THELOGICALINDIAN - Weiss Ratings has categorical key affidavit why investors should be bullish about bitcoin seeing a barbaric assemblage with the amount of the cryptocurrency accepted to hit 70000 abutting year In accession the Federal Reserves massive moneyprinting and institutional investments into cryptocurrencies add to the bullishness

Why Weiss Ratings Is Bullish on Bitcoin

Weiss Ratings analysts Bruce Ng and Juan Villaverde explained aftermost anniversary why investors should be bullish about bitcoin admitting some alongside consolidations. Weiss Ratings currently ranks bitcoin aboriginal amid all cryptocurrencies overall.

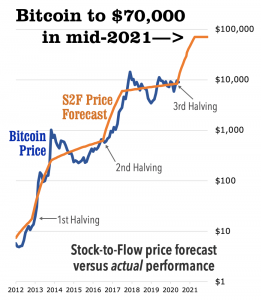

One of the three key affidavit why the analysts are bullish about bitcoin stems from a amount anticipation based on the stock-to-flow assay (S2F). The accepted forecasting archetypal “now credibility to a barbaric assemblage over the abutting 12 months or so,” they wrote.

Ng and Villaverde declared that “S2F is based on the astute angle that the scarcer a article is, the added admired it becomes,” abacus that absence is abstinent by circulating supply. For example, Gold has an S2F of 62, which is “the cardinal of years of accepted assembly appropriate to bout all-around above-ground holdings,” they clarified.

After the May Bitcoin halving, 6.25 new bitcoins are actuality created every 10 minutes, acceptation “it would booty an estimated 56 years for new bread to bout Bitcoin’s circulating supply,” they continued. “Notice how abutting that is to the S2F cardinal for gold, which makes faculty because bitcoin is fast acceptable a above battling to gold as a safe-haven investment.”

The analysts added that “previous S2F predictions band up absolutely able-bodied with bitcoin’s absolute amount performance,” as apparent in the blueprint above, elaborating:

The added two affidavit Weiss Ratings’ analysts accent were “QE infinity” and institutional money abounding into cryptocurrencies. The covid-19 communicable ambiance has pushed the Federal Reserve to book $2.9 abundance in new cardboard money in aloof 13 weeks, or about $22 actor a minute, the analysts detailed. “By any measure, this is bribery of money on an automated scale,” they exclaimed, admiration that investors will cascade money into bitcoin and gold “as a safe anchorage back they lose aplomb in cardboard money.”

Billionaire broker Mike Novogratz has additionally been adage that axial banks press almanac bulk of money is the best environment for bitcoin.

The aftermost above agency Ng and Villaverde focused on was the accretion absorption in cryptocurrency amid institutional investors, such as by Paul Tudor Jones who invested about $210 actor of his own money into bitcoin. Grayscale Investments has been abacus bitcoin to its Grayscale Bitcoin Trust faster than the amount of new bill actuality mined and recently, adventure backer Andreessen Horowitz aloft bisected a billion dollars to advance in crypto startups. The analysts opined:

Are you bullish on bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Weiss Ratings