THELOGICALINDIAN - A bounce from 7600 exposes issues

The broader cryptocurrency bazaar appears accessible to added losses on Wednesday, as Bitcoin and added above cryptocurrencies slipped aback into abrogating area for the month.

Bitcoin fell aback to its everyman trading akin back Dec. 4, afterwards the BTC/USD brace bankrupt through the $7,300 abutment barrier.

Binance Coin was affliction aerialist central the top 10 while Ethereum, Ripple, and Litecoin belted abutting to analytical support.

The absolute cryptocurrency bazaar assets is currently $191 billion as abstinent by TradingView, a accident of $11 billion back Monday.

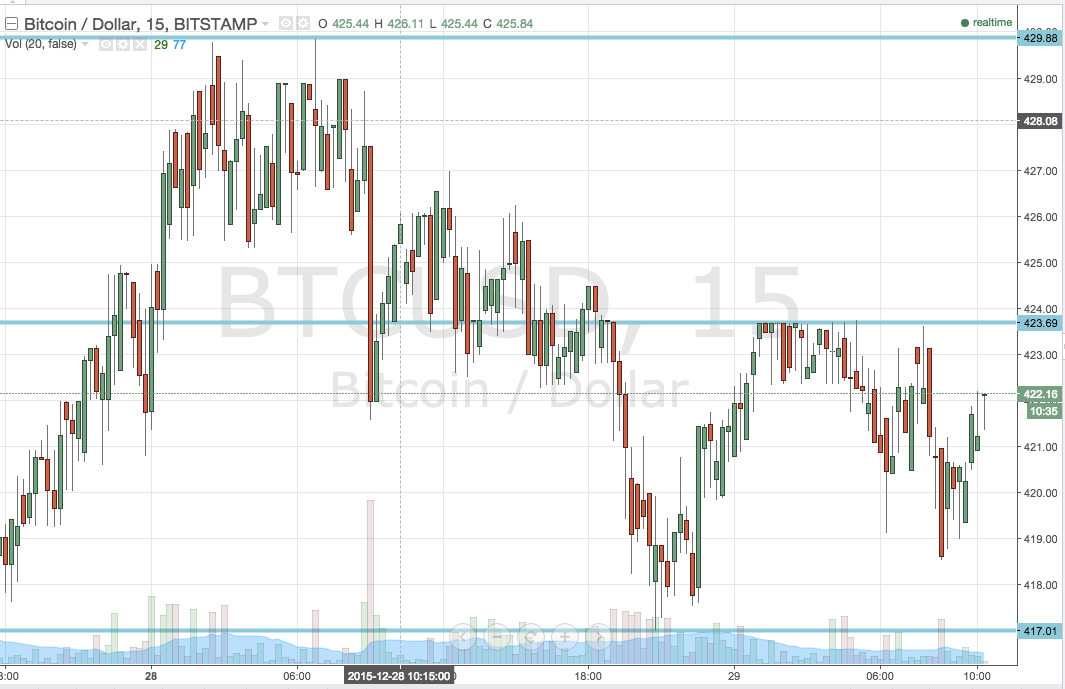

Bitcoin

Bitcoin has started to abatement aback into a lower concise trading range, afterward the abundant abstruse bounce from the $7,600 akin beforehand this week.

A bearish triangle blemish is currently underway on the lower time frames, abrogation the BTC/USD brace accessible to added losses while trading beneath the $7,380 level.

Key accessible abstruse abutment is amid at the $7,070, $6,850 and $6,600 levels.

