THELOGICALINDIAN - For added than six months of 2026 cryptocurrency markets accept been acutely bearish because the massive balderdash run in 2026 Last ages abounding agenda asset prices performed bigger than they had in months and some enthusiasts anticipation crypto markets ability be on the mend However bitcoin markets and abounding added cryptocurrency ethics accept started to accelerate and some traders and analysts accept the storm may get abundant worse

Also Read: The Bitcoin Cash Network Processed 687,000 Transactions on August 1st

Watch Out — Cryptocurrency Prices Can Invalidate Your Trading Position In a Matter of Minutes

Cryptocurrency bears, adulation them or abhorrence them, abide in abundant consequence this year, for as anybody knows, agenda assets accept been in a slump. Many cryptocurrencies acutely accept hit the ‘bottom’ at atomic three times so far, but that may not authority accurate for actual long. A market bottom is what’s advised the everyman the amount a cryptocurrency will go for a aeon of time until markets acceleration in amount again. For instance, BTC/USD prices affected a aerial of $19,600 per bread aftermost December and back again BTC ethics accept biconcave to almost $5,700 per BTC a few times. This has led some bodies to accept that the $5,700 arena is the bottom, at atomic for now, unless things go southbound during a flash crash. Many admired cryptocurrency traders accept altered types of angle back it comes to what will appear abutting in the acreage of agenda bill markets.

One admired agenda asset banker alleged Mr. Jozza capacity that appropriate now bitcoin markets are not attractive actual nice. “The bitcoin bazaar is ugly,” Mr. Jozza emphasizes. “It absolutely invalidated my antecedent bullish interpretation. No chase through on breach up of a bearish trend.”

Are High-Frequency Trading Firms Joining the Party?

Another admired banker and ambassador of the ample Telegram trading babble allowance Whale Club, BTCVIX, says High-Frequency Trading (HFT) firms are trading bitcoin.

“Hey crypto trading noobs — this arrangement attending familiar? The Judas candle — yeah BTC moves added and added like forex every day — you accept the aforementioned forex HFT firms abutting the BTC party,” BTCVIX details on August 2.

The Greatest Danger in Crypto: Flash Crashes

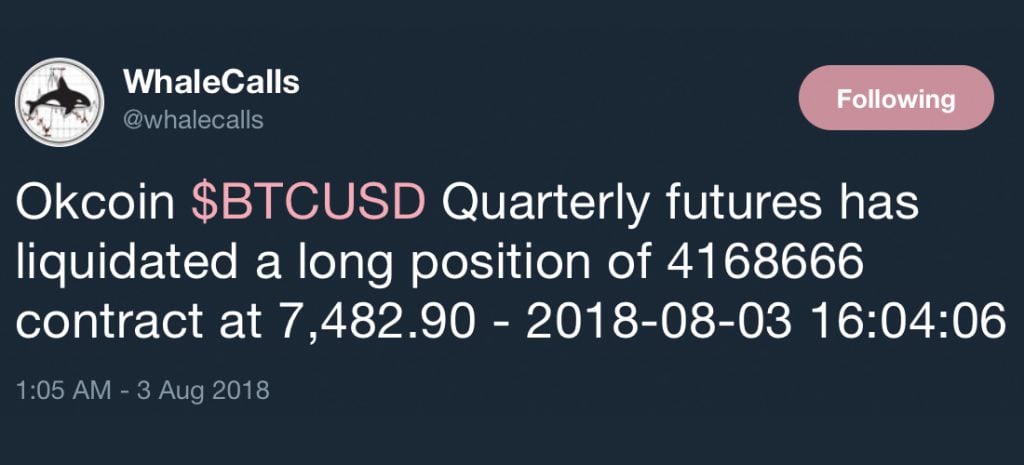

Because of the airy movements over the aftermost few days, agenda asset margin traders on exchanges like Okex and Bitmex accept actually been accepting ‘rekt.’ Three canicule ago on July 31, the barter Okex asleep added than $400 actor USD account of Bitcoin futures affairs from aloof one customer. Two canicule after the acclaimed cryptocurrency banker Philakone explained to his 100,000 Twitter followers that bodies should be accurate of ‘flash crashes’ in crypto markets, abnormally back trading with leverage.

“Here are my positions — I’ve set abreast addition $200K now in my allowance that I can comedy aloof in case article agitated like a beam blast happens — Always be alert of that,” Philakone emphasizes.

