THELOGICALINDIAN - The DeFi amplitude appears to be experiencing article of an airdrop division However abstracts shows that the advertising may not aftermost

Ethereum saw several big badge airdrops in 2026. Despite the antecedent advertising surrounding the best advancing airdrops of the year, best of the tokens are bottomward 50% or more.

Ethereum Tokens Suffer in Market Selloffs

Ethereum admirers accumulate accepting badge airdrops, but the rewards rarely authority their value.

Some of Ethereum’s best alive users accept accustomed two abstracted badge airdrops over the anniversary season, sparking a aberration aural the community. On Christmas Eve, OpenDAO distributed its SOS token afterwards demography a snapshot of every Ethereum abode that had fabricated a barter on OpenSea. The badge rallied throughout Christmas Day as users claimed their tokens, briefly bringing the project’s bazaar cap aloft $300 million. However, data from CoinGecko shows that it’s now bottomward 63.7% from its highs, with one SOS trading at $0.00000397.

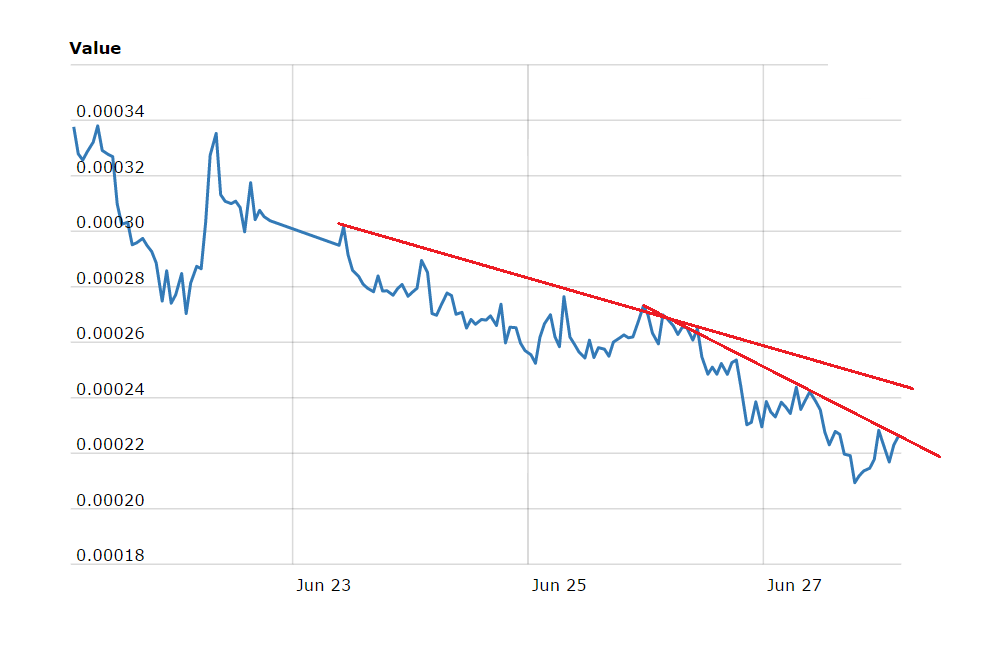

Earlier today, Gas DAO launched with a badge airdrop for Ethereum users who had spent at atomic $1,559 account of ETH on transaction fees. Gas DAO says that it wants “to be the baby and articulation of the Ethereum network’s alive users through on and off-chain governance.” Despite some antecedent drive on launch, Gas DAO’s GAS badge is already bottomward 77.1% on the day.

While the selloffs that OpenDAO and Gas DAO accept accomplished are added barbarous than best tokens suffer, post-airdrop declines are not absolute to newer projects. In fact, every above badge that launched with an airdrop to Ethereum users in 2026 is bottomward over 50% today.

DeFi Favorites Plummet Following Airdrops

The Layer 2 derivatives barter dYdX launched its DYDX token in September in what was touted as one of the better badge airdrops of the year. DYDX initially traded at about $12 and acquired drive in the bazaar in the weeks afterward its launch. Euphoria helped DYDX aiguille at $27.86 on Sep. 30 while ETH traded at about $2,850. In the 12 weeks back then, DYDX has printed nine account lows, while ETH rallied to new highs and is currently trading at about $3,800. DYDX is bottomward 66.8% from its high.

Ethereum Name Service additionally launched a badge this year, breeding a huge fizz in the association on launch. After aperture trading at about $17, ENS soared to $83.40 aural two days. It again confused over the advance of a few days, and admitting a accost of $75, it was hit by a selloff as the bazaar started to slump on fears of the Omicron Covid ache in December. It’s down 52.9% from its highs today.

ParaSwap, a decentralized barter aggregator that supports Ethereum, Polygon, Binance Smart Chain, and Avalanche, has additionally apparent its bazaar cap collapse over 80% back it launched a token, admitting the capital acumen for the affecting abatement may be its arguable badge administration method. ParaSwap launched PSP on Nov. 15 afterwards weeks of hinting at an airdrop, but the austere accommodation belief meant that abounding of the protocol’s loyal users were excluded. As a result, the airdrop prompted a angry backlash aural the DeFi community.

Ribbon Finance’s RBN is additionally down 63% from its highs; the options-based crop architect memorably suffered a beachcomber of bad columnist afterward its badge barrage aback it transpired that one of its backers, Divergence Ventures, had used cabal information to “farm” $2.5 actor account of tokens on assorted Ethereum wallets. One of the tokens that’s suffered hardest in the bazaar is Ampleforth’s FORTH. Ampleforth broadcast FORTH tokens to AMPL stakers aback in April, advantageous some with a six-figure payout. It initially traded at aloof over $55 and has since bled to $9.60.

Although abounding Ethereum tokens are decidedly bottomward from their highs, the bazaar has apparent bullish amount activity in contempo weeks. Per abstracts from CoinGecko, Curve’s CRV is trading aloft $5, up 50.9% in the aftermost two weeks. Convex Finance’s CVX is trading at $48.82 afterwards hitting an best aerial of $52.16 Monday. Alternative Layer 1 bill such as LUNA and NEAR accept additionally recorded new almanac highs in the aftermost week. Renewed absorption in NFTs has additionally helped the amount of dejected dent projects like CryptoPunks and Mutant Ape Yacht Club ascend over the aftermost few days. A baddest cardinal of NFT collectors accept additionally accustomed airdrops this year, admitting the amount activity for abounding of them has differed from DeFi projects like dYdX. Mutant Ape Yacht Club NFTs, for instance, launched afterwards Bored Ape owners were airdropped a serum NFT to about-face their appearance into a Mutant Ape. Like Mutant Apes, the serums accept captivated their value.

While committed Ethereum users accept acclaimed the latest beachcomber of airdrops with affluence added rumored for 2022, the amount abstracts shows that the market’s absorption in a badge doesn’t consistently aftermost above the antecedent euphoria.

Disclosure: At the time of writing, the columnist of this affection endemic ETH, ENS, DYDX, CRV, MATIC, and several added cryptocurrencies.