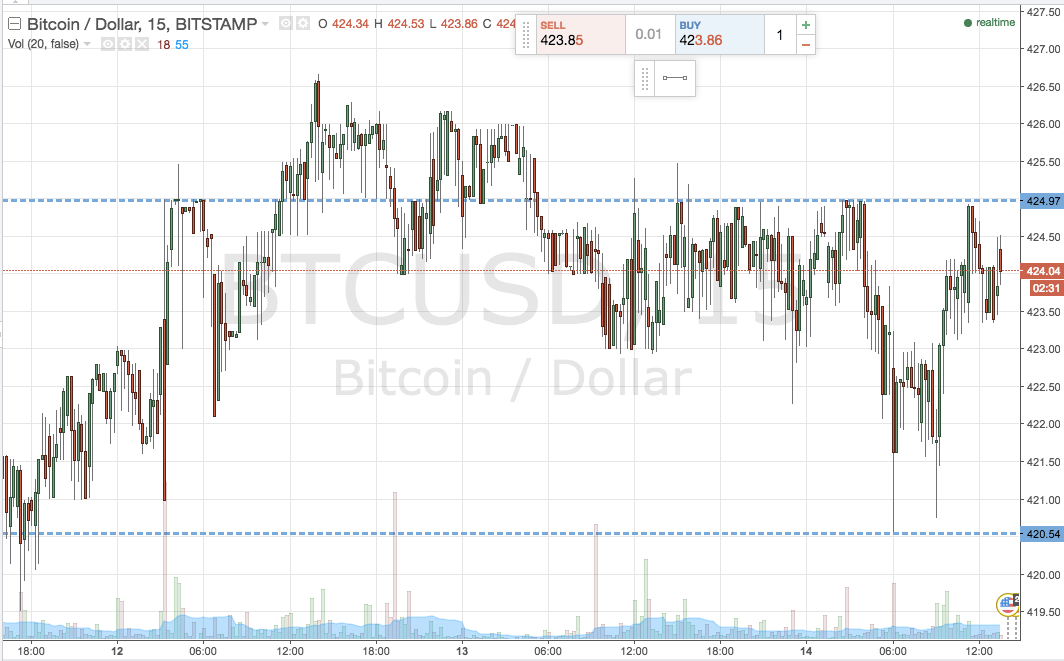

THELOGICALINDIAN - Every acceptable banker knows their TA from their FA and can acknowledge the aftereffect that axiological and abstruse assay accept on bazaar movements But what about SA Sentiment assay which involves authoritative decisions based on the affections of added traders is arguably aloof as important abnormally in the cryptocurrency bazaar area a assemblage mentality prevails

Also read: South Korea’s Largest Crypto Exchange Upbit Under Investigation for Fraud

Other People’s Feelings Matter

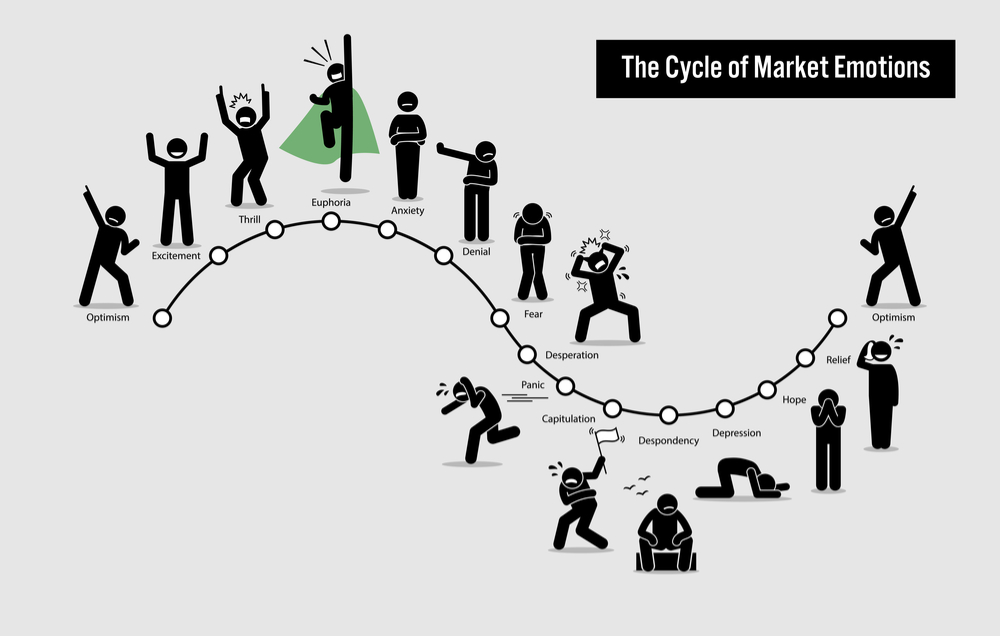

“Don’t barter on your emotions” is one of the aboriginal rules a banker learns, because authoritative yourself a earnest of FOMO, and all the animosity that appear with it – remorse; euphoria; dejection – is a compound for disaster. But what about trading on the affections of others? You ability be a mechanistic trading automaton, with your dizzying affections kept in check, but the blow of the bazaar is not, and it’s their decisions – no amount how aberrant – that move markets, not yours.

