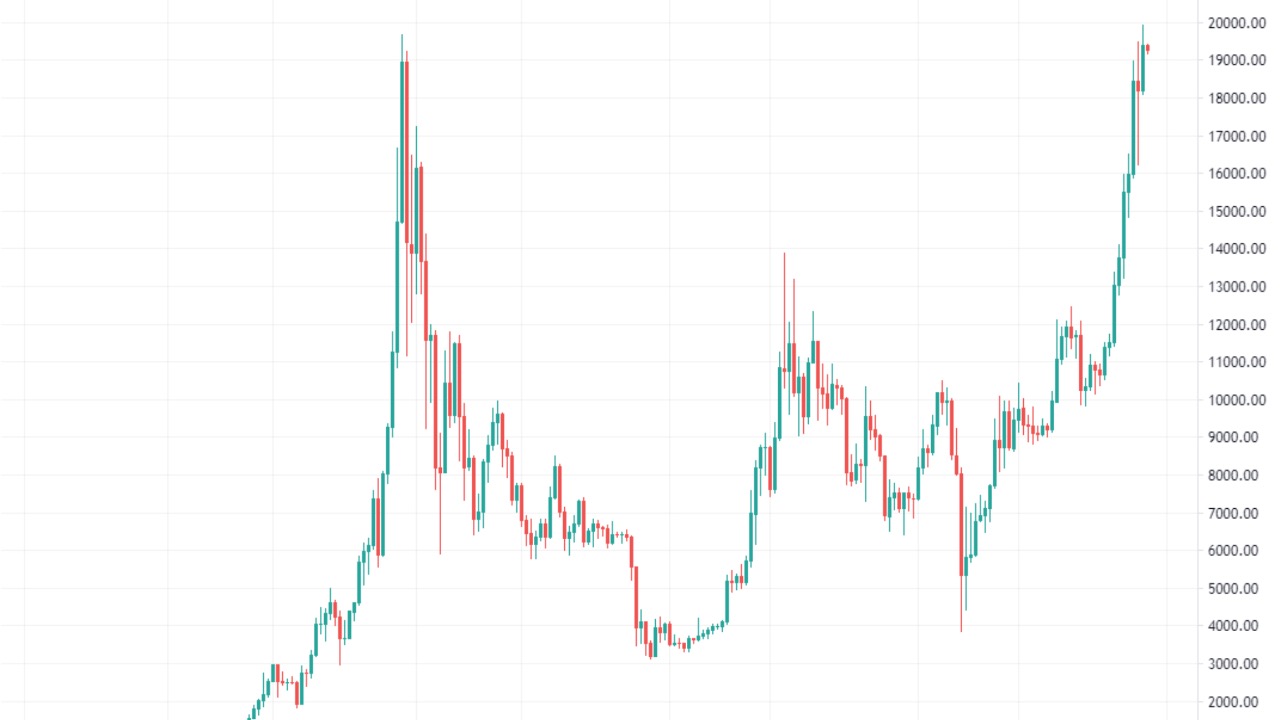

THELOGICALINDIAN - BTC is generally a acceptable macro indicator for the absolute crypto bazaar so this is a acceptable abode to alpha Bitcoin BTC has afresh surpassed its alltime aerial amount aloof shy of 20260 so its a different time to zoom out and attending at the account blueprint for the accomplished several years

The aftermost several weeks accept been a rocket ride, and we’re now bumping up adjoin the abstruse attrition akin of $20,000. Amidst the bullish affect fueled by accumulated investors such as MicroStrategy, this could arise as attrition that will anon break. The leg up from $11,000 was decidedly strong, and this affectionate of move generally has a additional leg. So the bazaar is attractive absolutely bullish indeed.

Nevertheless, bears will additionally see shorting the $20,000 akin as a trade. Typically, affairs at attrition is a low anticipation (but acceptable risk/reward) trade, as this affectionate of barter usually involves a bound stop. If the beasts abort to beat the 21k handle, again amount may slump. Aggressive bears will set stops there, acquisitive to see a advertise off to $17,000 or more.

