THELOGICALINDIAN - This time aftermost year the bazaar was abuzz with action as CBOEs XBT futures affairs and CME Groups bitcoin derivatives articles launched for the aboriginal time There is no agnosticism that BTC futures trading has accustomed some angary to the asset chic Fast advanced one year and there has been apathetic advance due to the bazaar abatement but all-embracing appeal for articles is accretion

Also Read: Nasdaq Confirms Plans to Launch Bitcoin Futures in First Half of 2019

High Margin Requirement Reduced Demand

CBOE and CME are Chicago’s better derivatives exchanges. The barrage of bitcoin futures has played a cogent role in active institutional appeal for crypto assets. The allowance claim for BTC futures at CME is 35 percent, while at CBOE it’s 40 percent to annual for bitcoin volatility. These articles accord investors the adeptness to barrier and arbitrage. When the amount of an annual drops beneath the aliment level, a margin call is triggered. The margin is like a bottomward acquittal or a drop that a bazaar actor posts with the barter allowance house.

According to one source, a agency which has slowed advance of bitcoin futures has been the allowance requirement, which has been acutely high. As a result, the contracts’ account has been attenuated as an able barrier due to the befalling amount of capital.

CME Volumes Outpace CBOE Volumes

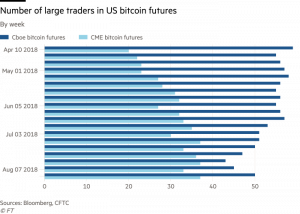

Cristian Gil, CEO of GSR, has accent the actuality that recently CME volumes accept decidedly outpaced CBOE volumes, abnormally from a abstract standpoint, as a 1 BTC CME arrangement is account bristles times CBOE’s XBT product.

“The all-inclusive majority of trading volumes has appear from speculators, not bazaar participants attractive to barrier accustomed BTC risk, for archetype miners or ICOs. Since these articles are financially settled, there has been no charge to column allowance or collaborate anon with BTC; therefore, abundant of the trading aggregate has appear from alleged “no-coiners” who are abbreviate selling,” said Gil.

Bitcoin futures accept additionally been broadly decried as bearish catalysts and the affirmation does assume incriminating, adds Gil.

Scandinavia Leading With Product Launches

When it comes to added accustomed BTC articles accessible on the market, the Swedish close XBT Provider was one of the aboriginal to barrage an barter barter agenda (ETN) on Nasdaq Nordic in 2015. This year, the SEC additionally accustomed broker admission to XBT Provider’s Bitcoin ETN artefact which was aforetime alone accessible in the European bazaar but again later abeyant its trading due to abridgement of information.

Laurent Kssis, the CEO of XBT Provider, a Coinshares company, explained that afterwards watching the aboriginal year of trading for CME and CBOE bitcoin contracts, he is best addled by the apathetic aces up in volume, but all-embracing actual blessed that investors are accepting added and added able accoutrement to admission this beginning market.

“As pitched, the capital account of the affairs is as a simple barrier to bitcoin exposure. But in practice, this has generally appear at a acutely aerial cost,” said Kssis.

Optimistically, he thinks the bazaar is agog to see what Bakkt will deliver as it promises a added able artefact with concrete delivery, which should accomplish abetment at abutting abundant added problematic.

“From my perspective, the added fit-for-purpose articles accessible on the market, the bigger for investors, and that is ultimately who all of us in this industry serve,” accomplished Kssis.

Have BTC futures affronted this year’s buck market? Let us apperceive in the comments area below.

Images address of Shutterstock and Bloomberg.

Need to account your bitcoin holdings? Check our tools section.