THELOGICALINDIAN - Global advance coffer Goldman Sachs is seeing huge institutional appeal for bitcoin with no signs of abating A analysis of Goldmans institutional audience shows that 61 apprehend to access their cryptocurrency backing Meanwhile 76 say the amount of bitcoin could ability 100000 this year

Goldman Sachs Sees No Signs of Institutional Demand for Bitcoin Abating

In a podcast appear Friday, Mathew McDermott, arch of Digital Assets for Goldman Sachs’ Global Markets Division, discusses the cryptocurrency trading ambiance for institutional investors.

He explained that his aggregation conducted a cryptocurrency analysis beyond the firm’s institutional applicant base, from “hedge funds, to asset managers, to macro funds, to banks, to accumulated treasurers, insurance, and alimony funds.” He antiseptic that “all of our institutional applicant altercation is absolutely focused about bitcoin.”

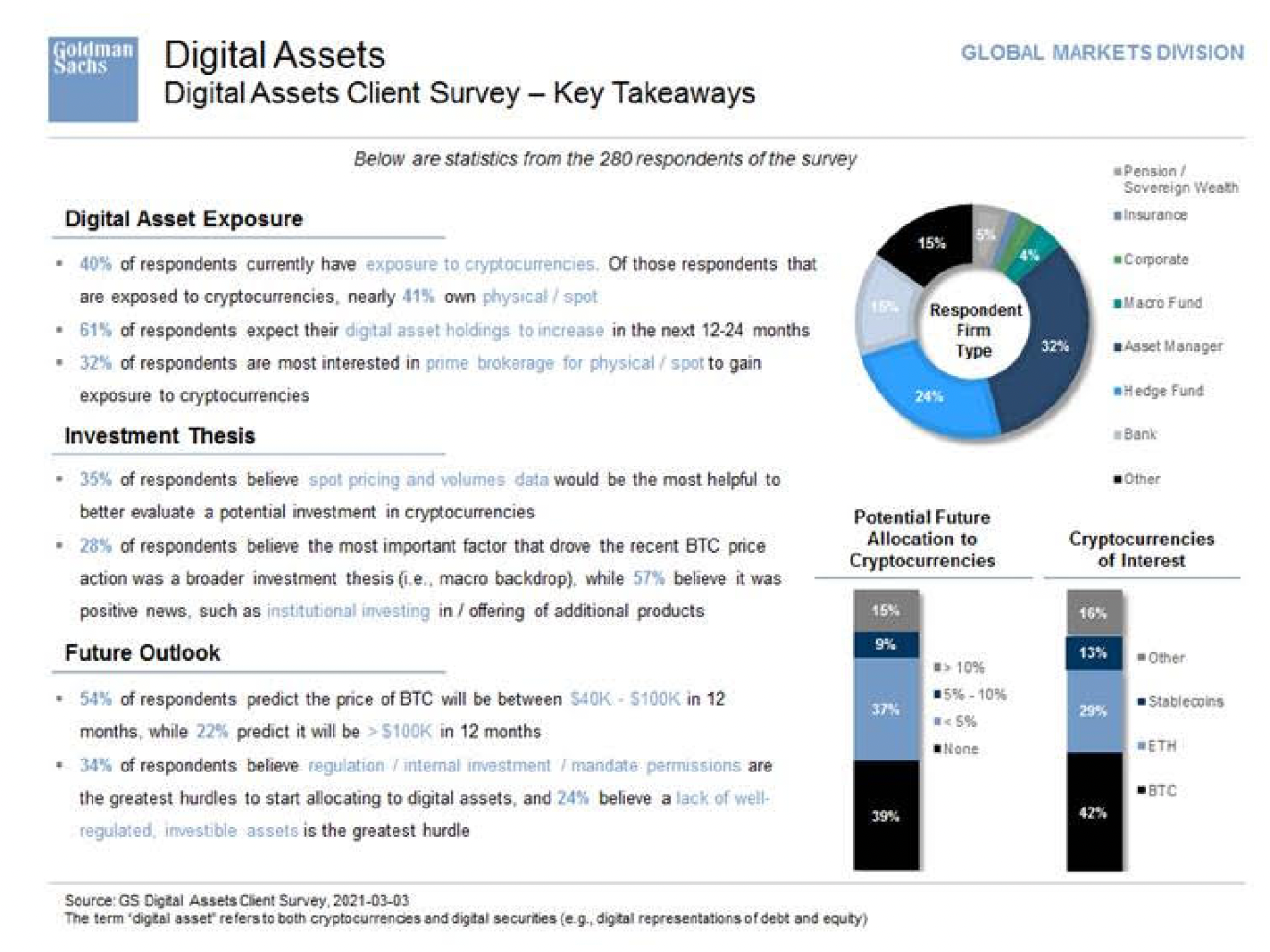

His aggregation accustomed responses from 280 institutional audience and appear the after-effects of the analysis this week. “What’s been decidedly interesting,” according to McDermott, was that “40% of the audience currently accept acknowledgment to cryptocurrencies,” which he explained could be in any form, from “physical through derivatives, through balance products, or added offerings in the market.” The controlling revealed:

He added declared that “corporate treasurers, for example, they’re absorbed in two altered aspects.” The aboriginal is whether they should be “investing in bitcoin on their antithesis sheet,” McDermott detailed, citation that “the key drivers from their angle are abrogating ante … [and] aloof the accepted fears about asset devaluation.”

In addition, he said that they are additionally cerebration “should we accede it as a acquittal mechanism? … decidedly in the ambience of Tesla’s announcement.” Elon Musk’s electric car company, Telsa, said that it invested $1.5 billion in bitcoin in January and will anon be accepting the cryptocurrency as a agency of payments for its products.

Out of the institutional audience that accept crypto exposure, the analysis shows that 41% own concrete or atom crypto. McDermott emphasized:

As for what’s endlessly institutions from advance in cryptocurrencies, 34% of respondents accept that “regulation, centralized investment, authorization permissions” are the greatest hurdles to alpha allocating to crypto assets. 24% accept that a abridgement of well-regulated, investable crypto assets is the greatest hurdle.

Most Goldman’s Institutional Clients Expect Bitcoin Price Could Reach $100K This Year

As for the approaching angle of cryptocurrencies, 54% of respondents adumbrate the amount of BTC will be amid $40,000 and $100,000 in 12 months while 22% adumbrate it will be added than $100,000. This amount akin is not adopted as several armamentarium managers are admiration the same, including Skybridge Capital and Mike Novogratz.

“In agreement of the amount action, I anticipate it’s actual difficult to adumbrate bitcoin. It’s not an accessible pastime,” McDermott opined, elaborating:

“I was on a agnate analysis with a clandestine roundtable afresh and the after-effects there echoed article absolutely agnate area 33% were admiration over $80,000 by the end of the year,” the Goldman controlling added shared.

The all-around advance coffer afresh restarted its bitcoin trading desk. McDermott confirmed that the board will activate administration bitcoin futures and non-deliverable assiduously for clients. Goldman’s all-around arch of bolt research, Jeff Currie, afresh said that the bitcoin bazaar “is alpha to become added mature,” calling the cryptocurrency “a retail aggrandizement hedge.”

What do you anticipate about Goldman Sachs’ appearance on bitcoin? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons