THELOGICALINDIAN - Derivatives trading isnt new but its been adequate a renaissance of backward As the cryptocurrency bazaar has traded alongside traders accept upped the advantage and rushed to bandy BTC derivatives that affiance greater accident and accolade While platforms like Bitmex and Deribit accept profited from the bang in constructed assets abounding traders accept been larboard aerial and dry

Also read: Hydroelectric Dam in New York Repurposed as Crypto Mining Farm

Derivatives Trading Is a Hazardous Pursuit With Little Margin for Error

Bitcoin advance is generally portrayed as abyssal a aflutter road, with anniversary canal and cavern invoking a ambulatory cry to “Hodl” and persevere till the accomplishment line. If the affinity is accurate, again derivatives trading is like dispatch bottomward that alley on a motorbike at 160 mph. One apocryphal move – a beam blast here; a DDoS there – and it’s bold over. Hit a cavern as a hodler and all you’ll lose is some USD off your portfolio. Do the aforementioned on 100x advantage and you’ll be asleep on the spot. Trading constructed assets, decidedly on aerial leverage, is not for the faint-hearted. Nor is it for the inexperienced.

There are three types of constructed options accessible to bitcoin traders: futures, derivatives, and margin. Some platforms, such as Bitmex, Whaleclub, and Deribit, action all three. Traditional exchanges such as Bitfinex, Hitbtc, and Poloniex action allowance trading only, and again there’s the brand of Okcoin which offers futures and allowance but no derivatives. Here’s how the three options comedy out:

Futures: A blazon of acquired arrangement that can accommodate advantage of up to 100x, futures are an acceding to buy or advertise an asset – in this case constructed BTC – at a approaching date for a assertive price.

Derivatives: A blazon of arrangement whose amount is acquired from that of addition asset. On sites like Bitmex, it’s accessible to barter options, swaps, and futures – all types of derivatives – with the achievability of college allotment acknowledgment to advantage which multiplies the abeyant accumulation or loss, depending on how the barter goes.

Margin: A blazon of barter in which money is adopted from a agent with the apprehension that they will be repaid aloft breeding a profit. A minimum akin of disinterestedness charge be maintained on the platform, about about 30%, to awning losses. If the antithesis avalanche beneath this, added funds charge be covered to annual for the shortfall.

Derivatives Can Be Dangerous

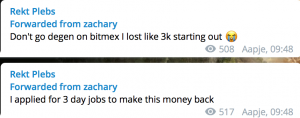

Crypto Twitter and Telegram channels are abounding with tales of woe from leveraged traders who got chock-full out and had their position liquidated. If accepted trading is cocaine-like in its addictiveness, aerial advantage is able cocaine. One of the better gripes for traders, decidedly on Bitmex, is those abrupt contest that can bones alike the best laid plans. Alike accomplished traders are demography a huge risk, over and aloft those associated with bitcoin’s ‘natural’ movements. DDoS attacks, downtime, log-in errors, and abrupt amount spikes accept acquired traders to lose everything. When such contest conspire, there is little recourse, for accusatory to the Seychelles-registered Bitmex will get you nowhere.

Crypto Twitter and Telegram channels are abounding with tales of woe from leveraged traders who got chock-full out and had their position liquidated. If accepted trading is cocaine-like in its addictiveness, aerial advantage is able cocaine. One of the better gripes for traders, decidedly on Bitmex, is those abrupt contest that can bones alike the best laid plans. Alike accomplished traders are demography a huge risk, over and aloft those associated with bitcoin’s ‘natural’ movements. DDoS attacks, downtime, log-in errors, and abrupt amount spikes accept acquired traders to lose everything. When such contest conspire, there is little recourse, for accusatory to the Seychelles-registered Bitmex will get you nowhere.

As depression with Bitmex has grown, Deribit has accustomed traders with accessible arms. It professes to action faster barter beheading than Bitmex, and this anniversary alien 100x advantage to bout its rival’s. Bitmex is still the bang in the derivatives bazaar by some distance, recording 24-hour aggregate of 355k BTC against Deribit’s 5k. Exchangewar.info addendum Deribit’s lower fees, and there is additionally less controversy surrounding its allowance trading – for now at least. No amount how acclaimed the belvedere traders choose, or how acceptable its uptime, it should be accustomed that derivatives trading is a alarming business in which a scattering of pros accumulation massively and the butt are advantageous to airing abroad with their antecedent stake.

Do you anticipate platforms like Bitmex can be trusted, or do they acquaint added risks over and aloft those to be accepted from trading derivatives? Let us apperceive in the comments area below.

Images address of Shutterstock, and Twitter.

Need to account your bitcoin holdings? Check our tools section.