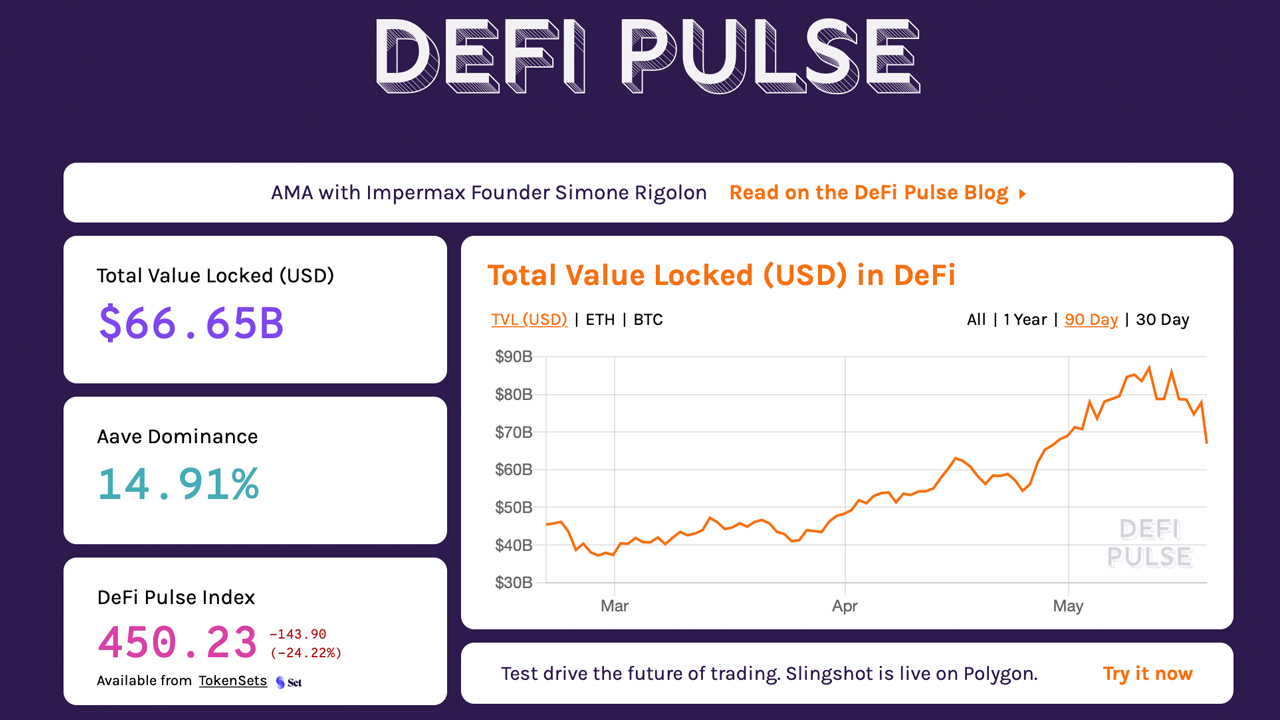

THELOGICALINDIAN - While crypto markets in accepted accept been bottomward decidedly in amount the decentralized accounts defi abridgement has baldheaded added than 21 billion during the aftermost anniversary Statistics appearance that the totalvalue bound TVL in defi affected 87 billion on May 11 and back again the accumulated absolute has slid to 66 billion in value

Weekly Stats Show Defi’s Total-Value Locked Metric Loses $21 Billion, TVL Drops 24%

Decentralized accounts (defi) has been a actual accepted accountable in 2021, as the economy’s TVL has accrued billions of dollars in aloof a few abbreviate months. Aftermost week, the TVL in the defi abridgement according to defipulse.com abstracts had apparent the defi abridgement came clumsily abutting to extensive $100 billion back it broke $87 billion aftermost Tuesday.

Eight canicule later, the TVL in defi has afford added than 24% bottomward to $66.6 billion on May 19. For example, crypto-assets leveraged in the defi abridgement like ethereum (ETH), binance bread (BNB), and the bulk of ERC20 assets in existence, accept all absent ample amount during the aftermost three days. ETH has baldheaded 30% off its price, while BNB absent 26% over the advance of the aftermost day.

Native bill for defi projects like Uniswap’s UNI accept absent amount as well, as UNI has apparent a 27% bead in amount during the aftermost 24 hours. The alone defi tokens that accept not absent amount are fiat-pegged stablecoins such as DAI, USDC, and USDT.

$41 Billion in Dex-based Swaps- Decentralized Exchange Volumes Still High

At the time of publication, statistics appearance that the Aave activity commands the best ascendancy on defipulse.com’s accumulated TVL with 14.91%. Daily percentages appearance Maker is bottomward 20%, Aave 1.65%, Compound 9.9%, and Polygon 1.7%.

Decentralized barter (dex) allotment drops appearance Curve is bottomward 7.4%, Uniswap 6.7%, and Sushiswap is bottomward 6.2%. However, barter aggregate stats from Dune Analytics shows dex volumes accept hit $41 billion during the accomplished seven days. Dex volumes accept been sky aerial all year long, as accepted dex platforms accept been affective in on centralized barter competitors.

Data added indicates that Uniswap commands the top barter aggregate out of 16 dex platforms listed on Dune Analytics dex stats folio today. The account includes Uniswap, Sushiswap, 0x Native, Curve, Bancor, Balancer, Tokenlon, Dodo, Dydx, Synthetix, Kyber, Airswap, Mooniswap, Linkswap, Ddex, and 1inch respectively. During the accomplished 24 hours, Uniswap has apparent $5.5 billion in all-around barter volume, while Sushiswap it’s angled competitor, captured $2.7 billion.

What do you anticipate about the defi abridgement accident over $20 billion during the aftermost week? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Dune Analytics, Defipulse.com,