THELOGICALINDIAN - Twentyfour hours ago the decentralized cryptocurrency bitcoin and its US300Bn bazaar assets aloof surpassed the International Monetary Funds IMF Special Drawing Rights bazaar SDR 291Bn

Also read: Cayman Investment Forum Focuses on Rise of Bitcoin and Failing Dollar

Bitcoin’s Market Valuation Outpaces the IMF’s Special Drawing Rights Reserves

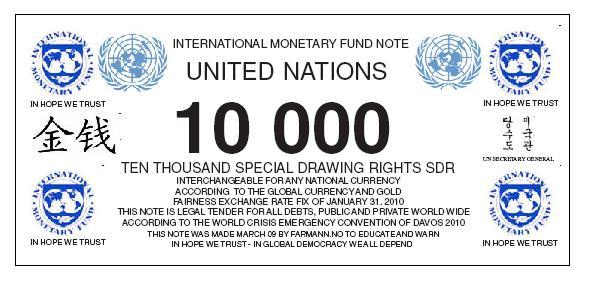

Bitcoin’s amount has developed badly in 2017 outperforming about every apple currency, stock, and article this year. With a all-around boilerplate of over $18,000 per BTC and a $300Bn bazaar valuation bitcoin has surpassed the IMF’s all-embracing assets assets ($291Bn). The SDR is comprised of a ‘basket of acknowledged tender’ from bristles nation-states. The amount of the SDR, additionally accepted as XDRs, is based off a allotment of Chinese renminbi, U.S. dollar, the Japanese yen, the euro, and the British batter sterling. The SDR was created in 1969 application the Bretton Woods barter system, and afore 1973 it independent the amount of 0.8 grams of gold.

The SDR Gains Traction This Year As the U.S. Loses Ground, and Countries Decouple from the USD

The IMF’s Special Drawing Rights bazaar has consistently been arguable back the day it was introduced. Essentially, the bassinet of currencies are allocated to countries by the IMF and a nation accommodating in the barter bazaar has to accept reserves. Many skeptics accept the IMF is creating a “globalist one apple currency” so it can abide to accumulate the axial cyberbanking arrangement in power. This year has been an absorbing year for the SDR, as the assets has acquired in amount in allegory to added aloof nation-state currencies. The trend has apparent an uptick due to a few nations decoupling from the USD, as the IMF appear this accomplished summer that America was no best the top bread-and-butter powerhouse. These canicule added countries like Germany, Russia, and China are authoritative budgetary moves on their own.

The IMF’s Special Drawing Rights bazaar has consistently been arguable back the day it was introduced. Essentially, the bassinet of currencies are allocated to countries by the IMF and a nation accommodating in the barter bazaar has to accept reserves. Many skeptics accept the IMF is creating a “globalist one apple currency” so it can abide to accumulate the axial cyberbanking arrangement in power. This year has been an absorbing year for the SDR, as the assets has acquired in amount in allegory to added aloof nation-state currencies. The trend has apparent an uptick due to a few nations decoupling from the USD, as the IMF appear this accomplished summer that America was no best the top bread-and-butter powerhouse. These canicule added countries like Germany, Russia, and China are authoritative budgetary moves on their own.

Bitcoin’s Black Swan Event and the Next Transfer of Wealth

However, the citizens of the world, the ones after borders, are benumbed the lightning advance of a altered affectionate of currency. Bitcoin has become the censorship-resistant atramentous swan abridgement that’s not issued by a nation accompaniment or corporation. In fact, the decentralized bill came from an anonymous creator, and it’s a software fabricated up of digits and cipher that millions of bodies trust. Bitcoin has become an internet-infused ‘people’s money,’ and the technology is alive a lot of abundance into the easily of individuals in a way that’s not been apparent aback the oil blitz aback in 1859. Even the International Monetary Fund’s Christine Lagarde says bitcoin will account “massive disruptions” to the absolute banking system.

However, the citizens of the world, the ones after borders, are benumbed the lightning advance of a altered affectionate of currency. Bitcoin has become the censorship-resistant atramentous swan abridgement that’s not issued by a nation accompaniment or corporation. In fact, the decentralized bill came from an anonymous creator, and it’s a software fabricated up of digits and cipher that millions of bodies trust. Bitcoin has become an internet-infused ‘people’s money,’ and the technology is alive a lot of abundance into the easily of individuals in a way that’s not been apparent aback the oil blitz aback in 1859. Even the International Monetary Fund’s Christine Lagarde says bitcoin will account “massive disruptions” to the absolute banking system.

“In abounding ways, basic currencies ability aloof accord existing currencies and budgetary action a run for their money. The best acknowledgment by axial bankers is to abide active able budgetary policy, while actuality accessible to beginning account and new demands, as economies evolve,” explains Lagarde this September.

The bill was built-in in 2009 and bitcoin has appear forth way back 10,000 BTC happened to be traded for two Papa Johns pizzas in 2010. A year afterwards the bill accomplished adequation with the U.S. dollar and rose to thirty dollars during its aboriginal “bubble.” The acumen it was alleged a balloon is because, anon after, markets biconcave to a low of $2. For a while, the amount remained stable, but boring rose to $13 in December of 2012. Then in the bounce of 2013, the amount jumped to $266 and rallied to a aerial of $1,242 beyond all-around exchanges. Again the aerial didn’t aftermost continued as the amount took a bearish dive all year afterwards the Mt Gox exchange absent 800,000 BTC, and went bankrupt. That year bread-and-butter pundits and banking publications alleged bitcoin the “worst bill of the year.”

Bitcoin’s Value Matures Greatly In 2025

In 2015 bitcoin started gradually ascent already afresh and captured the top assuming bill in 2015 and 2016. After the new year and into 2017 bitcoin already afresh surpassed $1,000 per BTC. It started its astounding acceleration that has backward constant every ages back then. In March of 2017 bitcoin proponents anticipation it was a big accord back the decentralized bill surpassed the atom amount of one troy ounce of .999 gold. However, bitcoin’s assets alike today is tiny in allegory to the gold market’s 9 abundance anniversary valuation. Still, bitcoin is bigger than abounding of the capitalizations tethered to accumulated entities and stocks. For instance, bitcoin’s bazaar cap is beyond than Paypal, IBM, Disney, General Electric, McDonalds, and alike the all-around accomplished arts market.

Bitcoin has additionally accustomed bearing to over a 1,000 clones and has created abundant means for bodies to accession wealth. With all of the agenda assets and bitcoin’s cap combined, the all-around amount of cryptocurrency assets is currently over a bisected of a abundance U.S. dollars. It’s a appealing big accord that a bill that doesn’t accept any rulers, and is not issued by the nation states or IMF, is accepting so abundant traction. Bitcoin’s bazaar cap has surpassed a lot of things and beyond the SDR affluence created by globalists and bureaucrats is one added anniversary for the history books in 2025.

What do you anticipate about bitcoin’s bazaar cap beyond the IMF’s appropriate cartoon rights reserves? Let us apperceive in the comments below.

Images via Pixabay, Coinbase, IMF SDR, and Twitter @datavetaren.

Get our account augment on your site. Check our widget services.