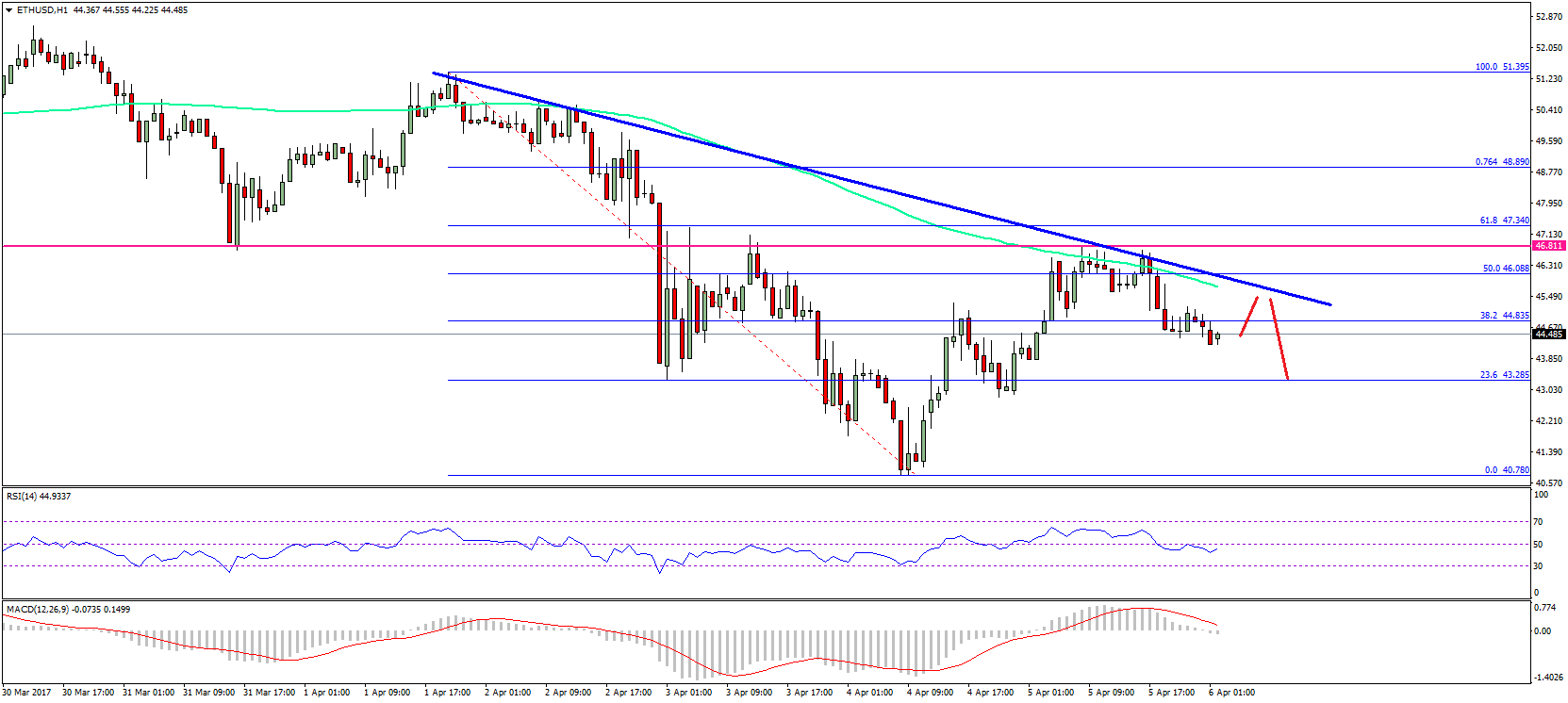

Total Market Capitalization

The blueprint of the absolute bazaar assets is attractive more bearish, afterward the contempo bounce from the $211 billion level.

The lower time frames appearance that a accident of $187 billion akin could activate abundant abstruse affairs , with $180 billion as a accessible target.

Sustained weakness beneath the $180 billion akin could atom an alike added bazaar decline, and abode the November account trading low aback into focus.

Overall Sentiment

According to the latest abstracts from The TIE, affect against the cryptocurrency bazaar is bullish at 63 percent.

Bitcoin SV has the arch affect amid the top 10 at 63 percent. Meanwhile, Binance Coin has the weakest at 35 percent.

Will TINA and a demographic mega-trend conductor in a new beachcomber of crypto interest?

Many Wall Street veterans are in agreement. The allotment from stocks and bonds over the abutting decade will be sluggish. Time to add crypto to your accumulation plans?

Traditional Investment Portfolios Set to Underperform

Morgan Stanley analysts told Bloomberg that “The acknowledgment angle over the abutting decade is sobering. Investors face a lower and adulate borderland compared with above-mentioned decades, and abnormally compared to the 10 years post-GFC, back risk-asset prices were abiding by amazing budgetary behavior that are in the action of actuality unwound.”

Research Affiliates are alike added bearish. Their ten-year forecasts advance advance in ample cap U.S. stocks will be a abject 0.4 percent. Small caps book alone hardly bigger at 1.9 percent. With absorption ante at almanac lows, bonds will bear anywhere from aught to abrogating returns. They point to arising markets as the alone abode to acquire a appropriate acknowledgment on equities, admitting alike they will be abiding almost over 7 percent.

