THELOGICALINDIAN - BitMEX CEO Arthur Hayes blanket the spotlight afterwards arguing that Bitcoin could bead to 3000 While this ambition is astute assorted indexes acknowledge that a lot has to appear afore it becomes accurate

BitMEX ambassador Arthur Hayes thinks $3,000 Bitcoin is astute accustomed accepted bread-and-butter conditions. Tone Vayes, meanwhile, thinks BTC will appearance its colors as a safe haven. Who’s right?

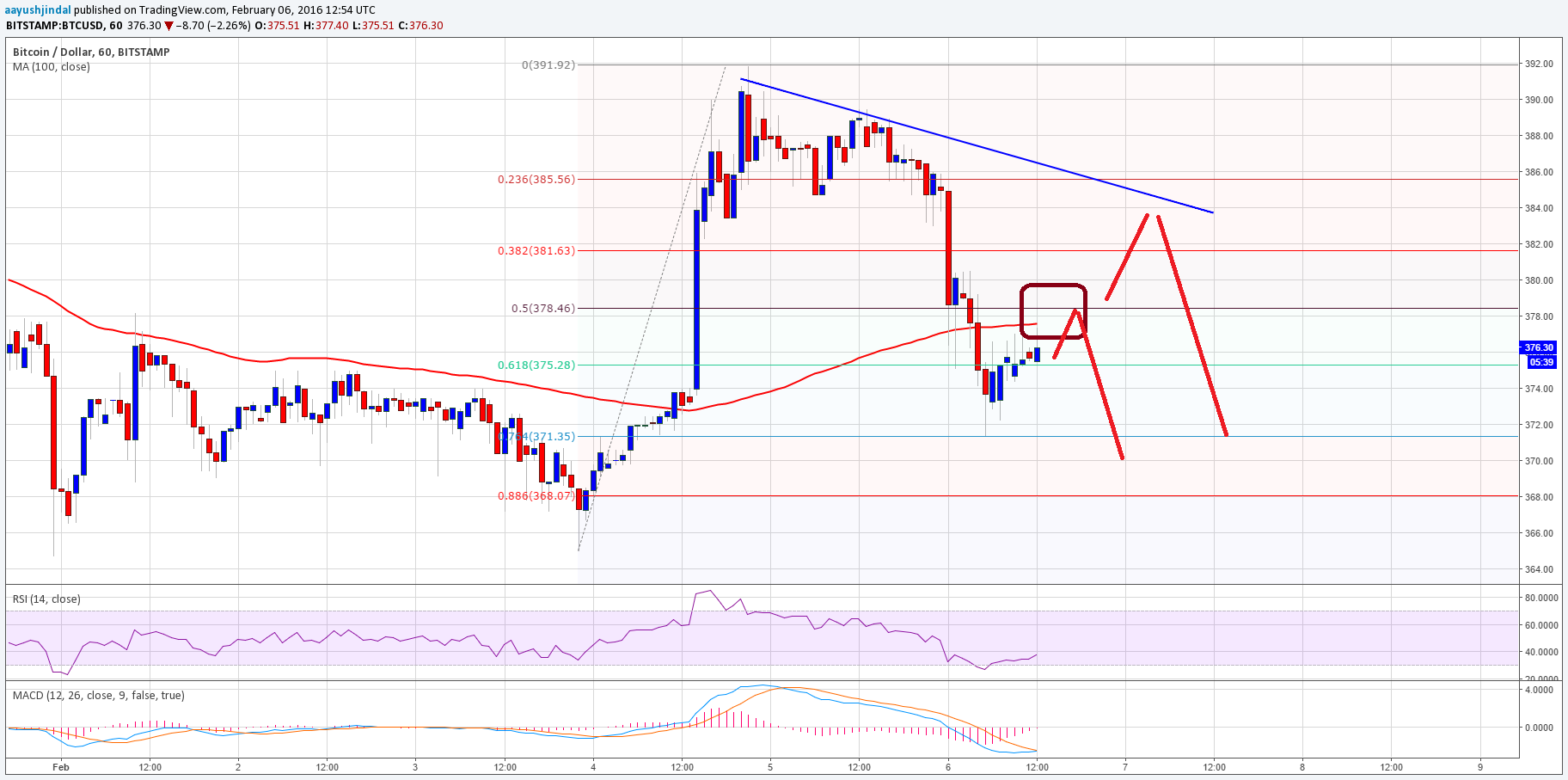

Signs of a Further Decline

In a contempo blog post, Arthur Hayes, CEO at BitMEX, explained that the all-around banking markets are assertive for a added downturn. The above institutional banker maintains that the $2 abundance bang amalgamation the U.S. Senate passed to accommodate abatement from the calamity acquired by the advancing pandemic may accept little to no appulse in the banal market.

Although the S&P 500 is up about 30% from the contempo crash, Hayes believes this bullish actuation represents a asleep cat bounce. He now expects a steeper abatement beyond all above economies, bleeding over into the crypto markets.

“As the SPX rolls over and tests 2,000 apprehend all asset classes to puke again. As agitated as the Q1 collapse in asset ethics was, we accept about 100 years of imbalances to disentangle the ancien régime,” said Hayes.

The above Deutsche Bank market-maker affirmed that Bitcoin could retest the $3,000 amount akin afore it is affected to backlash acutely and end the year at about $20,000.

Given the accepted accompaniment of commotion about the planet, the affairs of the bleak angle materializing are not small. As the unemployment amount rises and investors rush to safe anchorage assets, the banking agitation may accent creating the absolute altitude for a abysmal recession, which would discharge over into crypto.

Nevertheless, Tone Vays, a above Wall Street banker and VP at JP Morgan Chase, argues that an bread-and-butter crisis would acceptable be benign for Bitcoin back it could advance as a ambiguity asset. This blazon of ambiance is what makes the flagship cryptocurrency so resilient, according to the analyst.

While the Crypto Fear and Greed Index continues analysis “extreme fear” amid bazaar participants, Vays said to be added bullish than ever. Who is right?

Bitcoin’s Pivotal Point

Based on its 1-day chart, Bitcoin broke out of an ascendance triangle that was developing back the Mar. 12 crash. This abstruse accumulation is advised to be a assiduity arrangement that forecasts a 32% ambition to the upside aloft the blemish point.

After affective aloft the accumbent trendline of an ascendance triangle, best assets tend to acknowledgment to the blemish point afore continuing to trend. Currently, the avant-garde cryptocurrency appears to be behaving this way.

A added access in appeal for Bitcoin about the accepted amount levels could advance it up to $9,000 or higher. This ambition is bent by barometer the acme of the triangle at its thickest point and abacus that ambit to the blemish point.

Nonetheless, if the accepted akin of abutment provided by the 78.6% Fib fails to hold, the bellwether cryptocurrency could bead to the abutting appeal barrier about $6,100. This amount hurdle would again be key to BTC’s trend.

Breaking beneath it will add acceptance to Hayes’ outlook, while bouncing off from it will accord hope to investors.

Only time will acquaint whether Bitcoin will be able to advance as a safe anchorage asset during the advancing banking accident or collapse with the blow of the markets.