THELOGICALINDIAN - n-a

There are two things that every new crypto broker learns. First: pay absorption to bazaar cap. Sure, Ripple may be alone account fifty cents—but with a $20 billion bazaar cap, there’s not that abundant allowance to grow.

The additional big lesson, which abounding traders accept not absolutely learned, is not to go by Market Cap. It’s a simplistic and easily-manipulated admeasurement of value. “Mint a abundance tokens and advertise one for a penny,” makes you a billionaire on paper, but it won’t pay your bills.

Add that to the actuality that best cryptocurrencies are actual agilely traded, and that the exchange is abounding of ablution trades and instamines. No admiration we end up with Syscoins account 96 BTC and Ripple “worth” hardly beneath than SpaceX.

Stocks or Money

Here’s the analogue of bazaar capitalization, address of Investopedia:

Market assets refers to the absolute dollar bazaar amount of a company’s outstanding shares. Commonly referred to as “market cap,” it is affected by adding a company’s shares outstanding by the accepted bazaar amount of one share. The advance association uses this amount to actuate a company’s size, as against to application sales or absolute asset figures.

This is one of the peculiarities of crypto-investing: best traders amusement cryptos as stocks, rather than money.

The affinity to aggregation shares works—at best—with ICO tokens. Currencies accretion amount from actuality traded and spent. But it’s a analogously aerial admeasurement for a currency. When’s the aftermost time you heard addition allocution about the Market Capitalization of the Yen?

Several studies accept appropriate that Market Cap statistics may be manipulated, inflated, or aloof mismeasured. Last March, a abstraction of barter adjustment books by Sylvain Ribes begin about $3 billion of bogus trading volume; OkEx was the affliction blackmailer “with up to 93% of its aggregate actuality nonexistent.”

The abstraction was offered acclamation by Binance’s Zhao Changpeng as “a acceptable all-embracing analysis,” apparently afore the circadian 1000 ETH giveaway.

It’s not consistently wrongdoing. Last year Ripple “lost” $20BN in bazaar cap, in a blast that angry out to be CMC alteration its algorithm.

Make Crypto Currency Again

There accept been some efforts to align the figures. Luckily there are alternatives to CMC. Sites, like Cryptocompare, Coincap.io and Coingecko use altered metrics, as able-bodied as bazaar cap, to amount the bloom and backbone of cryptocurrencies. One banker created a calligraphy blue-blooded “Honest CoinMarketcap,” attempting to abatement the furnishings of crypto-crypto trades. Although the barter listings are not kept up to date, the calligraphy is still running.

Another access ability be to alpha alleviative cryptos as currencies rather than stocks, absorption on p2p transactions rather than speculation. If you appetite to admeasurement real-world spending, it ability be best to avoid the poker chips.

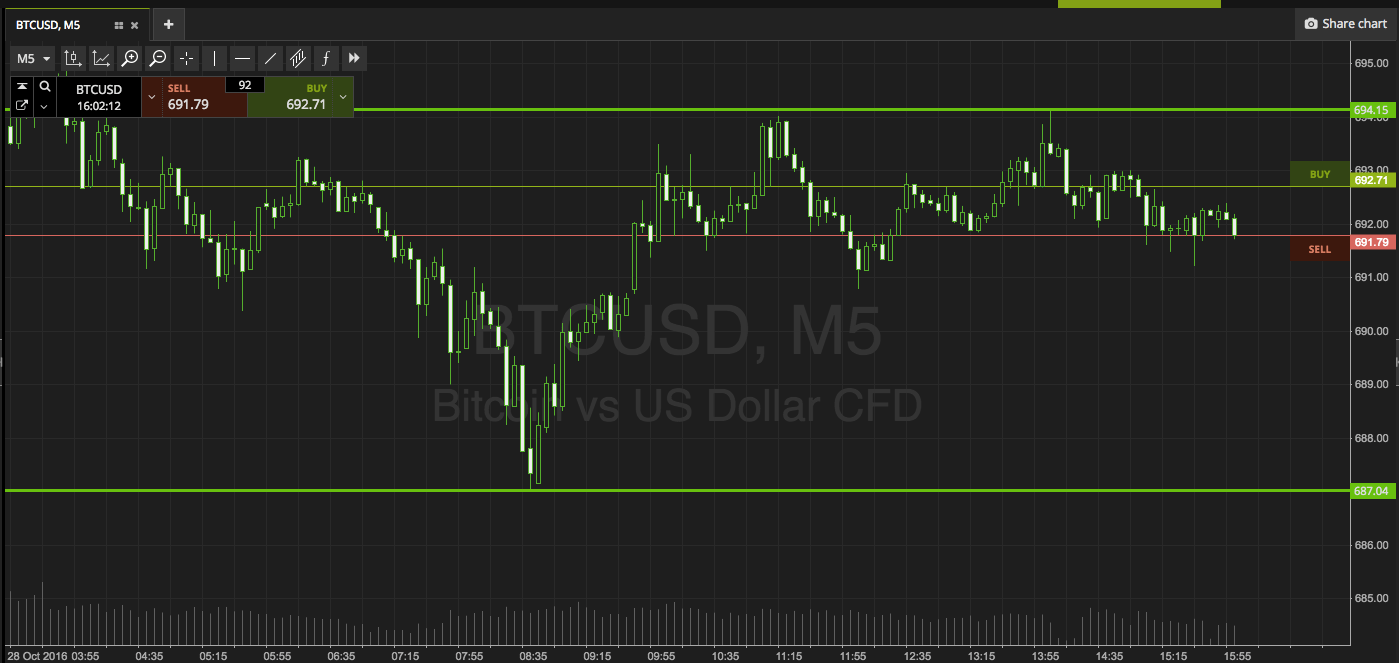

At the time of writing, CoinMarketCap letters that Bitcoin had a 24hr aggregate of $4.7 bn, a sum accustomed at by abacus up action on above exchanges. In the aforementioned time period, users sent $6.2 bn of affairs on the Bitcoin blockchain, excluding mining rewards.

There apparently aren’t abounding real-world currencies for which belief accounts for 43% of bread-and-butter activity, but compared to added cryptos, Bitcoin looks appealing good: alert as abundant Ethereum was spent in exchanges as was absolutely exchanged on the blockchain, and for Ethereum Classic it was fifteen times as much.

This isn’t an active method—it doesn’t accommodate off-chain trades like Lightning or Coinbase, and it does accommodate on-chain DEXes and arbitraging amid exchanges.

But it’s additionally harder to wash trade the blockchain, and provides a back-of-the-excel-sheet way of artful how abundant use these currencies get. Until some able statistician devises a bigger metric—or calculates the absolute GDP of the cryptocurrency economy— it seems astute to accumulate clue of how money is spent, as able-bodied as bet.

The columnist is invested in Bitcoin, Ethereum, and added currencies mentioned in this article.