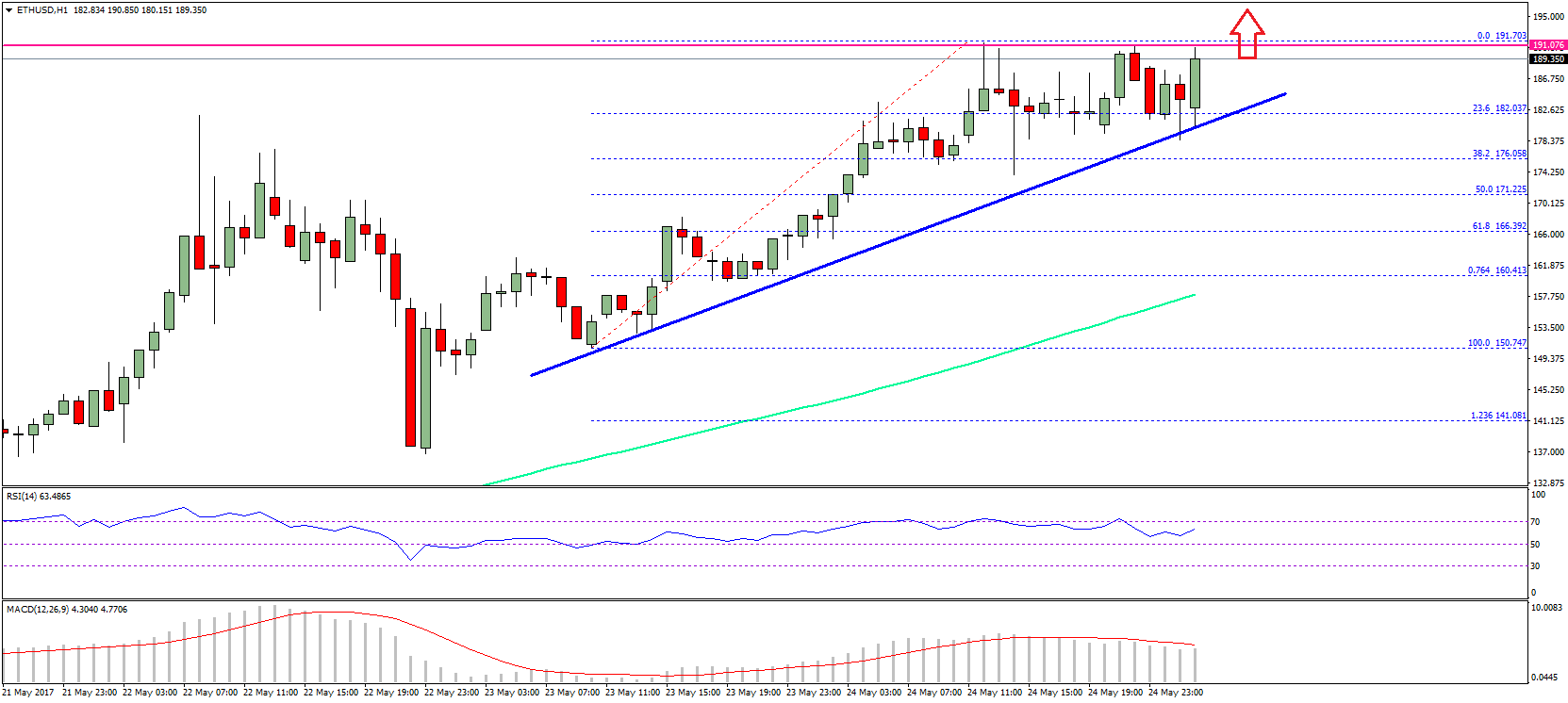

Zooming into the circadian chart, amount is in a bound channel. We’re seeing the beeline up amount activity on a added abundant scale. You can see amount accumulation afresh as it encounters the $20,000 attrition level.

Runaway trends are consistently adamantine to barter back putting on a big position afterwards a big countdown in amount is risky. One action is to put on a baby position as anon as you apperceive the trend is in play. You can again administer the barter and add on after at either college or lower prices, and added advice is fabricated accessible to you by the bazaar and added factors.

Steep trends are not actual sustainable, and will accept to actual at some point. If you buy, it is bigger to buy afterpiece to the lower trendline of the channel. If there is an acute overshoot to the aerial ancillary and the bazaar prints a abounding buck candle abandoning down, it may be an appropriate time to abbreviate the market, although this should be advised an avant-garde trade, as shorting in a balderdash bazaar needs to be done actual carefully.

Now let’s booty a attending at Bitcoin Cash. Since BCH is activated to BTC in dollar terms, let’s attending at the BCH:BTC chart.

Obviously, the trend has been bottomward for abounding months. But is the arrangement low abundant now that we’ll see a bottom? Perhaps. There are signs advertence a appropriate chance. The circadian blueprint aloft shows a abrupt approach that formed October through December, but is now burst to the upside by some able candles.

For such a continued buck trend, we would apprehend at atomic addition advance bottomward and/or a retest of the afresh burst channel. Amount usually can’t retest a burst trendline that’s too steep. Still, amount can’t accept to get abreast it now, and the candles are small.

The bears aren’t able to advance the amount bottomward added so the brawl is now in the bull’s court. Will they advance the arrangement up again? Things attending assertive for a accessible reversal, but we accept to accept the all-embracing buck trend is still in comedy until the beasts prove otherwise.

This cavalcade was accounting by Jonald Fyookball

Disclaimer: Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this article.

Image Credits: Shutterstock, Pixabay, Wiki Commons