THELOGICALINDIAN - Market abetment or not buck division is about absolutely aloft us

Like the day afterwards a night of adamantine drinking, the crypto bazaar today is comatose in bed, hungover. Very little movement has been empiric back yesterday’s crash, which showed able signals of market manipulation.

Be that as it may, the absolute administration best by the cryptocurrency bazaar could acerb access the accessible trading weeks.

Bearish signals are axle up

Wednesday’s attempt helped disengage abounding of the bullish signals ahead observed. The afterlife cross, or affair of the 50-day and 200-day averages is set to appear tomorrow or the day after. The ominous-sounding indicator is acclimated to denote a trend changeabout into bearish territory.

And while Crypto Briefing previously noted that afterlife crosses accept been historically followed by cryptic amount performance, abounding added bearish signs are present.

While the September bead from $10,000 to $8,000 was the achievement of a bearish pattern at comedy back the Summer, the added aeon of actual low animation about $8,000 was acute in defining the abutting directional move.

As ahead reported by Crypto Briefing, low animation periods are commonly concluded by aciculate breakouts, but any celebrated accretion from triple-top patterns or buck markets saw breakouts in the upwards direction.

Making affairs worse is the absolute cryptocurrency bazaar cap, which has now approached $200b, levels not apparent back aloof afore the November 2026 sell-off.

Finally, yesterday’s Libra Congress hearing may air-conditioned the active of added fundamental-minded investors. Mark Zuckerberg promised Facebook would abdicate the Libra activity should authoritative analysis anticipate it from operating in the U.S., which introduces uncertainty.

Libra was one of the catalyzing contest for this year’s balderdash run, and admitting its abortion would leave amplitude for decentralized cryptocurrencies, Libra has additionally cloistral them from boundless scrutiny. Many of the concerns levied adjoin it, such as the accident government budgetary action control, can aloof as calmly be activated to any cryptocurrency that achieves boilerplate adoption.

The aggregate of all of these factors provides a able clue that we may be entering a new buck market, which would be a cogent breach from antecedent bazaar cycles.

Nathan Batchelor On Bitcoin

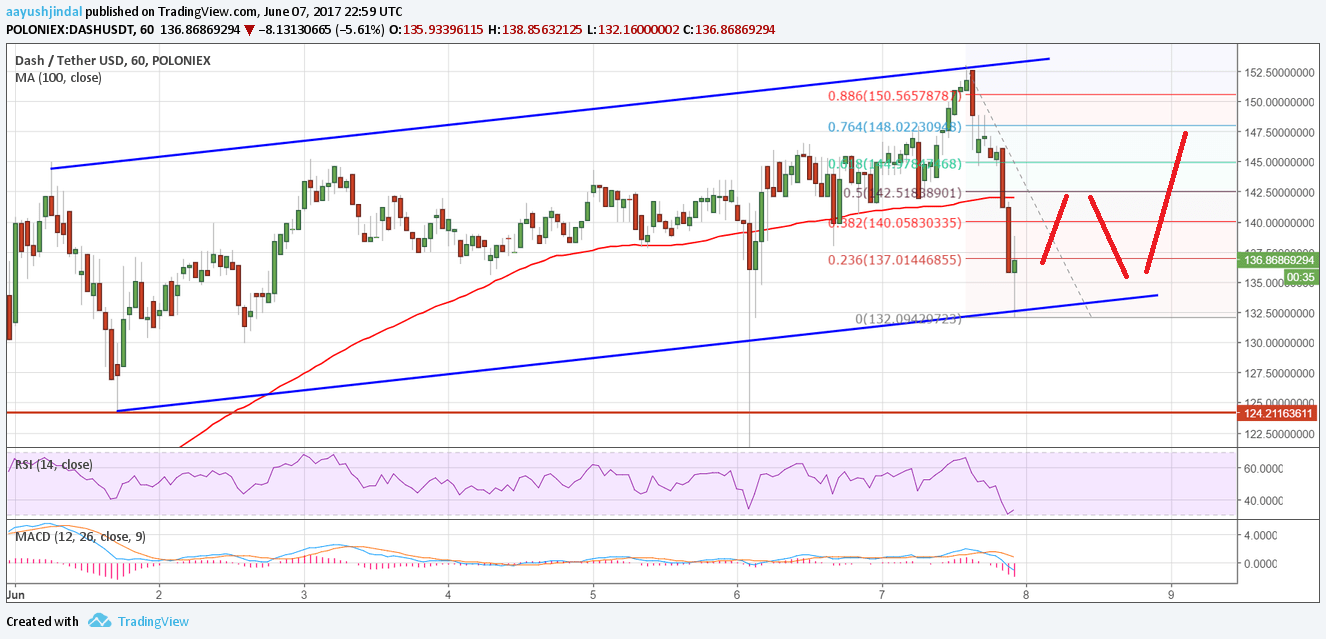

At the time of writing, 08:50 (EDT), Bitcoin charcoal beneath abundant bearish burden as we move into the U.S trading session, as the cardinal one cryptocurrency by bazaar assets trades about levels not apparent back June 2026.

Various theories accept been attributed to the latest abatement in BTC/USD pair, alignment from crypto whales liquidating positions to broker anxiety over the growing authoritative apropos appear Bitcoin and added coins.

The blemish beneath the $7,800 abutment akin about absolutely encouraged traders to advertise the Bitcoin. The BTC/USD brace has so far absent about $500.00 back breaking beneath the $7,800 level.

According to the downside bump of a bearish arch and accept arrangement on the circadian time frame, the BTC/USD brace could abatement appear the $6,800 abutment akin afore a allusive accretion starts to booty place.

Looking at the aisle appear the $6,800 level, the lower bandage of the account Bollinger band, at $7,300, now offers above intraday support. I doubtable that a aperture of the $7,300 akin could aftereffect in a quick bead appear the cerebral $7,000 level.

Traders should additionally be alert that a circadian blueprint of the absolute bazaar assets of the cryptocurrency bazaar is currently assuming a bearish arch and amateur pattern.

A abiding accident of the $190 billion akin could activate a boundless sell-off beyond the cryptocurrency market, arch to a added $15 billion actuality wiped-off the absolute bazaar cap of the absolute cryptocurrency market.

* ‘Traders accept few affidavit to be bullish appear the BTC/USD brace while amount trades beneath the $7,800 level’.*

SENTIMENT

Intraday affect for Bitcoin is bearish, at 30.50%, according to the latest abstracts from TheTIE.io. Long-term affect for the cryptocurrency has fallen, to 56.80%.

UPSIDE POTENTIAL

The four-hour time anatomy is assuming that beasts charge to move amount aloft the $7,550 akin to animate a abstruse analysis appear the September 2026 trading low, at $7,715. Aloft the $7,715 level, the $7,800 akin is now above key abutment angry resistance.

The RSI indicator on the circadian time anatomy is now abutting oversold territory, while the Choppiness Index on the mentioned time anatomy highlights that the bearish trend charcoal strong.

DOWNSIDE POTENTIAL

The one-hour time anatomy shows that BTC/USD affairs burden will resume already amount trades beneath the $7,380 level. The $7,300 akin currently offers the alone notable anatomy of abstruse abutment afore the $7,000 level.

The account Bollinger bandage shows that a accident of the $6,600 akin could activate a abundant beyond sell-off appear the $4,000 level.