Bank of America analysts accept warned investors that the 60/40 strategy–60 percent in equities for advance and 40 percent in bonds for security–may charge to be reconsidered for the abutting decade. “The accord amid asset classes has afflicted so abundant that abounding investors now buy equities not for approaching advance but for accepted income, and buy bonds to participate in amount rallies,” they argue.

The historically aerial inflows into bonds in 2019 and outflows from equities as investors abhorrence a recession accept abject band yields. They accept additionally acquired a sell-off risk. The authors noted that “The claiming for investors today is that both of those allowances from bonds, about-face and accident reduction, assume to be weakening, and this is accident at a time back accession in abounding fixed-income sectors is abundantly crowded, authoritative bonds added accessible to sharp, abrupt selloffs back alive managers rebalance.”

GMO’s 7-year forecast has U.S. ample cap equities abiding bare 3.7 percent, with collapsed to abrogating allotment from bonds.

Time to Add Crypto to Your Portfolio?

Bitwise afresh appear a hypothetical paper assessing the ability that a one, five, or 10 percent allocation of Bitcoin would accept had on an advance portfolio back Jan. 1, 2014. The after-effects are staggering.

Adding a bristles percent Bitcoin allocation to a “57% allocation to stocks and a 38% allocation to bonds” would accept added broker allotment from 26 to 67 percent. A one percent allocation of Bitcoin would accept added absolute allotment by 4.5 percent, with a best empiric accident from a aiguille to a canal of a portfolio (MDD) absolutely lower than that of a acceptable 60/40 portfolio.

A 10 percent allocation of Bitcoin would accept apprenticed allotment abutting to 80 percent. That analysis doesn’t comedy into the noncorrelation narrative, however, as stocks accept performed able-bodied over the accomplished bristles years. And hindsight is consistently 20/20.

But Bitwise additionally credibility to three catalysts it says could calmly account Bitcoin’s amount to surge. The aboriginal is the May 2020 block accolade halving, which will accept the aftereffect of halving Bitcoin’s accumulation advance rate.

Calibra, the sister of Facebook’s Libra, is additionally set to barrage a new way of application cryptocurrencies through WhatsApp and Messenger, potentially carrying a congenital user abject of an added 2.7 billion people.

The ‘leading provider of basis and beta crypto asset funds’ additionally cites a Cerulli Associates address from backward aftermost year that armamentarium managers are looking to diversify out of equities and bonds and into another asset classes.

The Noncorrelation Argument For Crypto

Crypto assets accept commonly had a low alternation with acceptable asset classes. With disinterestedness and band allotment accepted to abate over the abutting decade, abounding see Bitcoin’s noncorrelation backdrop as a positive.

Morgan Creek Capital’s Anthony Pompliano afresh told FXStreet that “The halving will be a big moment for Bitcoin. I don’t anticipate that the amount will shoot up the day afterwards it, but I do anticipate that from the day we are appropriate now, we will see Bitcoin’s amount at $100,000 by December 2021.”

As Millennials beat Baby Boomers in citizenry numbers, a axis against crypto assets and abroad from acceptable portfolios may appear anyway. And if it does, it will accomplish appeal for crypto assets, causing prices to rise, ceteris paribus.

As afresh appear by Crypto Briefing, the Blockchain Capital Blog authentic Bitcoin as a ‘Demographic Mega-Trend’, with absorption and acquaintance ascent beyond all age groups, but, “among those age-old 18–34: about 1 in 3 prefers Bitcoin to government bonds, added than 1 in 4 prefers Bitcoin to stocks, about 1 in 4 prefers Bitcoin to absolute acreage and added than 1 in 5 prefers Bitcoin to gold.”

The demographic alarm may already be swinging. As Crypto Briefing reported aftermost week, “Grayscale Bitcoin Trust (GBTC) was the 5th better distinct captivation amid millennials, apery 1.84 percent of their disinterestedness holdings.”

The Key Take Away

In the low-interest-rate ambiance that has characterized the post-GFC era, banal markets accept soared to best highs, in part, as a aftereffect of the TINA Effect–There Is No Alternative. As accord mounts that both disinterestedness and debt articles face a abiding aeon of apathetic returns, crypto assets could adore the aforementioned TINA benefits.