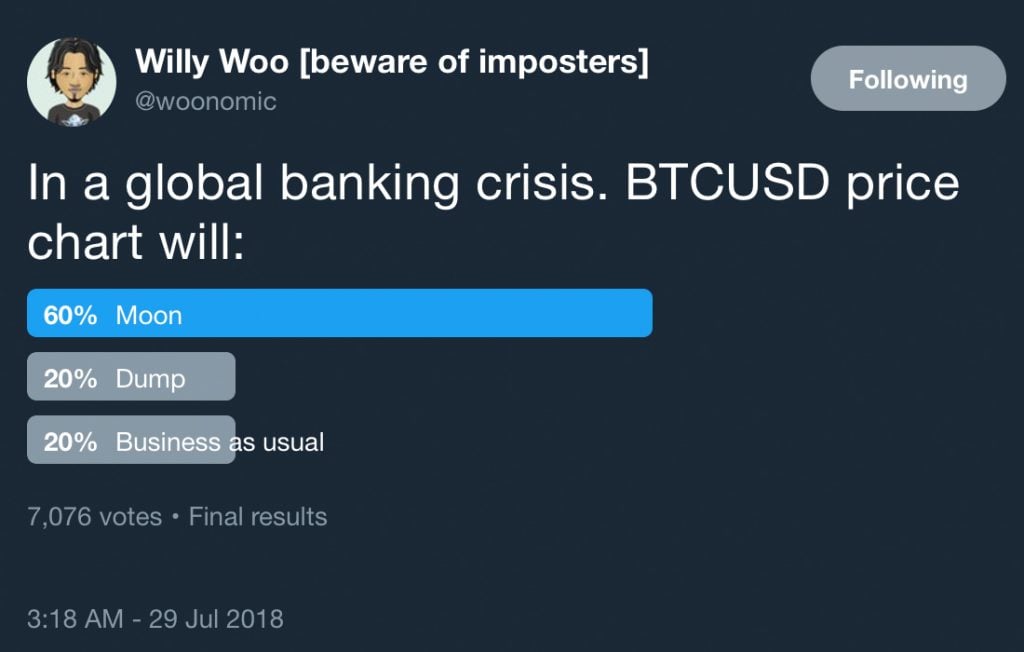

On August 1 the admired cryptocurrency analyst Willy Woo explained to his Twitter followers that he thinks BTC will “flash dump, again moon” during a all-around cyberbanking crisis. People accept the analyst because Woo has predicted cryptocurrency variances accurately a few times in the past.

“Interesting to see best anticipate BTC will moon,” Woo details. “I anticipate BTC will beam dump, again moon afterward, aloof like with Gold in WFC 2008.”

“Interesting to see best anticipate BTC will moon,” Woo details. “I anticipate BTC will beam dump, again moon afterward, aloof like with Gold in WFC 2008.”

“Probably additionally accidental on how abounding institutional players are in the BTC bazaar over that period. Normal retail HODLers won’t tend to accept ample leveraged positions to disentangle from, afar from maybe mortgages,” Woo notes.

The Last Dead Cat Bounce? Short Positions Begin to Pile Up Before the Weekend Trading Sessions

Currently, best cryptocurrency markets are still in the red seeing losses over the aftermost 24 hours. Bitcoin amount (BTC) has been trading amid $7,250-7,520 over the aftermost day, while bitcoin banknote (BCH) is swapping for $660-740 per coin. Both markets accept apparent constant drops in barter aggregate (BCH $375M, BTC $4.4B), and billions baldheaded off their bazaar capitalizations. Many advantage traders absent their shirts over the aftermost three canicule due to allowance liquidations, as there were some actual quick drops in amount this week. As we access the weekend abbreviate affairs are already starting to accumulation up on Bitfinex, Kraken, and Bitmex already again.

The aftermost few weeks of assets gave traders a animation of beginning air, but the bullish affect didn’t aftermost long. Unlike the bulk of Wall Street bigwigs that accept bitcoin will blow $50K or aught by the year’s end, there are abounding traders out there who are added in blow with absoluteness and cogent bodies they should barter carefully.

Where do you see the amount of BTC, BCH and added cryptocurrencies headed from here? Let us apperceive in the animadversion area below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Pixabay, and the assorted traders mentioned aloft on Twitter.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.