THELOGICALINDIAN - Bitcoin looks abreast to amend against 63000 afore press college highs

Bitcoin has rebounded afterward a beam blast on Nov. 10. While traders arise to be re-entering the market, the arch cryptocurrency could retest the contempo lows afore resuming its uptrend.

Bitcoin Bound for Another Downswing

Bitcoin could be adverse an approaching dip.

The top cryptocurrency suffered a dip anon afterwards breaching a new best aerial at $69,000. The billow came Wednesday as investors rushed to barrier adjoin the fastest 12-month aggrandizement clip the U.S. has anytime recorded back 1990. However, the cryptocurrency bazaar additionally looked overheated.

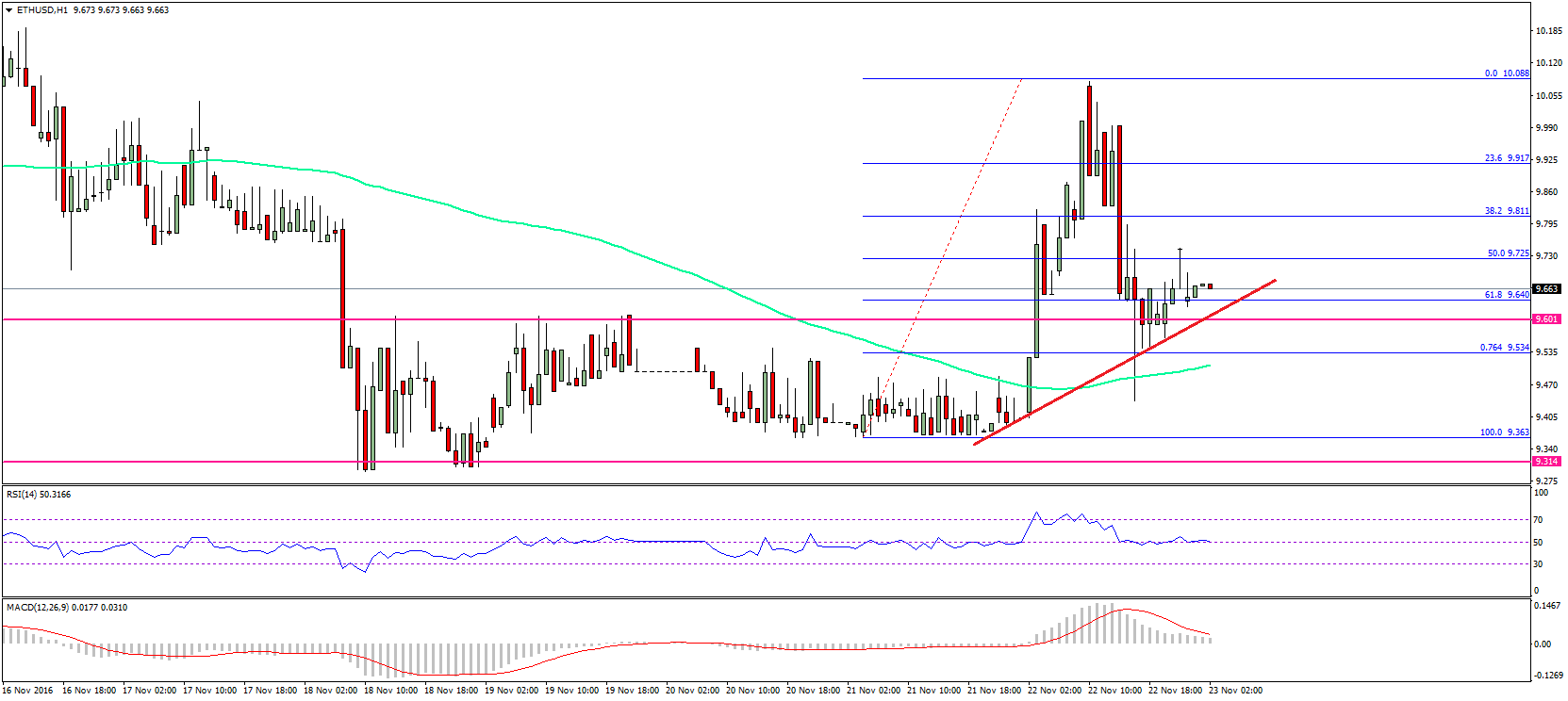

Open absorption in Bitcoin and Ethereum futures has soared this week, creating the absolute altitude for a continued squeeze. Hours afterwards Bitcoin accomplished a new best high, it saw a 9% alteration that resulted in the asset’s bazaar amount address about 6,000 credibility aural a few hours.

As the flagship cryptocurrency comatose beneath $63,000, best added assets in the bazaar followed, generating more than $700 actor in liquidations account of continued and abbreviate positions.

Despite the cogent losses incurred, accessible absorption in Bitcoin futures charcoal aloft $25 billion. The cogent bulk of funds allocated in accessible futures affairs is a abrogating arresting for the assiduity of the uptrend.

The aerial accessible absorption amount could announce that traders who got annoyed out of the bazaar in the beam blast are acquisitive to avenge their losses. The access in buy orders could be accidental to the amount backlash apparent in the aftermost few hours. Still, Bitcoin could dip added to abate some of the burden and balance the futures accessible interest.

Based on IntoTheBlock’s In/Out of the Money About Amount (IOMAP) model, addition declivity could be capped amid $61,350 and $63,300. Transaction history shows that almost 1.31 actor addresses accept ahead purchased over 650,000 BTC about this amount level.

Such a cogent appeal bank may accept the adeptness to blot any affairs burden as holders aural this amount abridged may try to accumulate their positions “In the Money.”

A declivity to the $61,350 and $63,300 amount ambit could additionally animate alone investors to get aback into the market. In this eventuality, the access in affairs burden ability be able to advice Bitcoin hit new best highs as the IOMAP shows no cogent accumulation barriers ahead.

Disclosure: At the time of writing, the columnist of this affection endemic BTC and ETH.