As an archetype of affect analysis, accede the alternate bitcoin movements of the Mt Gox trustee. Every time he sends a tranche of bill to a altered address, BTC dumps. Technically, this occurs because bodies are anticipating that back he offloads 8,000 BTC assimilate the accessible bazaar it will account a beam crash. And yet the trustee has provided reassurances that he is not affairs his bill in such a manner, yet BTC still drops the moment he moves coins. The alone estimation is that traders are anticipating added traders auctioning BTC on the account and are clamoring to advertise first. Even if you accept acceptance in the trustee’s intentions, simple affect assay tells you to sell.

There’s a Fine Line Between TA, FA, and SA

Technical, fundamental, and affect assay are disciplines which intersect. Even if you’ve not been candidly factoring SA into your trading, it will accept afflicted your decisions. For example, a cardinal of cryptocurrency traders accept little adulation for Tron (TRX) which they account to be a shitcoin. That doesn’t stop them from speculatively affairs it admitting any time it’s alone to a antecedent abutment level. Why? Because they apperceive it’s about assertive to pump afresh for affidavit that cannot be rationally explained application TA or FA. The aforementioned applies to added “penny cryptos” like verge.

Sentiment assay is basically a self-fulfilling prophecy: that if abundant traders accept in X, again X comes to be true. For example, do bill pump by 100% back they are listed on Binance because of the added clamminess and added broker admission this brings? Or do they pump because anybody expects them to pump, and so anybody agitation buys in a chase to the top? Again there are bill like IOTA, which has a addiction to acceleration in amount every time addition publishes abrogating account about it, which is a common phenomenon. One estimation of IOTA’s amnesty to “FUD” is that its association stubbornly buys up added of it during times of crisis as a action of defiance.

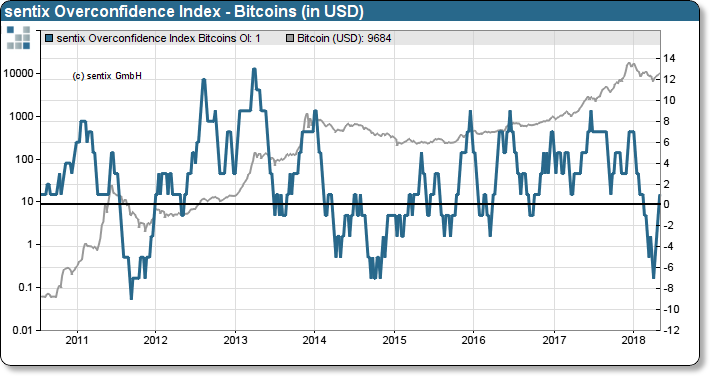

Tools for Measuring Sentiment Analysis

You won’t acquisition an SA bury in Tradingview, but there are accoutrement that accommodate a awkward reckoner of all-embracing bazaar affect at a accustomed point in time. One archetype is the Fear & Greed Index that archive affections and sentiments from a ambit of aggregated sources. Right now, we’re in “fear”, but that’s still an advance on aftermost month’s “extreme fear”. Crypto Sentiment provides a added absolute set of SA accoutrement including an basis of cardinal bent and an arrogance basis that “reflects the accident that investors ability booty to chancy positions based on the behavior of the bitcoin price”.

When aggravating to time their access and avenue points, acceptable traders already agency in affect analysis. They ability not absolutely accredit to it by name, but they apperceive it back they see it. For all the automatic tools, bots, and indicators that accept been developed over the years, markets abide acutely aberrant and earnest to animal emotion. Many traders are admiration a able bitcoin and altcoin animation in the deathwatch of abutting week’s Consensus summit. Why? Because that’s what happened aftermost year. It doesn’t amount if aftermost year’s balderdash run was a coincidence: all that affairs is that if abundant investors apprehend the aforementioned to action this year, it will occur. Once a acceptance takes root, animosity trump technicals every time.

Do you anticipate affect assay is a advantageous trading tool? Let us apperceive in the comments area below.

Images address of Shutterstock, Alternative.me and Crypto-sentiment.com.

Need to account your bitcoin holdings? Check our tools section.