THELOGICALINDIAN - n-a

The Wizard of Oz is a admired archetypal cine over the blithe season. In an iconic scene, the titular appearance is initially presented as a “great and powerful” blooming head, with a booming voice, amidst by bonfire and red smoke.

But when Toto tugs at the curtain, the ‘Wizard’ is appear to be a bungling old man who isn’t abundant or powerful, or alike decidedly acceptable at magic. Dorothy placed her achievement in a being whose ability adequate on a well-maintained illusion. Her adventure for a acknowledgment to Kansas doesn’t await on alien armament – it’s aloof a catechism of borer her shoes.

Like Dorothy, markets can abatement for illusions too. One of the best constant and blurred is the over-the-counter (OTC) bazaar for cryptocurrencies, and in accurate Bitcoin (BTC).

An OTC barter is a transaction that takes abode abreast off-exchanges. It comprises a client and agent and – sometimes – a agent to arbitrate amid the two parties. The capital advantage of the OTC bazaar is that it’s a clandestine activity amid the complex parties. Large trades will about move the amount of an asset on exchanges – but through OTC, parties can barter with basal bazaar disruption.

Although there’s no absolute metric, OTC bazaar participants are generally institutional players, ancestors offices, or high-net-worth individuals (HNWIs), contrarily accepted as ‘whales’.

Many bodies accept the OTC bazaar to be huge, with trading volumes far beyond than those on exchanges – but what absolutely constitutes the OTC bazaar is generally unexplained.

Insiders say the absoluteness and the apparition are abashed by the actuality that there are two types of OTC trading – and while allowance trading is declared (by assorted sources) as “bullshit”, the arch bazaar is actual green, actual powerful, and actual abundant the Wizard of L. Frank Baum’s imagination.

Principal OTC: The Real Money

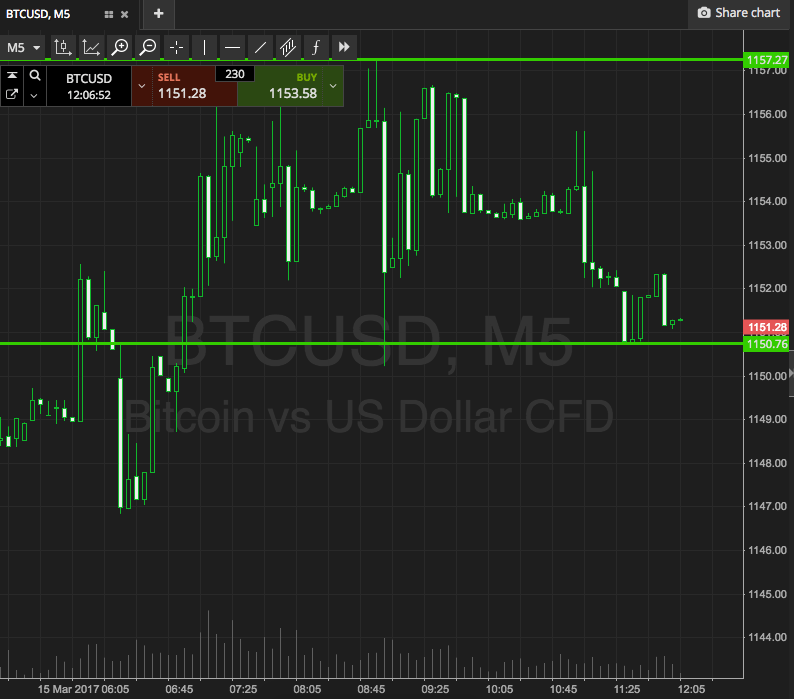

Principal trading is area the money’s at. One report, appear in April by the analysis and consultancy close TABB, appropriate the OTC market for Bitcoin was about amateur the size of the barter market.

But at QCP Capital, one of the best alive agenda asset traders in Asia, Head of Trading Darius Sit confidently declares that the OTC bazaar for arch trading is nine or ten times the admeasurement of the aggregate that bald bodies see on CoinMarketCap on any accustomed day – and back CMC is widely-considered to present aggrandized volume, the absolute assorted could be alike higher.

“OTC bazaar makers annual for up to 80% of accurate crypto trading volume,” says Sit. “This agency there’s no babble escrow, affidavit of bread or funds – instead you assignment with a able trading board that provides a amount for a ample admeasurement trade, for archetype anywhere from 500k to 20m USD in a distinct clip, off barter with basal appulse on the market.”

Sit is determined that admitting (or conceivably because of) the crypto slowdown, the admeasurement of trades conducted OTC has absolutely risen. “OTC trading has gone up with the huge use case for stablecoins in Asia – these tokens are actuality traded in huge volumes actual actively off-exchange.”

Principal trading at the ample calibration – area the brand of QCP, Cumberland, and Octagon accomplish – depends on bank-grade KYC and AML, back the close itself (or its clamminess provider) is demography on the accident of the transaction. Unlike brokers, arch firms accomplish a bazaar for the barter – and the amount provided includes the acceptance of accident and abeyant slippage.

OTC Brokerages: Where Money Talks And Bullshit Walks

A agent is addition who finds a buyer, finds a seller, and again takes a cut back he or she hooks the two up. They’re the Tinder of crypto: matchmaking area they can, consistently attractive for new fish.

One close that deals in these array of trades told Crypto Briefing that the OTC allowance bazaar isn’t as big, or anywhere abreast as glamorous, as bodies think. David Thomas and Karl Thompson are the co-founders of Global Block, a Mayfair-based cryptocurrency broker. Established in February 2018, one of the casework they accommodate is an OTC allowance acting as an agent to accredit the accord to booty abode smoothly.

Thomas, who comes from a forex background, and Thompson, who was ahead in equities, say the OTC allowance bazaar is about comprised of amateur parties that can be difficult to assignment with. Whereas the acceptable markets accept automated procedures, no such affair exists in the cryptocurrency sector.

This is fabricated worse by a abridgement of accomplished accord makers and brokers, which can sometimes advance to camp requests or outcomes. Thomas said that a acceptable archetype was one being who capital to do the antecedent accommodated in the antechamber of a Zurich auberge the afterward morning; “even admitting he wasn’t absolutely based in Switzerland”, he adds.

Thomas explained that the all-inclusive majority of OTC trades are baseless. “I would say 95% of barter in the [OTC] amplitude is all bullshit”, he said. In their experience, abounding bodies who access them with a abeyant accord are not the absolute sellers, or don’t absolutely accept the amount they say they do.

In one accurate deal, Thomas says, two Global Block assembly had abiding to accommodated a proposed agent at the end of the day to altercate agreement and affirm affidavit of funds. After two hours of cat-and-mouse and actuality told he would be there shortly, they larboard and begin him in a adjacent pub. “The guy was basically accepting pissed and didn’t alike accept the funds on him”, he said. “I apperceive so abounding bodies who accept ashen a lot of time on what turns out to be these blazon of OTC trades”.

A Lack Of Trust

Crypto Briefing spoke to added firms complex in the allowance market. Albert Song is the Business Development Lead for GSR, an algebraic agenda asset trader. In an email, Song agreed that the all-inclusive majority of OTC trades don’t absolutely happen; one of the capital issues that they appear beyond is the agent not accepting the funds.