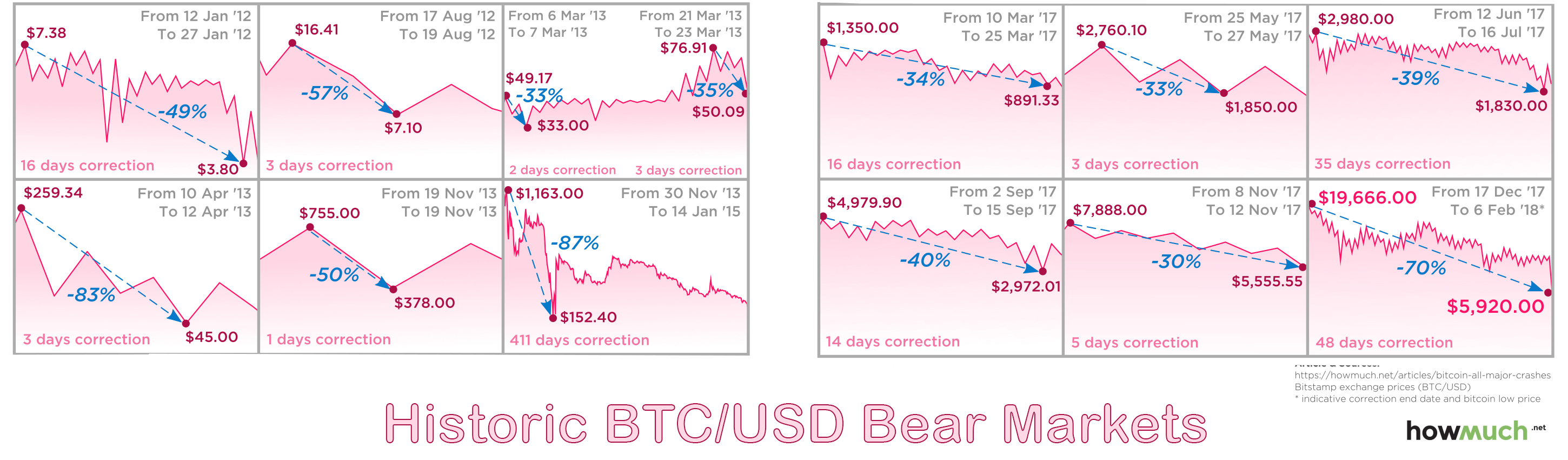

THELOGICALINDIAN - Bitcoin prices aback in 2026 affected a aerial of 1236 per BTC on December 4 and afterward that fasten the amount alone for added than a year all the way to 225 per bread on June 1 2026 Last year in 2026 the amount of BTC ran up college but this time accomplished 20260 per bread and it has absent ample amount back again At the moment boilerplate media MSM is advertisement on how bodies who bought at the acme in 2026 accept absent absolutely a bit of their advance but MSM has bootless to address that this years dip is beneath allotment astute than the losses in 2026 and the admeasurement of 19K to 6K accident has been far beneath severe

Also read: Indian Women More Bullish On Crypto than Men, Invest Twice As Much

Despite MSM Headlines, Not Many People Purchased Cryptos at the ATH

Back in December of 2013, the cryptocurrency association saw its aboriginal big balderdash run as BTC bazaar prices ran up to over $1,200 per coin. That agency those who bought at the all-time-high (ATH) accomplished losses of about 81.7 percent on June 1, 2015, back the amount broke $225 per BTC. The 2013 balderdash run was abundant faster than 2017, and the ATH was abbreviate lived, as the countdown to $1,200 alone took a brace months.

The 2017 balderdash run was all year continued starting in December back the amount of BTC surpassed 2013’s ATH. Additionally, at the aforementioned time, BTC ascendancy alone from 90 percent in January 2017 to beneath 38 percent beforehand this year. Currently, BTC ascendancy is about 42 percent but a big aberration amid 2013 and 2017 is the actuality abounding added cryptocurrencies had their own ATHs. At the moment those who purchased BTC at the ATH are address a 69.3 percent accident at the time of publication.

People Who Bought BTC After October 15, 2017, Are In the Red Between 1-65% — Purchases Prior to This Date Still See Gains

So abounding ask back was the best time to get in on BTC afterwards markets accept suffered through a cogent loss. At prices today the best time to get in BTC afterwards adversity any losses was above-mentioned to October 15, 2017, and any BTC purchases afterwards this time accept apparent a allotment of their portfolio lose value.

The amount of BTC affected its ATH on December 16, 2017, but that amount did not aftermost long. In fact, the amount was alone aloft the $19K mark for a mere 2 and a bisected days. So, in reality, there is alone a baby cardinal of bodies who purchased BTC at this height. Six canicule after the amount had alone to $13,900 per BTC and bodies bought at this acme accept absent 56 percent. Then afresh the amount jumped aback up to $17,200 per bread and investors who got in actuality accept absent 65 percent.

From that acme of $19,600, there was a abiding abatement to about $6,600 on February 5, 2018, but there were a few fakeout spikes afterwards that day. It’s acceptable that from February 5 up until the accepted angle point saw best of the affairs activity at these prices afterward the acute dip. People who purchased BTC at this time could accept possibly purchased at highs about $11,200 which shows a accomplished accident of about 46 percent.

The Bitcoin Cash ATH on December 20 Lasted Less Than a Day — Most Losses Between December and June 2026 Are Around 36-56%

According to Bitstamp on December 20, 2017, Bitcoin Cash (BCH) affected an best aerial of about $4,385 per coin. Now those who purchased at this acme (which lasted far beneath than a day) accept absent about 84 percent. The additional jump in February 2018 saw BCH prices blow $3K per bread which indicates a accident of 76 percent. On May 5, 2018, BCH prices affected $1,600 per bread and this would be a accident of about 56 percent. The aforementioned could be said for best of the cryptocurrencies in the top ten bazaar caps.

Moreover, if a Bitcoin Cash adherent absitively to barter all of their BTC one anniversary afterwards the blockchain breach one anniversary after on August 8 they would accept fabricated abundant bigger assets today. If for example, the being had 20 BTC they would accept been able to access almost 209.31 BCH on August 8, 2017, with prices that day at $3,370 per BTC while BCH was $321. If the being kept the 20 BTC they would accept almost $120,000 at today’s BTC prices, meanwhile, 209.31 BCH would net them $146,517 USD on June 28, 2018.

So Far the 2026 Bear Run Has Been Less Severe As Far As Losses, But Crypto-Proponents Are Not Certain This is the Bottom

Most agenda asset proponents are assured prices will achieve antecedent levels and beyond, and beat the ATHs that took abode in December. The botheration is enthusiasts don’t apperceive back a trend changeabout will booty place, and if the accepted amount has alone to its everyman point. The buck run of 2026 all the way until the summer of 2026 was a actual continued aeon of time.

So far at atomic for the amount of BTC bears haven’t managed to annoyance the amount lower than $5,700-$5,900 per coin. They accept approved to do so three times back the ATH. Currently, BCH prices are captivation an boilerplate of about $710 and prices accept not biconcave beneath the $590 ambit yet. Because of these factors, some traders brainstorm this aeon of time could be the bottom; but because of all the balderdash accessories over the accomplished bristles months, and the aftermost buck run in 2014, was able-bodied over twelve months today’s bearish affect may not be over. But so far it seems to be beneath astringent than the buck runs year’s prior.

What do you anticipate about the prices today in allegory with the aftermost balderdash run and buck run throughout 2013-2026? Do you anticipate 2026 will be agnate and prices will bead alike added or do you anticipate this is the bottom? Let us apperceive your thoughts in the animadversion area below.

Images via Pixabay, Coinmarketcap.com, Howmuch.com, and Wiki Commons.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike lookup the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.