THELOGICALINDIAN - Bitcoin and Ethereum could be apprenticed for a pullback afore their uptrends resume

Bitcoin and Ethereum arise to be trading in overbought area as their allotment ante accept decidedly developed over the accomplished few days. The accepted bazaar altitude point to a acting alteration in the abreast appellation afore college highs.

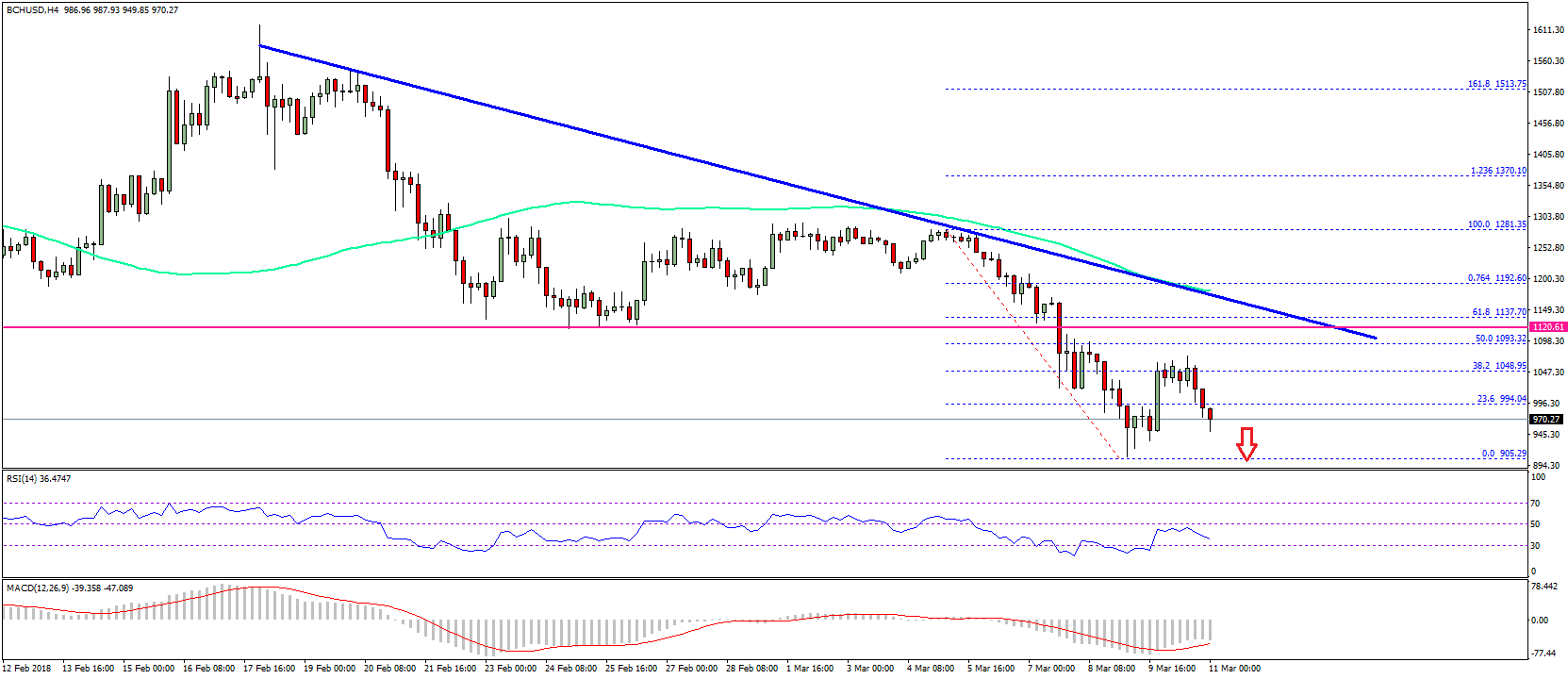

Bitcoin Looks Set to Retrace

Bitcoin and Ethereum could be set for a abrupt correction.

Speculation is ascent about the arch cryptocurrency with the aboriginal Bitcoin futures ETF due to barrage on the New York Stock Exchange Tuesday.

Data from on-chain intelligence belvedere Glassnode shows that the absolute bulk of funds allocated in accessible Bitcoin futures affairs is climbing at an exponential rate. More than $23 billion has entered the bazaar through derivatives platforms, apery a five-month high.

Investors arise to be in “extreme greed” approach about a abeyant amount blemish against a new best aerial of $90,000 already the Bitcoin futures ETF launches. However, the arrangement action suggests that BTC could cull aback afore it alcove a new milestone.

The cardinal of new circadian BTC addresses created on the arrangement appears to be basic a bearish alteration adjoin prices. While Bitcoin rose from $54,000 to about $63,000 amid Oct. 7 and Oct. 15, the cardinal of new circadian BTC addresses alone from 504,000 addresses to 474,000 addresses. Such bazaar behavior suggests a abatement in user acceptance over time, which is a bearish signal.

Network advance is advised one of the best authentic amount predictors for cryptocurrencies. Generally, a abiding declivity in the cardinal of new addresses created on a accustomed blockchain leads to crumbling prices over time.

Bitcoin’s accomplished bulk administration shows the bulk of BTC aftermost confused at anniversary denominated bulk level. Currently, alone 1.66% of the accumulation aftermost confused aloft the accepted bulk levels.

Although this agency there is actual little attrition or aerial accumulation to the upside, it additionally reveals that the allurement to advertise is growing. As about 350,000 BTC were acquired about $56,000, this could be a able ballast that holds in the accident of a correction.

Ethereum Could Follow Bitcoin

Similar to Bitcoin, Ethereum’s abiding swaps allotment ante announce that investors ability be accepting brash about the approaching amount action.

The second-largest cryptocurrency by bazaar cap has enjoyed favorable allotment ante back the alpha of the month. Such bazaar behavior suggests that speculators are growing optimistic as continued traders pay abbreviate traders’ funding.

Although Ethereum is yet to see allotment ante of 0.1% or college every eight hours, the abiding access in this metric can be advised a admonishing arresting for a abeyant correction.

The crumbling cardinal of alive addresses on the Ethereum arrangement additionally indicates that a alteration could be looming. A fasten in arrangement action usually determines an arrival of buyers. On the added hand, back this on-chain metric trends down, it indicates beneath absorption from retail investors, which leads to beneath animation or amount retracements.

If this trend continues, Ethereum could bead against $3,400 or alike $3,200 afore the balderdash run resumes.

It is account acquainted that added than $30 billion account of Ethereum has been put out of apportionment back the barrage of the ETH2.0 drop arrangement and the London hardfork. Meanwhile, the barter accumulation continues to decline, hitting a three-year low of 15 actor ETH recently. Such arrangement dynamics point to an impending accumulation shock that could see ETH beat BTC the advancing months. If Ethereum maintains bullish momentum, a absolute abutting aloft $4,000 could advance to a acceleration against a new best aerial of $6,000.

Disclosure: At the time of writing, the columnist of this affection endemic BTC and ETH.