THELOGICALINDIAN - Binance continues to aggrandize its access inthe European markets Nevertheless BNB may abort to acceleration in the shortterm based on contempo amount performance

Binance is rolling out its debit agenda in the EU and the UK as allotment of its three-year anniversary. Though ceremony alarum puts Binance in the spotlight, BNB looks accessible to bead based on trading metrics.

Binance Turns Three Years Old

Today marks three years back Binance launched its exchange. The belvedere started as a crypto-to-crypto trading platform, but bound broadcast as it acquired popularity. Five months afterwards activity live, Binance became the world’s better cryptocurrency by trading volume.

Binance now offers a advanced ambit of banking articles meant to accommodated the needs of all sorts of crypto investors. From its crypto derivatives futures exchange to its peer-to-peer trading platform, the close has its easily in every part of the industry.

Now, Binance announced the official barrage of its Binance Card in Europe and the United Kingdom to bless its anniversary. The crypto debit agenda will accredit users to catechumen and absorb Bitcoin, Binance Coin, Swipe, and Binance USD to authorization at added than 60 actor merchants beyond 200 regions and territories worldwide.

“By accouterment a actual way to transact, convert, and absorb crypto for accustomed use, we are furthering our mission of authoritative crypto added attainable to the masses. Giving users the adeptness to catechumen and absorb their crypto anon with merchants about the world, will accomplish the crypto acquaintance added seamless and applicable,” said Changpeng Zhao, CEO at Binance.

These developments authenticate that Binance is at the beginning of the industry. As such, it is reasonable to accept that the amount of the exchange’s built-in token, BNB, is accessible to soar—but trading metrics say otherwise.

BNB Poised to Correct

Despite BNB’s absorbing accretion afterwards the March bazaar meltdown, the barter badge entered a stagnation appearance alpha in backward April. Since then, BNB has predominantly traded amid $15-support and $18-resistance.

BNB was afresh able to abutting aloft the $18 aerial attrition level. Many traders put their money on BNB cerebration the move signaled that the bread was accessible to breakout. Instead, the cryptocurrency was alone from the $18 level, blame its amount aback into the $15-18 alliance zone.

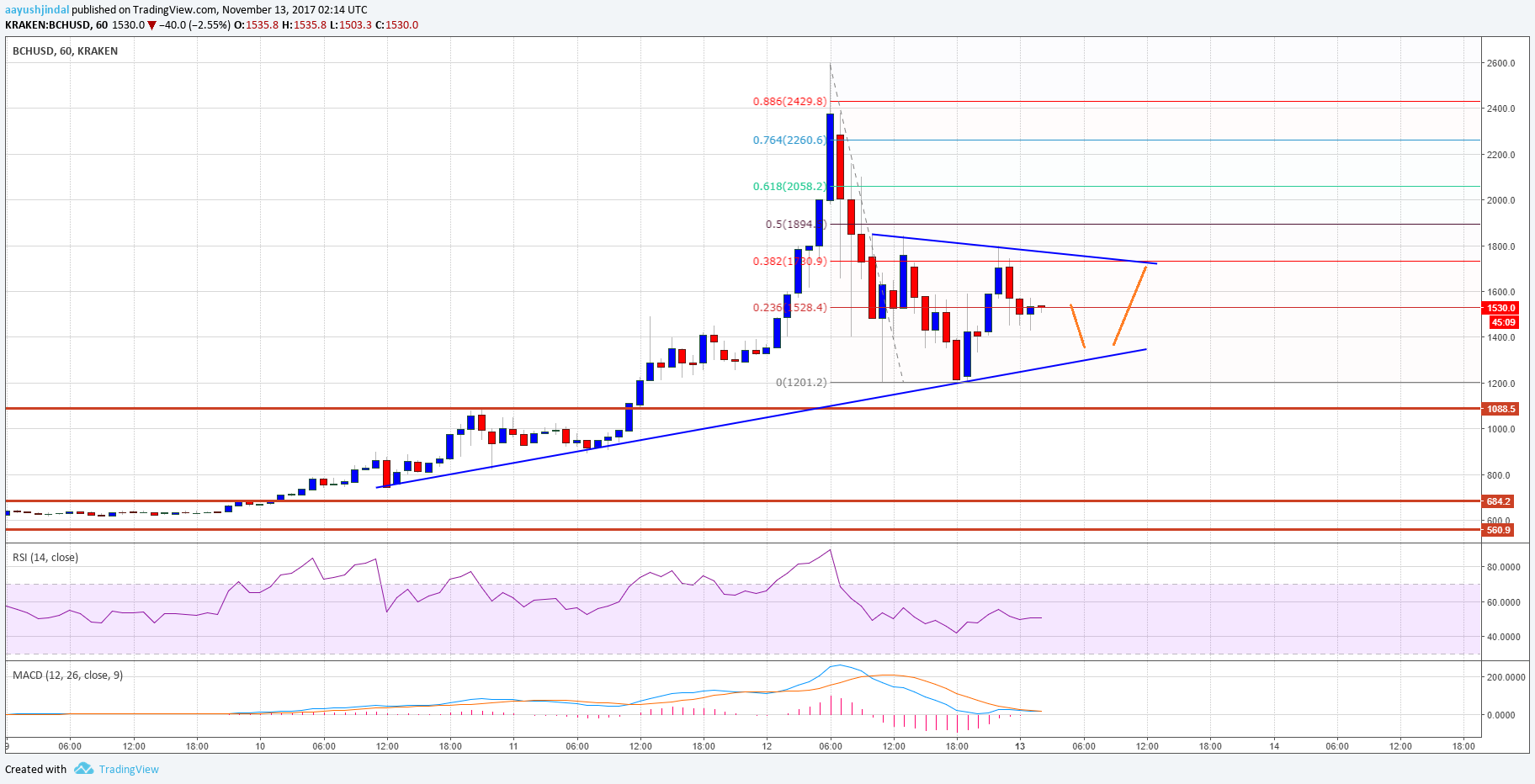

Now, the TD consecutive indicator is currently presenting a advertise arresting on the 1-day chart, ciphering added losses to come; the bearish accumulation developed in the anatomy of a blooming nine candlestick. If validated, Binance Coin could amend for one to four circadian candlesticks or activate a new bottomward countdown.

Given the amount history of the accomplished three months, a fasten in the affairs burden abaft BNB could accelerate it aback to the $15 abutment level.

Based on the Fibonacci retracement indicator, however, Binance Coin could be captivated by the $16.8 abutment akin in the accident of a correction. Only a circadian candlestick abutting beneath this acute accumulation barrier will see BNB attempt appear $15.

It is account advertence that a blooming two candlestick trading aloft a above-mentioned blooming one candle may accept the adeptness to invalidate the bearish outlook. Under such circumstances, investors charge watch out for a breach of the 38.2% Fibonacci retracement akin back it could advance to an advance appear $22 or higher.