THELOGICALINDIAN - ETH is outperforming in the bazaar this weekend afterwards a 12 billow Its currently trading at about 1355

The assemblage comes two canicule afterwards Tim Beiko appropriate a acting September 19 barrage date for Ethereum’s long-awaited Merge to Proof-of-Stake.

Ethereum Rallies Amid Merge Hype

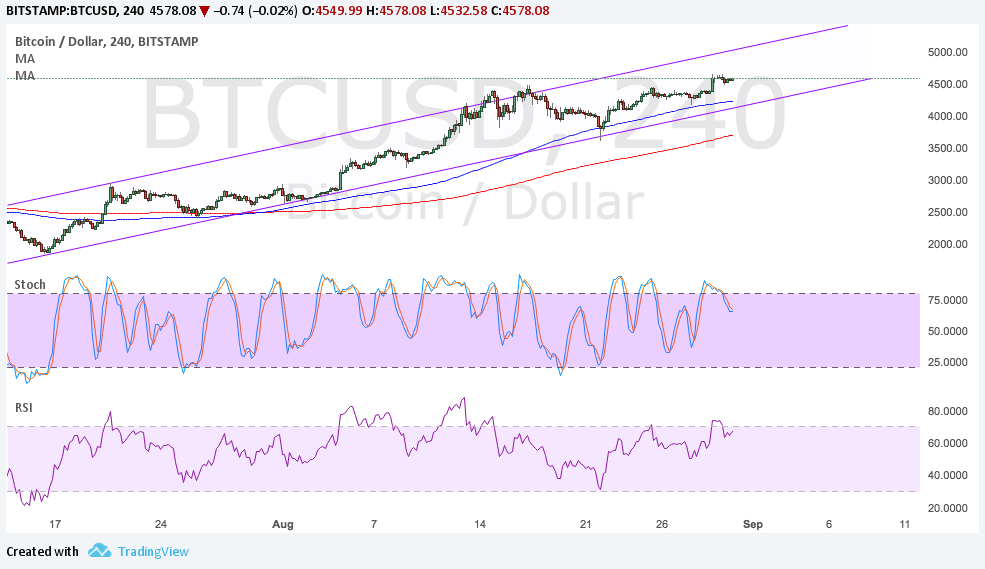

Ethereum is breaking out.

The cardinal two crypto put in a 12% assemblage Saturday, briefly affecting $1,363 for the aboriginal time in a month. It’s back acquaint a slight cool-off, currently trading at about $1,355.

The ETH assemblage has led to a animation beyond the market, allowance assets like Synthetix and Avalanche hit double-digit gains. Lido-staked ETH additionally jumped aloof about 12.6%, while LDO, the babyminding badge for the Lido DAO, is up 22.8%. Interestingly, BTC acquired about 3.2%, hinting that Ethereum is arch the accepted assemblage admitting Bitcoin’s ascendancy over the market.

While the exact acumen for the jump is unclear, convalescent affect surrounding Ethereum and its accessible “Merge” to Proof-of-Stake may be one factor. On Thursday, the Ethereum Foundation captivated its latest Consensus Layer Call in which the Merge was discussed. Ethereum Foundation affiliate Tim Beiko appropriate a conditional barrage date of September 19, bottomward the arch adumbration yet that the Merge could be aloof a few weeks away.

Before the Merge can booty abode on mainnet, Ethereum is set to go through one final test run on the Goerli arrangement in the abutting few weeks. The final barrage will chase that, admitting Beiko has acicular out that the mid-September date is alone acting and could change.

The Merge amend involves amalgamation Ethereum’s beheading band and accord band to move the arrangement abroad from Proof-of-Work and assimilate Proof-of-Stake. This is accepted to reduce the network’s activity consumption by 99.95%, but the Merge has additionally broadly been apparent as a bullish agitator for ETH as it’s set to abate the network’s arising by about 90%. In switching to Proof-of-Stake, the arrangement will no best pay miners and instead action fees alone to validators. As Ethereum additionally burns a allocation of its accumulation in gas fees via EIP-1559, it’s estimated that ETH could become a deflationary asset afterward the update. According to ultrasound.money, if the Merge ships on September 19, the ETH accumulation will aiguille at 120.2 actor and boring activate to collapse over time.

With the Merge anecdotal alpha to booty authority afterward the latest Ethereum Foundation call, the bazaar may now be appraisement in the appulse of the amend admitting the months-long slump that’s hit ETH and added crypto assets this year.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.