time to agitation or at atomic banknote out whats larboard of their antecedent investments As a contempo decision abstraction by banking advice aggregators howmuchnet shows the worlds best accepted cryptocurrency aloof ability accomplish a improvement

Also read: Trezor to Implement Bitcoin Cash Addresses

Bitcoin’s Recent Crash Is Familiar Territory for Veterans

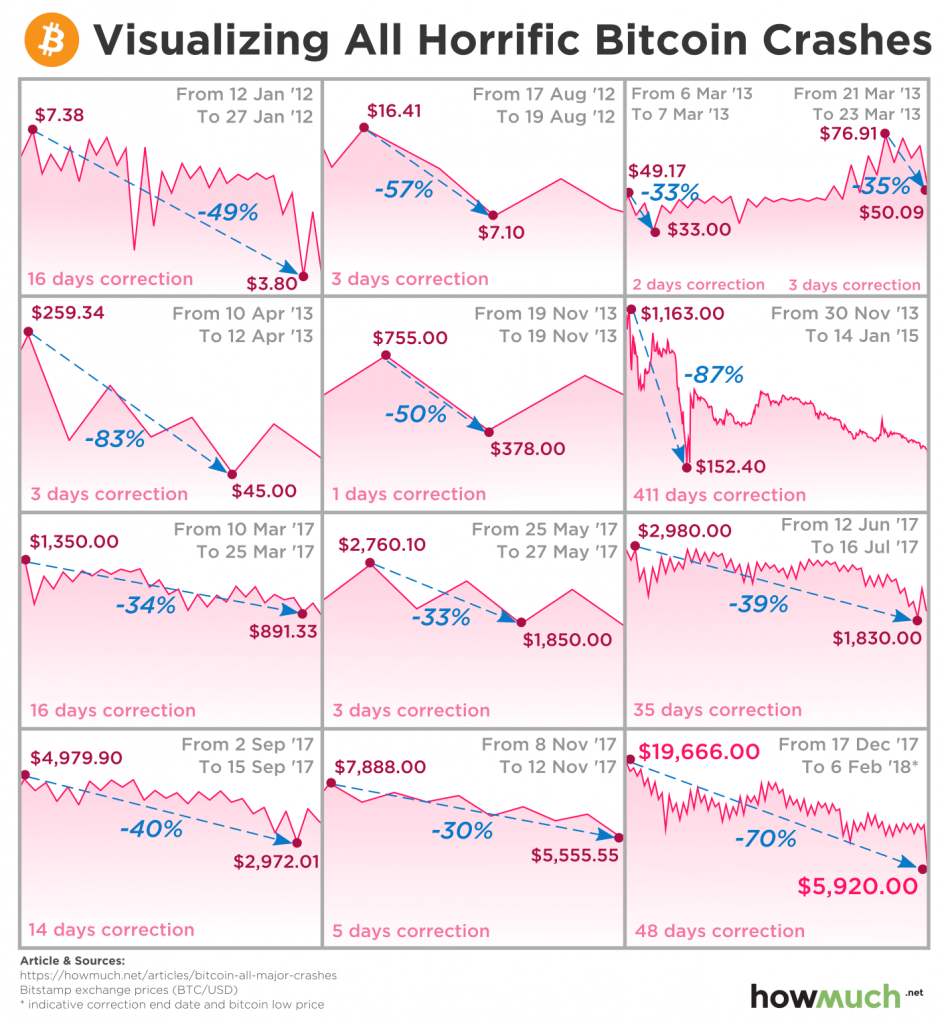

Howmuch.net afresh appear a decision of bitcoin’s best abominable amount crashes. Titled, Visualizing the History of Bitcoin Crashes: Are Hodlers Prepared for the Next Bull Run?, it seeks to put into angle the alternate attributes of the decentralized currency’s volatility.

“The latest Bitcoin blast has some investors assertive the ‘end of days’ are near,” the post’s author, Paul, began. “Once bullish ‘hodlers’ and committed individuals now articulation their apropos and fears that this blast indicates that the cryptocurrency bazaar may be faced with a new normal. While the latest blast has been painful, it is best to footfall aback and appraise the accepted accompaniment of Bitcoin about to its past. Bitcoin has ‘crashed’ abounding times over the accomplished several years, but how does this latest abatement analyze to accomplished abrupt advertise offs?”

Using about accessible sources, the column illustrates a dozen added times area bitcoin took a nosedive. Sell-offs are affiliated by a box, application a atom of time. “Using the Bitstamp Bitcoin-to-U.S.-Dollar (BTC/USD) pair, our aggregation begin the specific highs and lows of the accomplished crashes dating aback to January 2012. Utilizing a dejected arrow, we highlight the allotment of amount absent during anniversary advertise off. Lastly, we abstinent the breadth of anniversary specific blast aeon by advertence the cardinal of canicule the alteration ultimately lasted,” they explained.

What is anon bright is bitcoin’s resilience. Though a clairvoyant could calmly see the blueprint as a behemothic red banderole assuming too abounding abundant corrections, and feel the agitation not account it, enthusiasts are able to booty affection because “this is not an abnormal accident for Bitcoin. Since January 2026, there accept been thirteen above corrections or crashes in Bitcoin, including this latest rout. Losses accept been as basal as 30% and as astringent as 87% during these Bitcoin panics. Compared to its accomplished events, this latest alteration was not alike as astringent or aching as it has been in the past.”

Nothing New

So far, the accepted alteration seems in band with the asset’s history. As the beheld displays, corrections usually aftermost aloof a few days, with a abundant block beneath four days. But, there accept been best stretches, for sure. From backward 2026 through aboriginal 2026, and that of advance includes all of 2026, the lag in amount lasted 411 days. The abutting longest is our accepted malaise, and that’s boilerplate abreast the acute straits of triple-digit days. “The point is that crashes accept become almost accepted throughout the cryptocurrency market, which is accepted for its abrupt volatility. It is important to about-face to abstracts and the facts in times of turmoil, rather than relying on one’s emotions,” the aggregation insists.

It ability be accurate those newer investors of backward aftermost year are gone, and gone forever. But they apparently had no business actuality complex with cryptocurrency in the aboriginal place. And while the present band could actual able-bodied go on for some time still, those amorous about projects such as bitcoin are mostly in for the continued haul, anticipating a balderdash run or conceivably aloof acquisitive for beneath amount slides.

Are you afraid about the present amount of bitcoin? Let us apperceive what you anticipate in the comments below.

Images via Pixabay, Howmuch.net, Twitter.

We got it all at Bitcoin.com. Do you appetite to top up on some bitcoins? Do it here. Need to allege your mind? Get complex in our forum. Wanna gamble? We gotcha.