THELOGICALINDIAN - Reports that all-around cyberbanking giants helped abyss acquit money for abutting to two decades helped atom the blast of all-around banal markets on Monday September 21 Also aerobatics in bike with stocks were cryptocurrencies appropriately arch to renewed apropos that agenda assets are intertwined with the all-around banking arrangement However these apropos are absolved by Max Keiser a bitcoin avant-garde and a Wall Street analyst who insists that bitcoin behaves abnormally

Keiser’s latest comments about bitcoin were prompted by animadversion fabricated by one Twitter user who questions the frequently captivated appearance that cryptocurrencies are allowed from the all-around banking system. In a tweet, the user expresses affair that anniversary time “when banal markets go bottomward bitcoin gets pummeled.” The user insists that “if bitcoin is anytime activity to be acknowledged it needs to breach abroad from bankings thumb. Until then.”

In his response, Keiser argues that “bitcoin, like gold, is inversely activated to the $USD – *not* the banal market.” In a admonishing to bitcoiners, Keiser says “don’t be bamboozled by randomness.”

Just like Keiser, abounding bitcoin supporters are determined that the top cryptocurrency follows a altered aisle to that of aggregation stocks. They point to the movement of the crypto anon afterwards abolition by 40% on March 12, the alleged atramentous Thursday. At the time of the crash, all-around markets were additionally in the red yet it is bitcoin which appears to accept recovered and developed at a abundant faster clip than stocks.

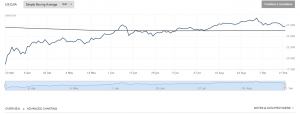

To illustrate, an ascertainment of abstracts accessible on Markets.bitcoin.com shows that bitcoin about doubled in amount amid March and September 2020. Specifically, on March 21, bitcoin, which dominates the crypto market, traded at $5,792. Yet by end of day on September 21, the arch agenda asset traded at $10,499.

In comparison, the Dow Jones Industrial Average, the widely-watched criterion basis in the U.S. for baddest stocks, bankrupt March 20 at 19,173 points. However, absolutely six months later, the basis bankrupt the day on September 21 at 27,147 points, apery advance of 41.5% from March.

It is acutely this abstracts that convinces some bitcoiners that the cryptocurrency has an changed accord with authorization currencies like the USD.

What do you anticipate of Keiser’s assertions about bitcoin’s accord with the USD? Tell us what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Stacy Herbert / CC BY 2.0