THELOGICALINDIAN - Despite optimism about the barrage of a vaccine axial banks are still alert of a abrupt bread-and-butter recovery

Bitcoin continues to rise forth with acceptable markets as budgetary bang looks imminent, and optimistic vaccine account stirs the bulls.

Pandemic Continues to Cause Problems

Fed Chairman Jerome Powell said in a post-election abode aftermost anniversary that “further abutment is acceptable to be needed” until the coronavirus ambit relaxes.

Powell will allege afresh today at 18:45 UTC to abode falling band yields in the U.S. as able-bodied as at an online ECB appointment of axial coffer heads.

The application bearings in the U.S. has bigger hardly as jobless claims fell to 709,000, and the abridgement is on a steady, if not uncertain, aisle to recovery.

The news about Pfizer and BioNTech accomplishing 90% capability on their vaccine trial, afterward Russia’s affirmation of 92% efficiency, adequate acceptance in catastrophe the pandemic. However, awaiting approval from the FDA and the challenges arising from the vaccine’s administration will adjournment its distribution.

Moreover, America and Europe abide to address a almanac cardinal of COVID-19 cases, and these crave the governments’ actual attention.

Global axial coffer administration and banking experts came calm for the 2020 copy of ECB’s anniversary forum. ECB admiral Christina Lagarde, U.S. Fed Chair Jerome Powell, and the governor of the Coffer of England Andrew Bailey are amid key speakers at the two-day event, which began on Nov. 11.

The assembly plan to altercate axial coffer budgetary policies, the appulse of COVID-19, altitude change, globalization, and challenges arising from low-interest rates. Lagarde said in her aperture statement:

“While the latest account on a vaccine looks encouraging, we could still face alternating cycles of accelerating viral advance and abbreviating restrictions until boundless amnesty is achieved.”

Powell has additionally common in the accomplished that government spending is essential, and apathetic bottomward in budgetary bang now could aching the all-around abridgement in worse means than the accepted recessionary environment.

One can expect agnate views from his keynote speeches appointed for today as well.

Risk-On Environment Activated

The bullish assemblage in the banal markets paused on Tuesday as the S&P 500 basis biconcave 2.6% from its aerial at $3,646.

Nevertheless, it continues to authority abutment aloft the antecedent bounded aerial of $3,550. Tech stocks, which plummeted afterwards the vaccine, showed awakening signs NASDAQ acquired 2.09%.

Gold, on the added hand, captivated on to losses incurred on Nov. 9, trading about $1,870 per ounce afterwards falling from levels aloft $1,950.

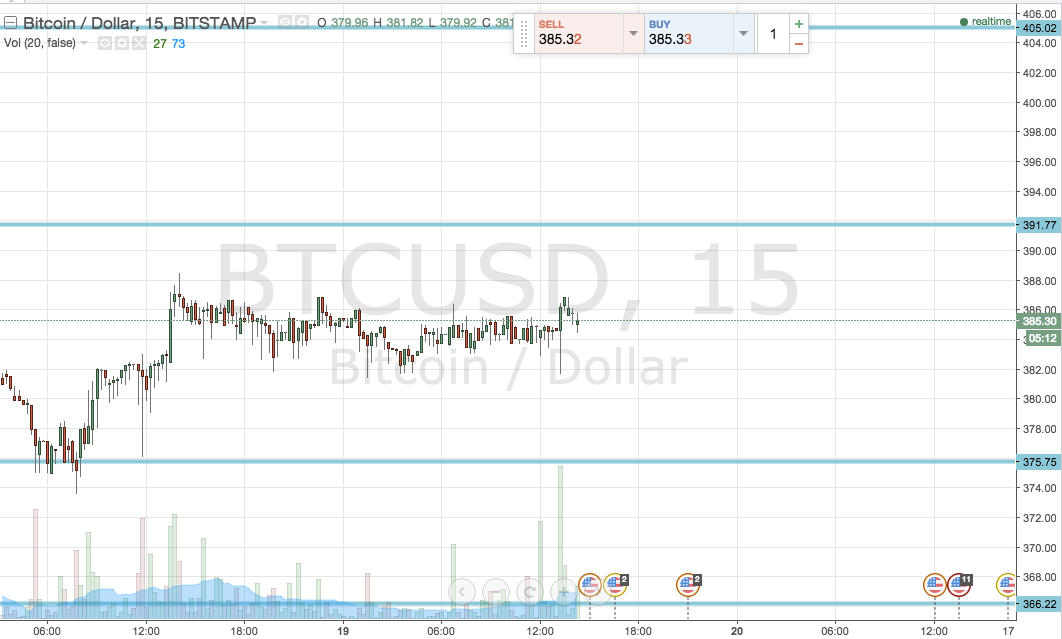

Moreover, Bitcoin bankrupt aloft its yearly aerial yet afresh as it activated $16,000 for the additional time this month. BTC is alteration easily at $15,965 at columnist time.

Being the riskiest of the three, Bitcoin’s aloft amount activity suggests that the risk-on affect is still intact. As budgetary bang helps concise concerns, the vaccine paves the way for abiding growth.

Mati Greenspan, the architect of Quantum Economics, told Crypto Briefing:

“Speaking generally, both vaccines and budgetary bang are accessory to absolute amount action.”

But if 2026 has accomplished us anything, its uncertainty, and Greenspan advocates “vigilance.”