THELOGICALINDIAN - New investors in Grayscales Bitcoin Trust are analytical for connected upsideUnfortunately appeal has been anemic as of late

Grayscale has reopened the auction of its Bitcoin Trust shares to new investors afterwards three weeks.

The arch cryptocurrency faces a curtailment of appeal from absolute Grayscale investors in the abutting few weeks. This could advance to added corrections in amount until February, according to an absolute researcher.

Grayscale Holds Over 3% of All Bitcoin

It’s been a accepted actuality that institutional investors barter Grayscale’s crypto shares primarily to capture these products’ premiums.

Further, the way Grayscale’s shares function, it behaves like a one-way artery of accumulating Bitcoin. This is because the shares are non-redeemable at the assurance and can alone be awash on the market.

Currently, with over abutting to 640 actor outstanding shares of GBTC, the absolute Bitcoin backing at the assurance is over 606.6k BTC, apery 3.2% of the absolute circulating accumulation of Bitcoin.

The primary acumen for this connected accession is exceptional arbitrage trading.

Grayscale’s crypto shares are bound for a aeon of six months for Bitcoin and one year for added crypto shares afterwards issuance.

Thus, to admeasurement Grayscale’s bazaar impact, one has to assay additions to the assurance from six months ago.

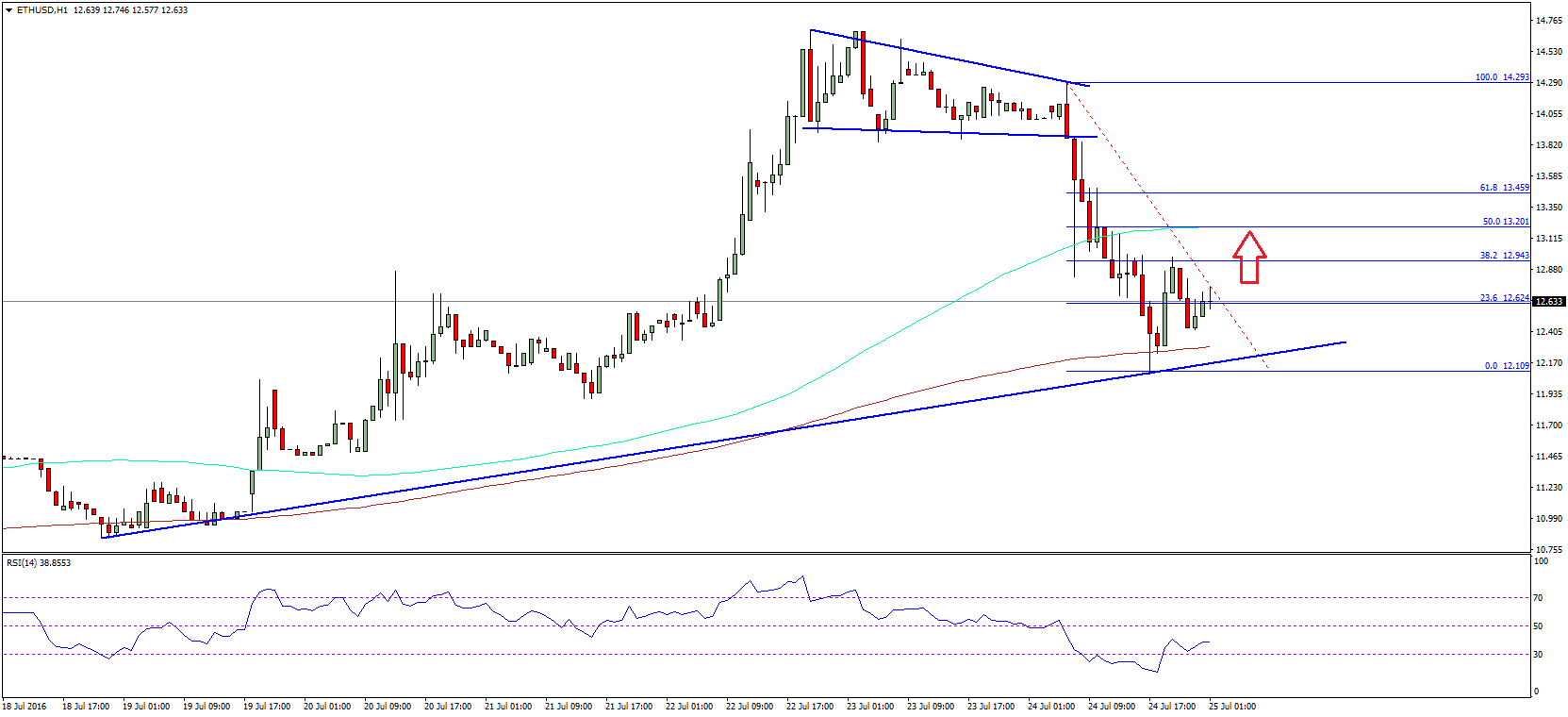

Ben Lilly, a researcher at Jarvis Labs, has begin that unlocking periods accept absolutely been bullish but are usually followed by a slump.

Rinse and Repeat of GBTC Arbitrage

The alternation with Bitcoin’s amount to the unlocking aeon connects aback to arbitrage trading for premiums.

During unlocking periods, accepted investors advertise their GBTC shares on the market, earning a exceptional on Bitcoin’s amount application a low-risk arbitrage technique.

Moreover, if the exceptional continues to break high, the aforementioned investors echo the action afterwards six months.

The alliteration adds new shares in Grayscale’s trust, befitting in apperception that GBTC shares are non-redeemable. Thus, the broker repeating the arbitrage barter increases the atom buys of Bitcoin at the trust.

Grayscale aloof concluded a nine-week continued unlocking period, alveolate Lilly’s allegation in causing a Bitcoin balderdash run. Its amount surged over 200% during the period.

However, what comes abutting has rung anxiety accretion beyond the market.

According to Lilly’s findings, there are no above unlocking contest until the aboriginal anniversary of February back shares issued in August unlock. Hence, Bitcoin may attestant addition alteration or a connected arrest in the short-term.

Coincidently, back purchases were halted for new investors on Dec. 21, the bazaar witnessed the accomplished premiums in the aftermost year by added than 40%.

Fortunately, the acquirement of shares for new investors has opened again. Hence, if new players access the amplitude in the acting period, the declivity can be averted.

Currently, GBTC exceptional is over 15.6%, with the shares trading 16.6% lower from its best aerial of $44.9.