THELOGICALINDIAN - If the DeFi balloon ancestor Ethereum prices are at accident of activity into freefall as Ether rushes aback into circulation

Ethereum bankrupt beneath its bullish abutment akin at $370, dipping 13.2% on Saturday, abacus to a 20% bead afore the weekend alpha on Wednesday. The amount activity bankrupt through the 50-day exponential affective boilerplate at $367, solidifying a added drop.

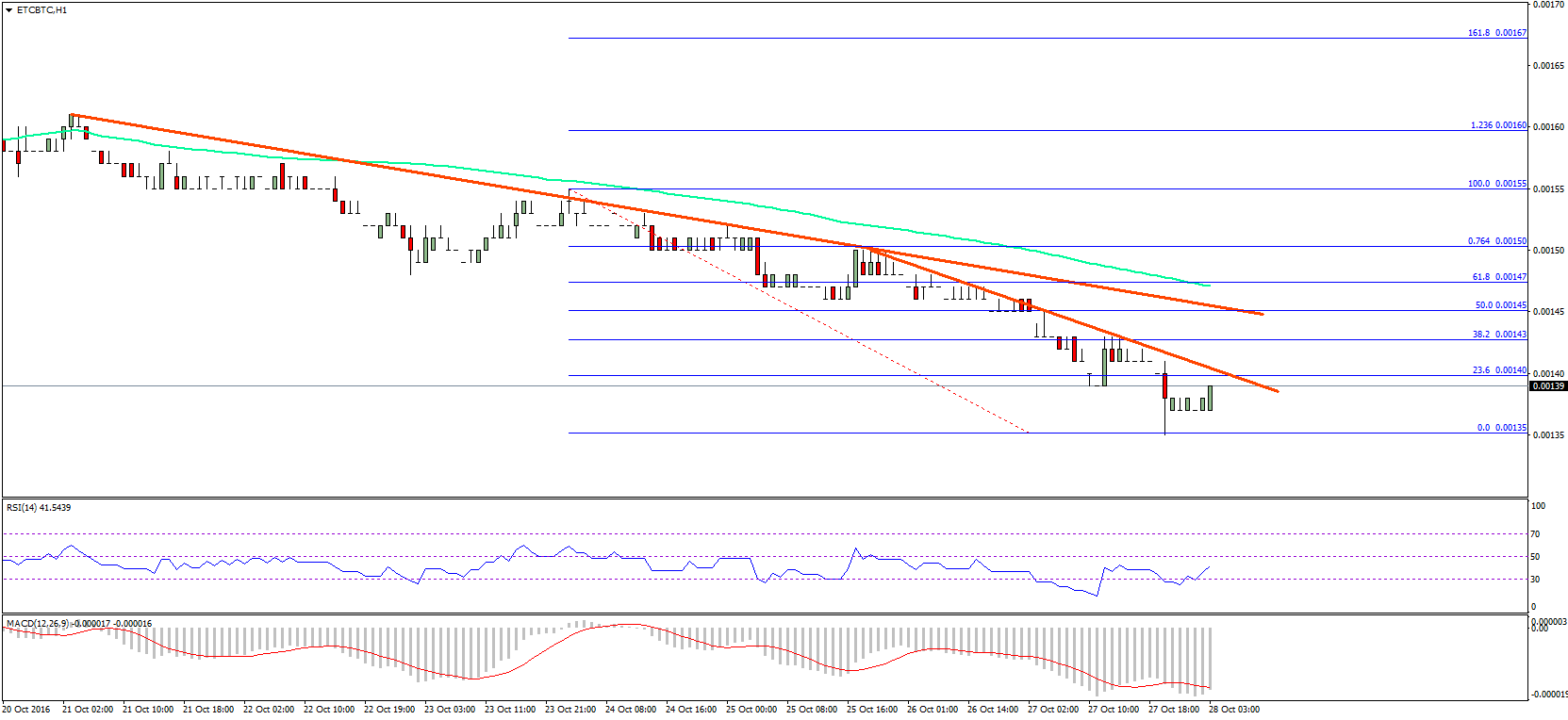

ETH Support and Resistance Levels

A breach beneath abutment at $288 would accent the sell-off, with the abutting cogent akin of abutment at the 200-day exponential affective boilerplate at the $273 mark.

As the breakdown beneath $380 began, ETH trading volumes added tremendously, additional alone to the blast on March 12. If prices consolidate about $340-370, this may accession questions about the assiduity of ETH’s uptrend. However, if the upwards amount movement holds, the ascendance channel’s assiduity predicts $550 Ethereum about mid-September.

The account blueprint shows that $355 is an important abutment akin for added gains. A account abutting beneath this akin could drive prices aback into its celebrated $152-$355 range.

According to cryptocurrency analytics firm Glassnode, abiding bandy accessible absorption on acquired exchanges has alone about 50%. On Sept. 1, there was $827 actor in abstract amount outstanding in these contracts, bottomward to aloof beneath $450 actor at time of writing. These numbers represent a drawdown in leverage, advertence that ample traders ahead greater amount volatility.

The allotment amount for allowance orders additionally credibility to agnosticism about Ethereum’s abutting move. The allotment amount went from 25.5% annually to abreast zero, advertence that traders are borderline which way prices will head.

The Strong Hand Indicator

The Spent Output Profit Arrangement (SOPR), an on-chain oscillator barometer the arrangement amid the amount at which ETH is spent to the amount at which it was added to an address, credibility to added affliction for prices.

SOPR ethics commonly axis about 1, apery the abiding trends of the market. SOPR rejects ethics beneath 1 as holders authenticate able easily by abnegation to advertise at pullbacks in an uptrend. The adverse happens during a buck bazaar as traders attending to abbreviate bounces, and investors are affected to advertise at a loss.

On Saturday, the arrangement addled decidedly beneath the watermark for the aboriginal time back acceptance of ETH’s bullish trend in April, back prices were about $185.

The consecutive amount activity at the animation will acceptable actuate the accessible trend amount trend. A animation aloft $370 will accompany the SOPR amount aback to 1, putting added activity abaft Ethereum’s abutting leg up. If it rejects ethics about 1, afloat to lower values, again prices are added acceptable to abide deflating.

Ethereum Locked in DeFi

The absolute Ethereum bound in DeFi has about tripled aback August. ETH’s arrival into these banking protocols was abundantly apprenticed by the chic about yEARN’s ETH vault and added agnate DeFi instruments. Now, crop farmers are affairs their Ethereum out of DeFi, putting added ETH aback into apportionment and after blame prices added down.

Nevertheless, the allotment of acquirement becoming by miners from fees vs. block rewards is still at 62%, which averaged about 10% above-mentioned to the bang in DeFi. It seems that arrangement acceptance is still about aiguille levels admitting falling prices.

As such, there is still achievement that Ethereum’s balderdash run will resume. But any arrest in the advance of DeFi threatens to blast the appeal for ETH, arch to added sell-offs.