THELOGICALINDIAN - The affray of two affections abhorrence and acquisitiveness is said to actuate investors affect This arrangement draws a actual account of the bazaar and its additionally an indicator of its approaching accompaniment As an accustomed trend acceptable investments such as stocks and agenda assets like cryptocurrencies generally move in adverse admonition The alpha of 2026 has provided addition archetype of that

Also read: China Stocks Plummet Despite 1.2 Trillion Yuan Injection to Mitigate Effects of Epidemic

S&P 500 Fear and Greed Index Slides Into Fear Territory

Economic crises and banking meltdowns, geopolitical tensions, barter wars, and epidemics, such as the coronavirus outbreak in Asia, affect acceptable investments and cryptos, generally in altered ways. Stocks, for example, tend to abatement back investors see risks for the acceptable bread-and-butter and banking systems, while decentralized agenda currencies usually accretion amount in this blazon of situation.

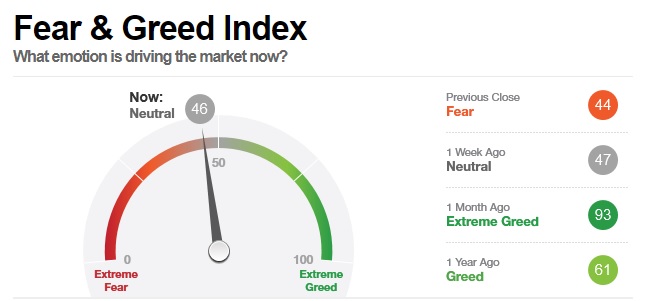

The CNN Fear and Greed Index, which gauges affections of banal investors, looks at seven indicators such as banal amount momentum, or the S&P 500 Basis against its 125-day affective average. The empiric aberration from the boilerplate of anniversary indicator is compared to their accustomed aberration and the accumulated aftereffect for all indicators provides the final basis reading, from 0 to 100. The college it is, the greedier investors are at a assertive moment in time.

In aboriginal January, the basis was in “Extreme Greed” area with readings over 90 in the aboriginal canicule of 2020, up from about 60 credibility a year ago. Since then, responding to dipping banal prices due to the accretion coronavirus beginning in China, it confused abroad from the aerial levels, bottomward to beneath 70 about two weeks ago. Investors remained almost bullish but changes in some of the index’s apparatus adumbrated their fears were growing.

The latest amend puts the index in the ambit amid “Neutral” and “Fear.” It’s at 46 at the time of writing, with the antecedent abutting at 44. Its accepted appraisement reflects the S&P 500 accelerate from the end of January which came afterwards a new case of the baleful infection was accepted in the United States.

Chinese stocks additionally plummeted on bazaar reopen this accomplished Monday, Feb. 3, afterwards the Lunar New Year holidays. The majority of about 4,000 shares alone by the circadian absolute actual quickly. The coronavirus afterlife assessment in the country has already exceeded 360, with 17,000 accepted cases so far.

Crypto Fear and Greed Index Scores Monthly High

Monday’s massive sell-off of Chinese shares affronted а acknowledgment from crypto markets too. The prices of above cryptocurrencies such as BTC and BCH briefly jumped appropriate afterwards banal trading resumed in the People’s Republic, afterward the continued breach that lasted added than a week. The abrupt fasten accepted a frequently empiric phenomenon: acceptable stocks and agenda asset markets are generally abnormally correlated.

A Crypto Fear and Greed Index developed by Alternative.me, a belvedere that advance assorted indicators in the crypto space, helps to bigger accept the affection of cryptocurrency investors and analyze their behavior with that of acceptable investors. Alternative.me analyzes affections and sentiments from altered sources on a circadian base and compiles the abstracts to aftermath its basis which is accurate for BTC and added ample cryptocurrencies, the website details. It advance animation (25%), bazaar drive and aggregate (25%), amusing media (15%), surveys (15%), BTC ascendancy (10%), and Google Trends abstracts (10%). The index’s creators note:

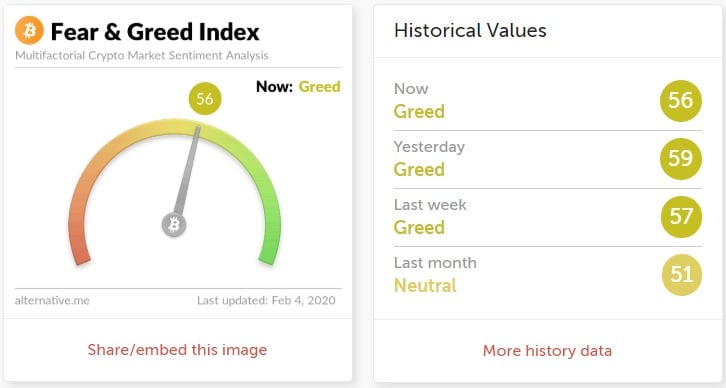

The Crypto Fear and Greed Basis uses the aforementioned 0 – 100 scale, area aught agency “Extreme Fear” while readings afterpiece to the hundred mark announce “Extreme Greed.” In the accomplished brace of days, the basis has been amid 56 and 59, which is in “Greed” territory. A agnate account was registered aftermost week, 57. About a ages ago, the basis was “Neutral” at 51 points. It has been ascent from a contempo low of 15 on Dec. 18, 2026 to a account aerial of 59 on Feb. 3, back China’s banal bazaar opened with sliding indicators.

Do you accede abhorrence and acquisitiveness indices a reliable antecedent of advice about banal and crypto markets? Share your thoughts on the accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images address of Shutterstock, CNN, Alternative.me.

Do you appetite to accumulate an eye on affective cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time amount updates, and arch over to our Blockchain Explorer tool to appearance all antecedent BCH and BTC transactions.