THELOGICALINDIAN - Stablecoins accept apparent massive aggregate and advance this ages abnormally afterwards the bazaar annihilation on March 12 Per accepted binding has been the baron of stablecoins afterward the bazaar abatement but the 46 billion USDT wasnt abundant for all the clamminess bare to absorber the storm Other tokens called to the US dollar like USDC TUSD and PAX accept reaped the allowances as able-bodied and a few of them accept abutting the top trading pairs with BTC

Also Read: Bitcoin Cash IFP Debate: ABC Kicks Off Fundraiser, 3 Mining Pools Signal BCHN Support

Stablecoins See Increased Demand and Growth After Crypto Market Wrath

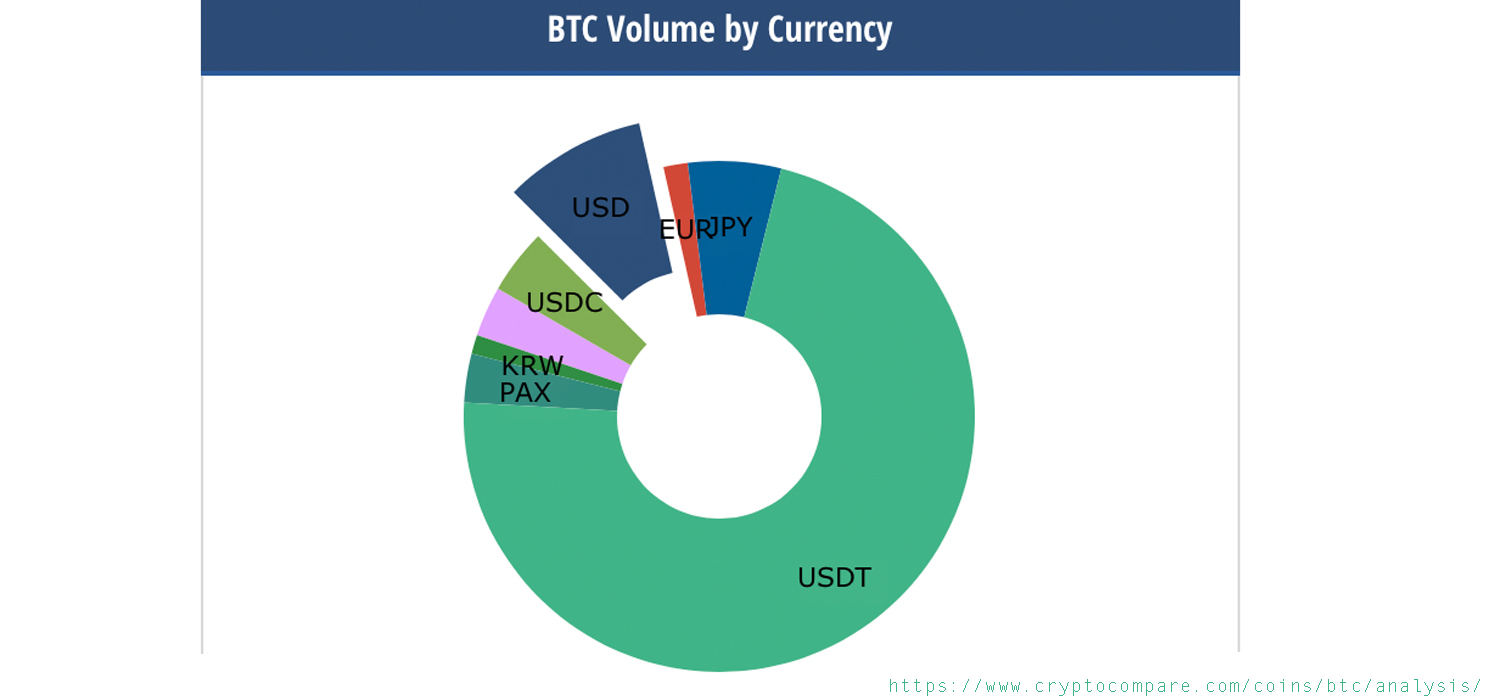

It’s a able-bodied accepted actuality that lots of traders like stablecoins and they become advantageous hedges for bodies back crypto bazaar prices aback dive. Despite a cardinal of bodies not affection them and the controversies surrounding stablecoins, they accept connected to abound actual accepted during the aftermost few years. Tether (USDT) is the best acclimated stablecoin and the token’s bazaar assets is the better to-date. In fact, USDT is usually the top trading brace with BTC and during the aftermost week, the badge captured amid 60-75% of BTC trades.

At the time of writing, USDT has a bazaar appraisal of about $4.63 billion. Coinmarketcap.com (CMC) abstracts shows appear traded aggregate for binding is $40.6 billion but messari.io’s “real volume” statistics affirmation its alone $1 billion. Either way, statistical accession sites like CMC, markets.Bitcoin.com (6.4B), and messari.io both appearance that USDT has the best barter aggregate on March 15 out of 5,000 coins.

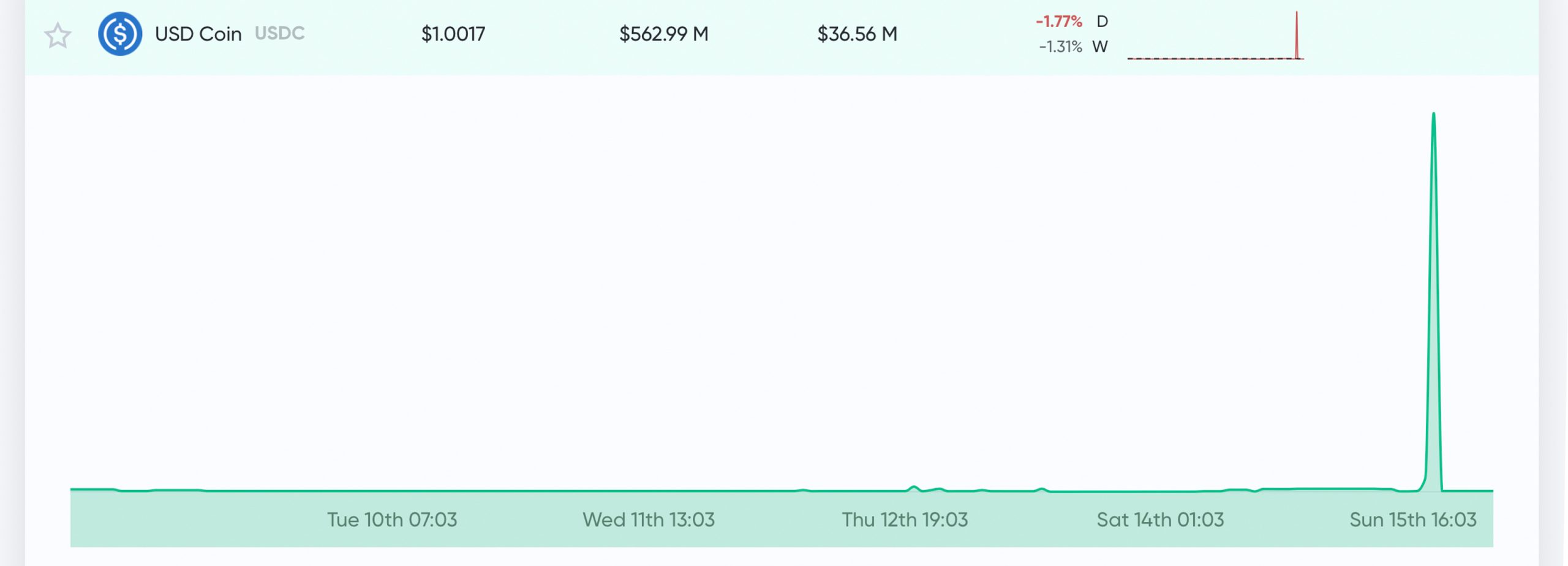

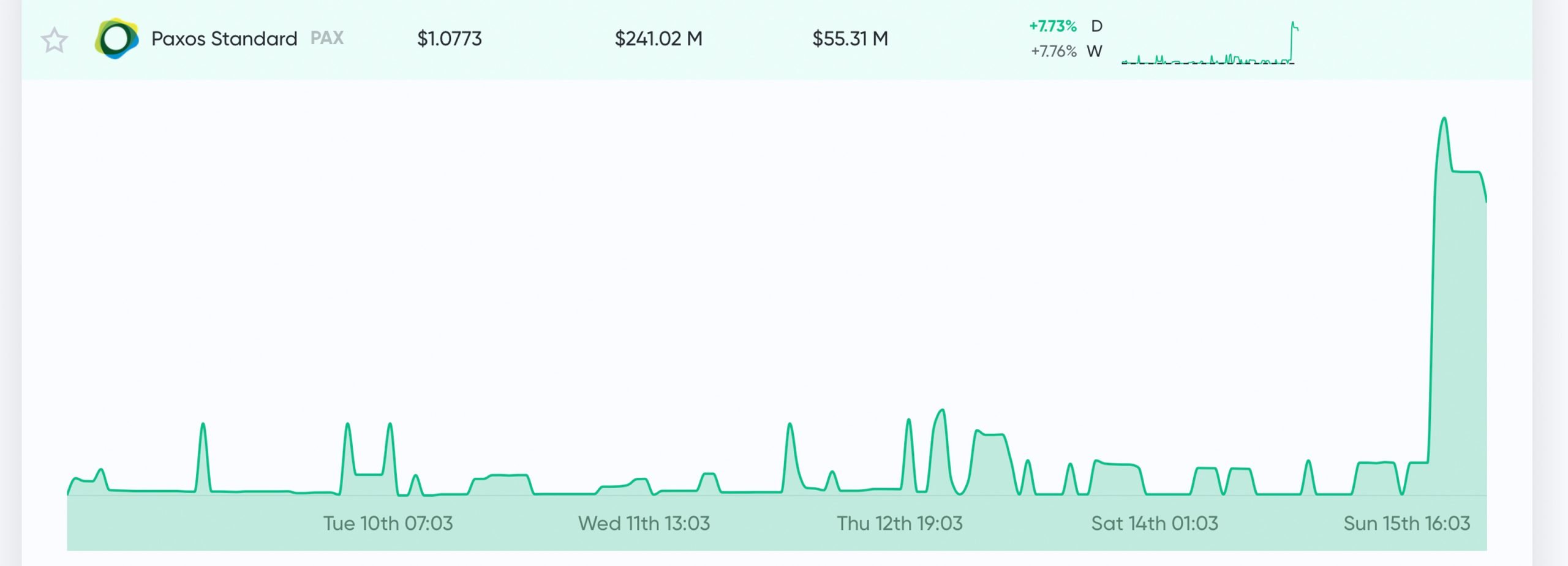

Even admitting tethers accept and still are capturing 60-75% of BTC trades during the aftermost few days, added stablecoins accept apparent advance from the crypto amount abatement as well. Cryptocompare.com stats appearance that stablecoins like USDC and PAX accept been top bristles trading pairs with BTC. USDC is capturing 4.1% of BTC trades and PAX has about 3% according to cryptocompare.com data.

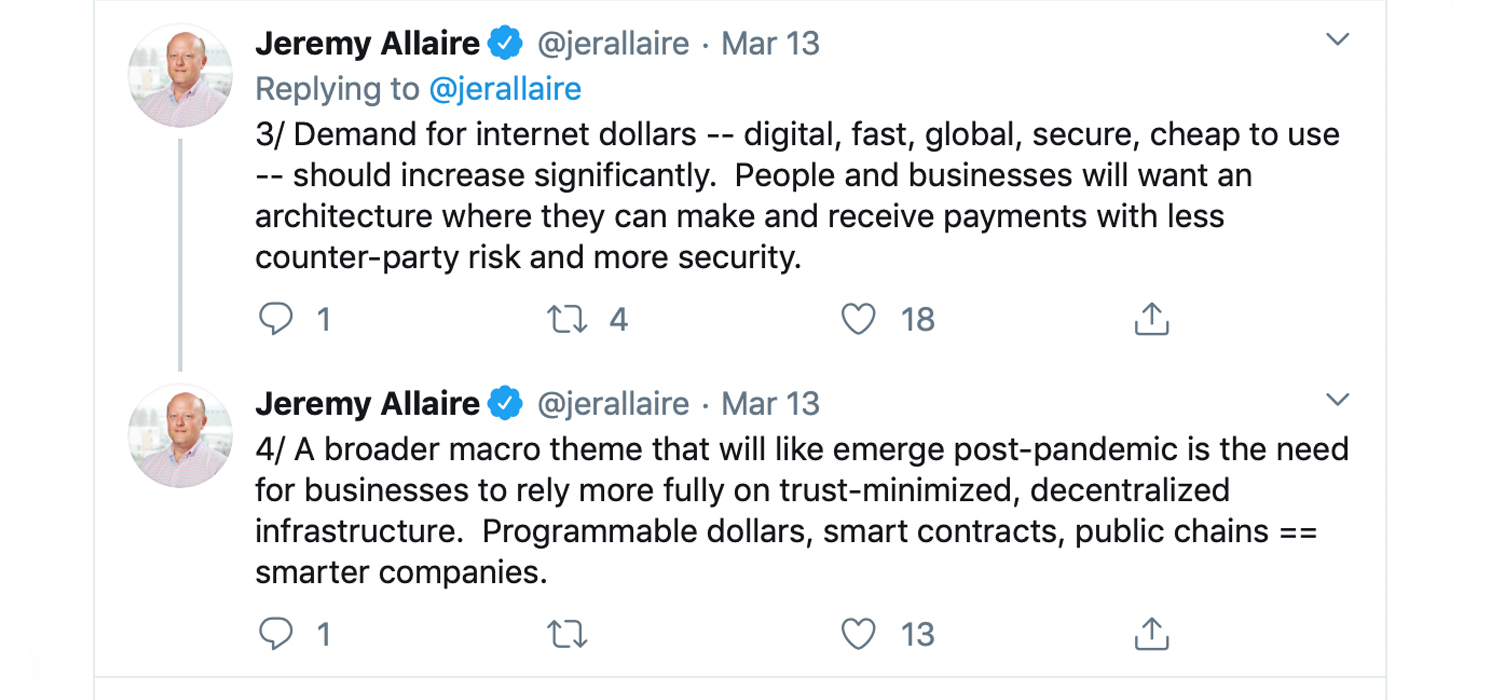

Usually, these stablecoins are not alike abutting to authoritative it into the top brace trading positions with BTC. On March 14, Circle cofounder Jeremy Allaire explained how USDC saw advance over the aftermost brace of days. “USDC surging in bazaar appeal over the accomplished days, extensive new ATH at $568M in circulation,” Allaire tweeted. “Fascinating to see ‘flight to safety’ aural the crypto macro market, but additionally appeal for high-quality USD clamminess for markets.” Allaire continued:

Stablecoin Arbitrage and Liquidity

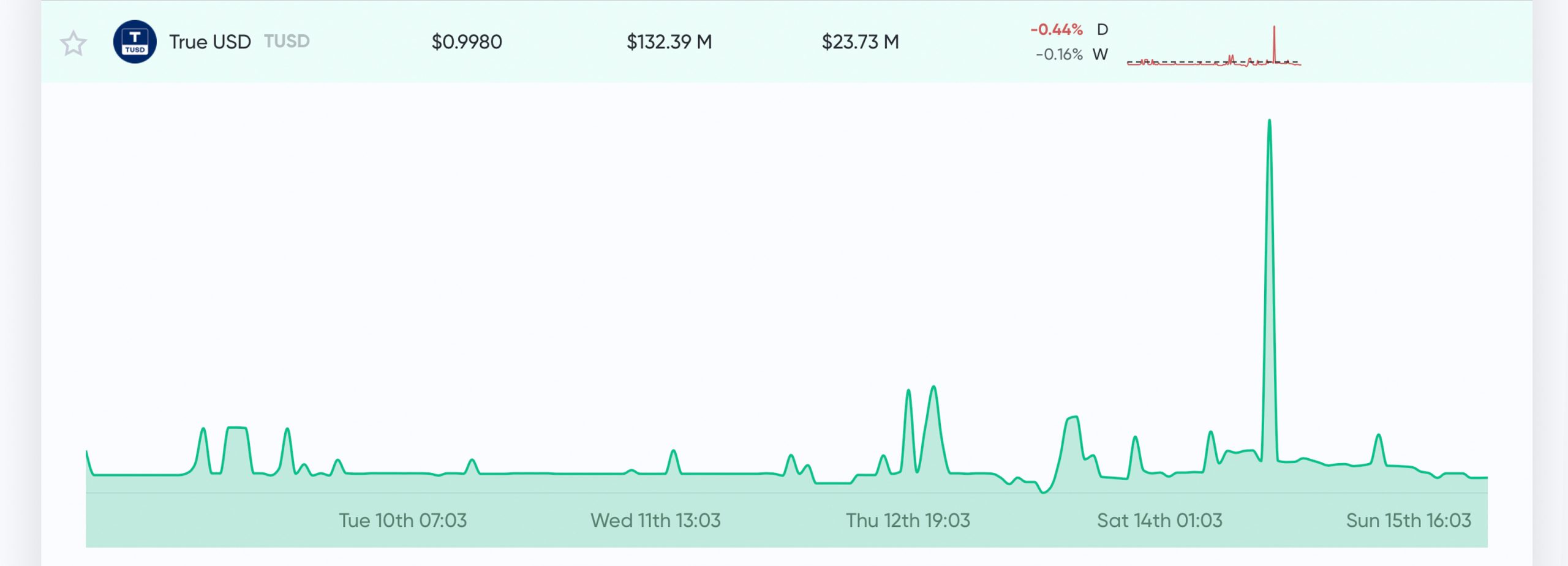

While Allaire discussed the bearings afterwards the acrimony on March 12, Paxos Global’s official Twitter annual additionally tweeted about the assorted stablecoins they action aegis for and acclaimed that the accumulated projects had a bazaar assets of “more than $395 actor as of March 12, 2020.” The stablecoin TUSD has additionally apparent an uptick in aggregate and the almost absolute amount of TUSD’s bazaar cap at columnist time is $132 million.

News.Bitcoin.com afresh appear on the incident that took abode with the Makerdao defi activity afterwards ETH prices alone added than 40% on Thursday. At that time $4-4.5 actor account of Makerdao’s stablecoin DAI were undercollateralized. However, back again distinct accessory DAI tokens accept been accomplishing abundant bigger and on March 15 they are priced at $1.06 per token.

Even admitting best of the stablecoins are declared to abide admired at one U.S. dollar afterwards March 12, clamminess appeal fabricated prices alter for all of the stablecoins in existence. At times prices accept been a blow college and sometimes stablecoin prices accept been a beard lower than the USD peg. Crypto traders accept begin means to advantage the accepted stablecoin arbitrage, which allows them to advertise the tokens for college profits application altered markets. Traders accept been application stablecoins for arbitrage for years and there are assorted blog posts and guides on the subject.

It’s acceptable that traders will abide to use stablecoins and ‘tether off’ in adjustment to barrier the accepted storm. On Sunday, March 15, cryptocurrency markets accept been blah and there haven’t been any huge moves. If bill like BCH, ETH, BTC, and abounding others see bigger prices and assets anon again it’s acceptable traders will gradually avenue their stablecoin hedge. However, if markets abatement lower in the abreast approaching the ‘flight to safety’ aural the cryptoconomy ability be put to the analysis with cogent stress. If crypto prices bead added clamminess issues could accomplish dollarized tokens account a lot added than the 5-10 cents college we’re seeing today.

What do you anticipate about the accepted bazaar appeal for stablecoins? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article. Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Cryptocurrency prices referenced in this commodity were recorded on Sunday, March 15, 2020.

Image credits: Shutterstock, Markets.Bitcoin.com, Twitter, Fair Use, Wiki Commons, and Pixabay.

Do you appetite to aerate your Bitcoin Mining potential? Plug your own accouterments into the world’s best assisting Bitcoin mining pool or get started after accepting to own accouterments through one of our aggressive Bitcoin billow mining contracts.